This is going to be one hell of a week for all markets. 🔴

When the European Central Bank, Bank of England, and U.S. Federal Reserve all report interest rate decisions, you can bet your behind that there will be some volatility.

In today’s Litepaper, we’ll look at Cardano’s new upcoming stablecoin, Polygon’s increased inflows, and why some selling pressure might be a good thing for the bulls.

Red day across the board for crypto. The Total Market Cap dipped below $1 Trillion, showing signs that the market might ping-pong around that level for a while.

Here’s how the market looked at the end of the trading day:

| TRON (TRX) |

$0.06

|

-2.50% |

| Avalanche (AVAX) | $20.20 | -3.03% |

| Dogecoin (DOGE) | $0.087 | -3.53% |

| BNB (BNB) |

$304.92

|

-4.00% |

| Bitcoin (BTC) |

$22,782

|

-4.31% |

| XRP (XRP) | $0.395 | -4.46% |

| Stellar (XLM) | $0.089 | -4.58% |

| Monero (XMR) | $176.40 | -5.11% |

| Shiba Inu (SHIB) | $0.0000114 | -5.46% |

| Bitcoin Cash (BCH) |

$129.67

|

-5.72% |

| Altcoin Market Cap |

$547 Billion

|

-4.54% |

| Total Market Cap | $985 Billion | -4.45% |

As announced last week by COTI ($COTI.X), Cardano’s ($ADA.X) over-collateralized, algorithmic stablecoin, DJED, is set to launch this week. 🚀

Quick note: Don’t know what stablecoins are? Check out our Crypto 101 article.

Algorithmic stablecoins have become a pariah in the crypto space. Not only has every single one failed, but the most spectacular collapse of any algorithmic stablecoin, Terra’s TerraUSD ($UST.X), last year is cited as one of the primary catalysts for the current bear market.

So why does Cardano think their stablecoin will be better? COTI created a video explaining the unique mechanism of DJED.

If you want to step into crazy math land, look at Cardano’s 86-page monster with a bunch of math sorcery and wizardry titled: Djed: A Formally Verified Crypto-Backed Pegged Algorithmic Stablecoin.

And then compare it to Do ‘Con’ Kwon’s TerraUSD – a 15-page middle-schoolers geography report in comparison.

So far, support for DJED has been confirmed by Bitrue, MuesliSwap, and Minswap. 👍

On-chain analysis involves several metrics that can be daunting for someone new to cryptocurrencies. So don’t get freaked out about the word. 🤔

Analysts often interpret inflows as bearish because crypto going to an exchange is usually sold.

Outflows, on the other hand, are often interpreted as bullish. Outflows mean crypto is leaving the exchange.

And net flows are just the difference between inflows and outflows – more crypto leaving (outflow) an exchange than entering (inflow)? That’s a negative net flow number.

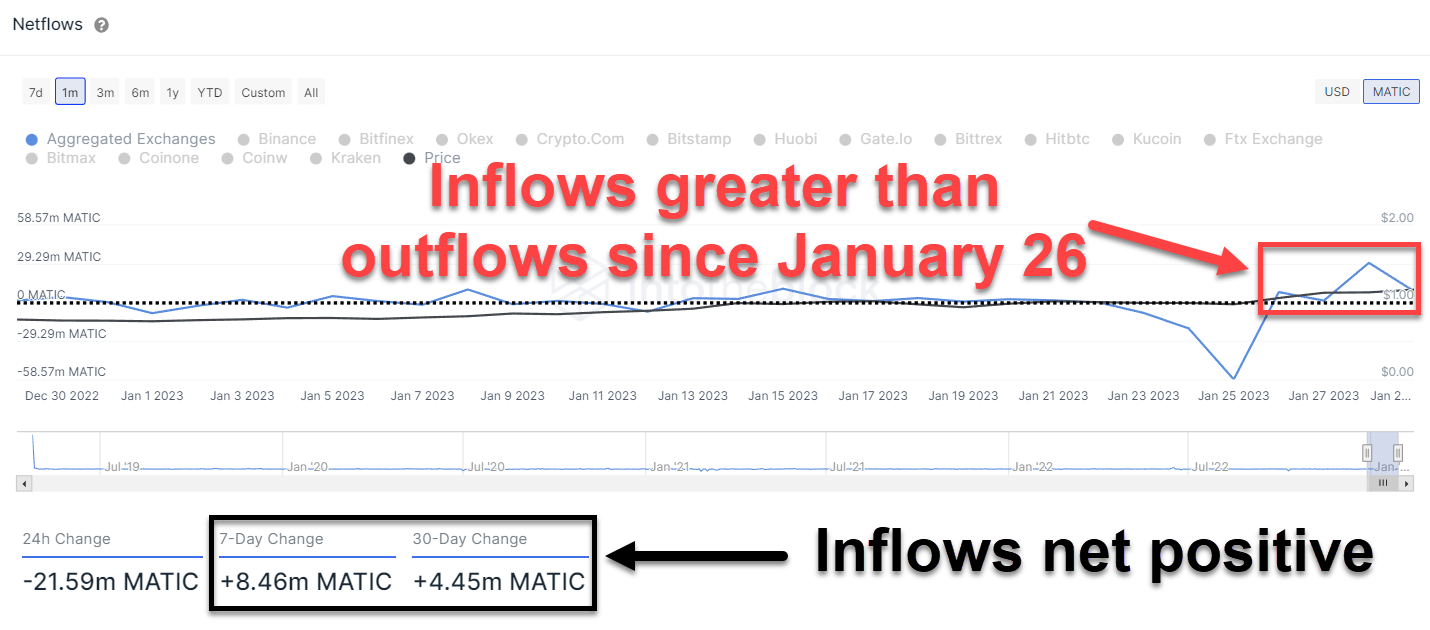

For $MATIC, there’s been an increase in inflows to exchanges.

While there were some major outflows for MATIC from January 23 to January 25, the inflows have been greater than outflows since January 26.

However, the graph shows that the most recent activity shows that the inflows have decreased.

Does this tell us a top is in for Polygon? No – but analysts warn it does show that some profit-taking is probably occurring.

We’ll keep an eye on MATIC and update you if there are any major changes. 🕵

Some of the strongest selling pressure of 2023 occurred today, putting traders and investors on edge as they digest today’s move. 🔻

A good number of analysts believe profit-taking is beginning before the major fundamental news events later this week – and there are some big ones.

Tuesday – January 31

Can’t leave January without some volatility and drama.

- E.U. GDP Growth Rate QoQ and YoY at 5 AM EST.

Wednesday – February 1

This is arguably one of the biggest days of the week due to the massive amount of major data coming from the E.U. and U.S.

- E.U. Unemployment and Inflation data at 5 AM EST.

- U.S. Manufacturing PMI at 10 AM EST.

- U.S. JOLTs Job Openings at 10 AM EST.

- And the biggest kahuna is the Fed’s Interest Rate Decision at 2 PM EST. 👀

Thursday – February 2

To top off all of Wednesday’s craziness, Thursday gives all market participants a double whammy of interest rate decisions.

- Bank of England Interest Rate Decision at 7 AM EST.

- European Central Bank Interest Rate Decision at 8:15 AM EST.

Total Crypto Market Cap Chart

So how will crypto respond before and after? It’s a crapshoot. Analysts are certainly mixed.

But some profit-taking before the major economic news dumps this week is very probable. And it might even be desirable.

Why desirable?

From an Ichimoku perspective, a Kumo Twist is coming up between February 3 and 5.

Kumo Twists are events when Senkou Span A crosses Senkou Span B – in other words, the Cloud changes color from green to red or vice versa.

Kumo Twists have a high probability of showing when a major/minor swing high/low could occur.

While bulls would love to see crypto continue creeping higher, if it does continue to move higher between February 3 and February 5, that could mean a top is in, and a big dump could be around the corner. Something bearish analysts and traders would like to see happen.

On the other hand, some selling pressure today could extend into February 5, giving the recent move a needed pullback.

For bulls, the ideal scenario would be a -10% retracement down to the Kijun-Sen at $900 Billion on or around February 4 to develop a possible swing low before continuing the current short-term drive higher.

However, the overall market remains extremely bearish – but we’ll keep an eye on how this market progresses. 👁️

Bullets

Bullets From The Day:

🔪 Exchanges, activists, and law enforcement are working hard to prevent North Korea’s Lazarus Group from laundering hacked crypto. The Harmony ($ONE.X) hack from June 2022 by Lazarus has not been forgotten. Last week, the North Korean hackers successfully launder roughly 63.5 million worth of $ETH.X and made another attempt to launder $27.7 million over the weekend. However, this time exchanges were reportedly able to stop most of the funds. Pundits are mixed as to whether the halted ETH will be returned to Harmony or handed over to the FBI. CryptoPotato has more.

👽 Captain Kirk wants Bitcoin to go to the moon. William Shatner, the captain of the original U.S.S. Enterprise from Star Trek took to Twitter and tweeted: “Have fun this week. Make Bitcoin go “to the moon”!” The tweet was on a photo from Chainstone Lab’s CEO, Bruce Fenton. See the Tweet here.

💊 Pfizer ($PFE) is throwing some money at Holy Grail Research longevity research. The pharma giant’s venture capital arm participated in a $4.1 million raise for VitaDAO. VitaDAO is a decentralized autonomous organization that is part of a relatively small and unknown part of the crypto universe known as Decentralized Science (DeSci). VitaDAO intends to focus on research and projects involved with aging and longevity. The Block has more.

👸 “Crypto-queen” Ruja Ignatova ‘might’ be alive, according to property documents filed in London. Her attorney’s listed one of the FBI’s Most Wanted as the beneficial owner of a $13 million (reduced from $15 million) property. It is believed that a change in Britain’s Companies House rules – which now requires beneficial owners to be named in full instead of anonymously through a different company, may have forced Ignatova out of hiding to claim the asset. Ignatova is the 11th woman to hit the FBI’s Most Wanted list in history. More from MSN.

😃 GOP Whip and major crypto proponent Representative Tom Emmer (R-Minnesota) believes Congress is warming to crypto. During an interview on The Block’s podcast, The Scoop, Emmer explained that there is growing bi-partisan support for crypto and that FTX is not indicative of the crypto industry. Emmer stressed that FTX is just another form of centralized, traditional finance. He also expressed that crypto is a topic that some Democrats and Republicans see eye-to-eye on. The Scoop has more.

Links

Links That Don’t Suck:

🎮 Steam reportedly getting classic PS1, PS2, and PS3 games

⤴️ Mina jumps 33% as OpenMina node browser concept gains traction

✂️ After job cuts, BuzzFeed employs ChatGPT to create website content

🔭 Biden administration urges U.S. congress to pursue crypto regulation

⛏️ Bitcoin mining difficulty touches new ATH following 4.68% adjustment

⚒️ South Korea to build a crypto tracking system to prevent cybercrime: report

🧨 Europe’s crackdown on Big Tech omitted TikTok — but now that’s set to change

📣 China will declare crypto and Bitcoin a ‘legitimate form of wealth,’ Tron founder claims

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: