Admit it, you thought yesterday’s close meant today would be another red day. 🔴

Crypto investors/traders are conditioned to expect that price behavior – and when it doesn’t happen, there’s a collective sigh of relief.

In today’s Litepaper, we’ll look at a new $150 Million fund to develop DeFi, an Arizona lawmaker’s push to make Bitcoin legal tender, and a Technically Speaking article highlighting the break out or fake out happening in crypto.

The table below is one of the most odd-looking ones we’ll probably see in a while. The Altcoin and Total Market Cap performance are each roughly +1.45% for the day. However, the Top 10 performers by market cap are mostly in the red.

Here’s how the market looked at the end of the trading day:

| Filecoin (FIL) |

$5.55

|

6.16% |

| Cosmos (ATOM) | $13.31 | 2.72% |

| OKB (OKB) | $35.84 | 0.55% |

| Bitcoin (BTC) |

$22,907

|

-0.45% |

| Litecoin (LTC) |

$88.87

|

-0.68% |

| Monero (XMR) | $173.16 | -0.78% |

| TRON (TRX) | $0.062 | -0.80% |

| NEAR Protocol (NEAR) | $2.47 | -1.25% |

| Cronos (CRO) | $0.081 | -1.34% |

| Chainlink (LINK) |

$6.89

|

-1.56% |

| Altcoin Market Cap |

$550 Billion

|

1.55% |

| Total Market Cap | $990 Billion | 1.45% |

El Salvador isn’t the only country pioneering crypto as a defacto currency. Individual U.S. States continue to push forward more crypto adoption. 📜

Colorado lets you pay income taxes with Bitcoin. Wyoming is still floating the idea of issuing its own stablecoin. Ohio lets businesses pay taxes with Bitcoin.

New Hampshire’s governor created a commission for the NH Department of Energy to look at how Bitcoin mining could be integrated into its energy plan.

Two bills in Mississippi and Missouri have been introduced to protect mining cryptocurrencies as a Right.

And now Arizona is in the crypto policy game. State Senator Wendy Rogers introduced a number of bills to make $BTC.X legal tender in Arizona. 😲

Just as the U.S. Dollar is legal tender for all debts, public and private, the proposed legislation would extend that right to Bitcoin in the State of Arizona. It also gives state entities the ability to work with crypto firms.

However, this isn’t the first time Senator Rogers introduced a ‘make BTC legal tender’ bill. Rogers introduced the bill in January 2022, but it was defeated.

We’ll keep you updated as this legislation develops.

While a lot of retail trading interest has left the crypto space during the bear market, many big players remain, and new ones continue to enter. 👋

The layer-1 financial app builder Injective ($INJ.X) launched a $150 million venture consortium to increase interoperability in not just the DeFi space but for trading/investing and scalability – but only for projects building on Injective or Cosmos ($ATOM.X).

What names/funds are behind this project? Jump Crypto, Pantera Capital, and Mark Cuban originally backed Injective. Still, the new fund includes the investment arms of the Kraken and Kucoin crypto exchanges, Delphi Labs, Flow Traders, IDG Capital, and Gate Labs.

Injective CEO and co-founder Eric Chen said in an interview with TechCrunch that there continues to be significant growth in the crypto space, a surge in builders, but difficulty accessing capital.

“In the current market, there’s a lot of quality projects looking for backing but having more difficulty reaching investors,” said Chen, “… this consortium is a strong signal that they’ll be backing new projects and their funds are actively participating in the ecosystem.” 💰

How many of you were freaking out about yesterday’s day of red? Probably everyone. 😱

Spend any time in a bear market, and you get suspicious of any pump and view every dump as the end of the world.

But looking at the charts shows a lot of support and bouncing has been happening.

Altcoin Market Cap

The first chart showing a bounce is the Total Altcoin Market Cap chart. Yesterday’s close was right on top of the Tenkan-Sen, but today it opened below that same level.

After pushing lower during the intraday session and hitting a new six-day low, bulls came back and have kept the Altcoin Market Cap above the Tenkan-Sen – so far.

The hidden bullish divergence between the candlestick chart and the Composite Index certainly has given bulls some hope – but they’ll have to show some follow-through, or the bears may easily take over.

Cosmos

Yesterday’s price action could have been one nasty bear trap for anyone shorting $ATOM.X.

The close below the Tenkan-Sen yesterday, in combination with the regular bearish divergence between the candlestick chart and the Composite Index, no doubt looked like a great opportunity to either take profit or go short, according to analysts.

However, a look at today’s price action is the equivalent of a bitch slap to any bear. Bullish analysts and traders see the current daily candlestick developing into one of the hawt-est bullish candlestick patterns there is: the bullish engulfing candlestick.

If bulls keep the momentum up and the bullish engulfing candle is confirmed, analysts see continued movement higher for Cosmos.

Hedera Hashgraph

While the Altcoin Market Cap and Cosmos charts look bullish, $HBAR.X falls into the ‘iffy’ category.

Hedera’s chart is iffy because it’s still below the Tenkan-Sen. And many altcoins today look like Hedera’s: off of its daily lows but showing clear signs of struggling to move above the Tenkan-Sen.

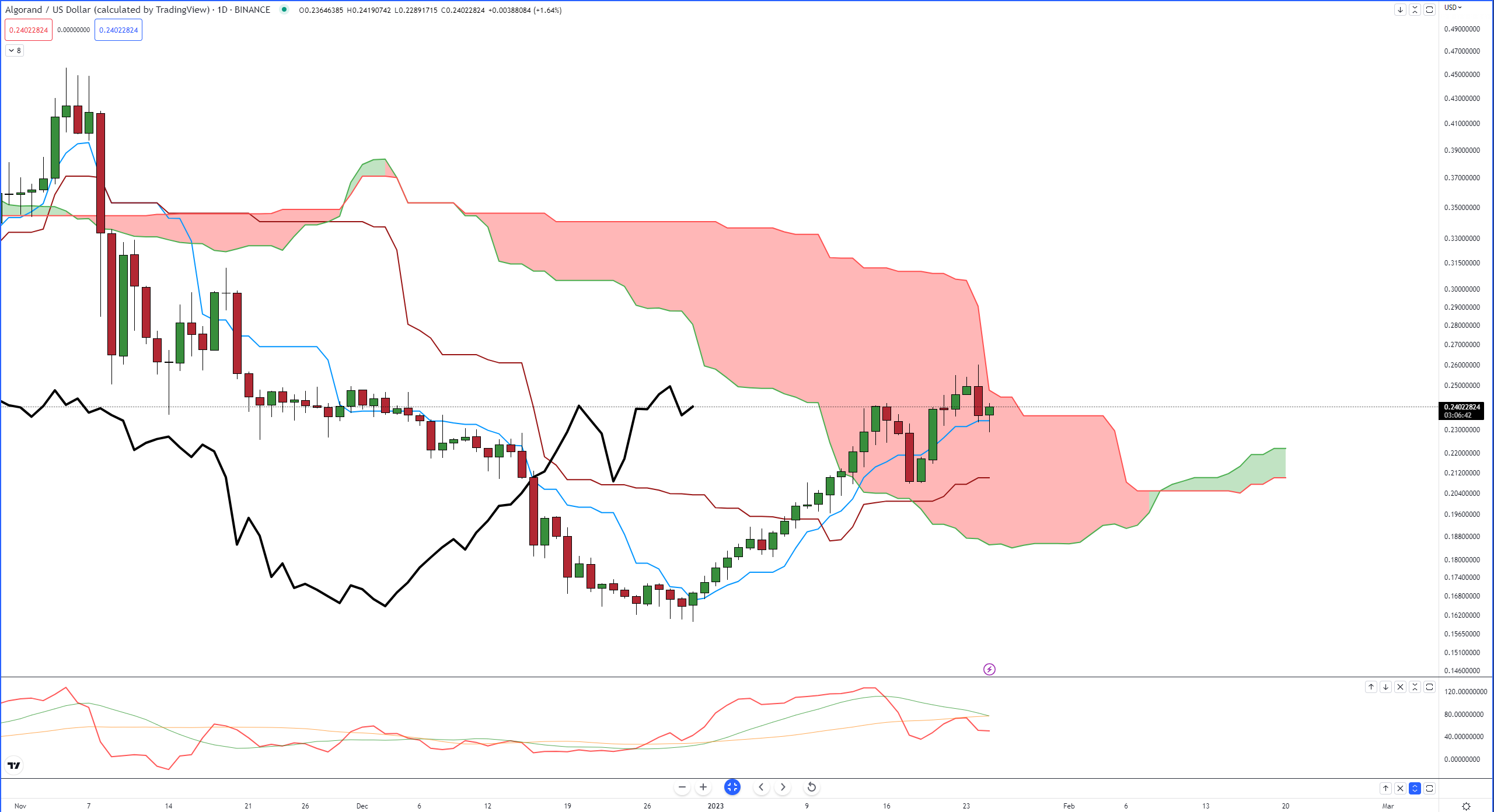

Algorand

If one chunk of the crypto market’s daily chart looks like Cosmos’s and another chunk looks like Hedera’s, there’s another smaller chunk that looks like $ALGO.X‘s.

What’s the key takeaway from Algorand’s daily chart above?

It’s stuck inside the Cloud – the place where trading accounts go to die.

A good amount of the altcoin market has yet to break out above their respective Cloud.

Putting It All Together

If the crypto market behaves the same as it has in past corrective moves or trend changes, then it’s normal to see instruments like $BTC.X, $ETH.X, and Cosmos ping-pong around if they broke out above the Cloud first.

It’s like they’re waiting for the rest of the market for instruments like Algorand to play catchup before any further big moves occur.

Let’s see what happens! 👍

Bullets

Bullets From The Day:

🏎️ What exactly went wrong with Porche’s NFT sale? Well, no one was really interested. Barely 1,900 of the 7,500 tokens were sold since yesterday – roughly 25%. The German automaker has decided to cut their supply and stop minting. Brandon Frankel, CBO of NoCap Shows, said, “This is so typical of big brands- they want to ‘innovate’ and push boundaries, but if they ever do, they don’t listen or they hire the wrong agencies. It’s wild.” CryptoNews has more.

🏦 The European Union voted on a draft bill that ties the hands of banks holding crypto. The bill would require banks to hold 1 Euro of their own capital for every Euro they hold in crypto. Crypto would be classified as ‘unbacked’ and in the highest risk tier, putting a 2% capital limit on crypto. Markus Ferber, a German MP, said these capital requirements would help mitigate crypto contagion from affecting the rest of the financial world. A final version of the bill has yet to be approved. More from Forkast.

🪙 The company that created stablecoin$USDC.X, Circle, blames the SEC for its failed SPAC listing. Circle announced its intention to go public with the Special Purpose Acquisition Company (SPAC) Concord Acquisition Group in July 2021. Initially valued at $4.5 billion, they had amended their filing a few months later when their valuation went to $9 billion – it would have been one of the largest SPAC listings ever. A spokesperson said, “The business combination could not be consummated before the expiration of the transaction agreement because the SEC had not yet declared our S-4 registration ‘effective.” Circle’s USDC is the second largest stablecoin by market cap, $43.6 billion. Yahoo!Finance has more.

🌳 There’s DeFi (Decentralized Finance), TradFi (Traditional Finance), and now ReFi (Regenerative Finance). ReFi is best thought of as blockchain and crypto’s green/eco-friendly side. It includes cryptocurrencies with networks that are carbon neutral or negative such as Cosmos ($ATOM.X), Hedera Hashgraph ($HBAR.X), and Polygon ($MATIC.X). Boyd Cohen, CEO of Iomob, discussed in an op-ed why regulation and policy changes could create a boom in the ReFi space. More from Coindesk.

Links

Links That Don’t Suck:

🤙 US accuses Google of ‘driving out’ ad rivals

🟨 Gold is expected to rally further – Credit Suisse

🎥 Film review: ‘Human B’ shows a personal journey with Bitcoin

⚗️ Core Scientific raised $500M from BlackRock, Apollo and others

💠 Polkadot speeds past Cardano to become top Crypto by dev activity

⛓️ Chainlink forms extremely important signal, here’s what it might bring

🎮 Mythical Games eyes $50 million raise, launches enhanced NFT-gaming marketplace

🕵 Hackers demand $10M from Riot Games to stop leak of ‘League of Legends’ source code

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: