USDC depegs, crypto related banks tank, the global financial system has jitters but crypto rallies back to $1 trillion. 🥞

Just a whole hell of a lot of craziness going on.

In today’s Litepaper, we’re going to take a hard look at Bitcoin’s and Ethereum’s charts and some long-term outlooks on what analysts see.

Additionally, if you’re wondering what the hell is going on with the crypto banking stuff and the accompanying FUD, there’s a very simplified explanation (and a link to a detailed one) for you, too.

As far as how price action has gone this Monday, well, look at all that green in the table below.

Here’s how the market looked at the end of the trading day:

| Filecoin (FIL) |

$6.33

|

22.03% |

| OKB (OKB) | $48.13 | 18.91% |

| Bitcoin (BTC) | $24,213 | 14.45% |

| Litecoin (LTC) |

$81.89

|

14.11% |

| Ethereum Classic (ETC) |

$19.53

|

10.59% |

| TRON (TRX) | $0.067 | 10.32% |

| Avalanche (AVAX) | $16.46 | 9.57% |

| BNB (BNB) | $308.02 | 9.12% |

| Solana (SOL) | $20.50 | 8.96% |

| Cardano (ADA) |

$0.344

|

8.74% |

| Altcoin Market Cap |

$575 Billion

|

3.67% |

| Total Market Cap | $1.04 Trillion | 5.91% |

Bitcoin

It’s been a while since we’ve reviewed some of the prior long-term analyses on $BTC‘s charts. Let’s do that now because the price level and price action currently occurring on Bitcoin’s chart are areas we looked at months ago. 🔭

Oh, there’s a TL;DR (Too Long; Didn’t Read) summary if you can scroll down to if you want to skip the nerd speak.

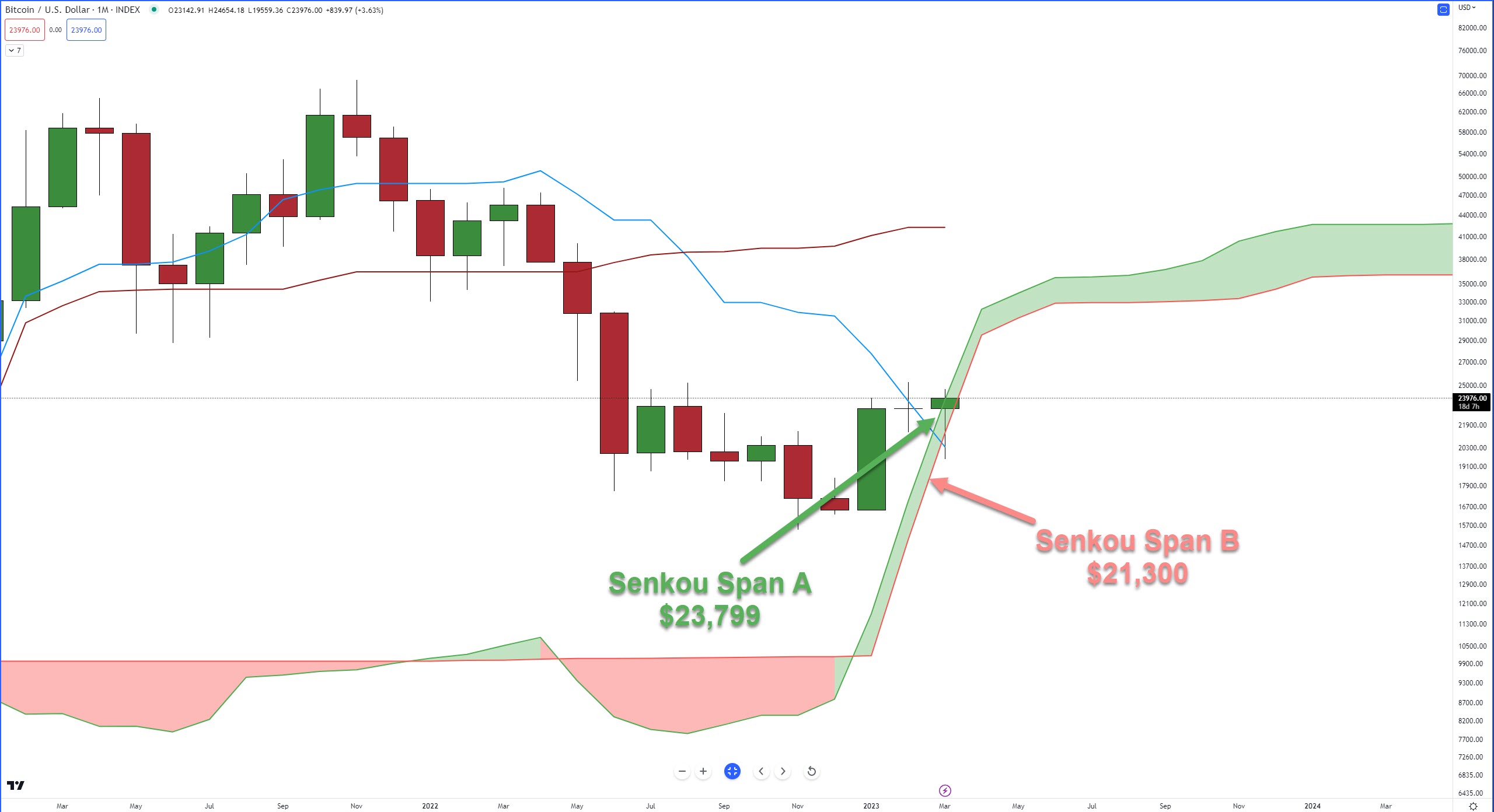

We’re stepping back in time a little over six months ago to the September 2, 2022, Litepaper.

In either scenario, 2023 will be critical for Bitcoin within the Ichimoku system. Because in order for Bitcoin to maintain a clear and strong bullish trend, it will need to remain above the monthly Cloud.

The bottom of the monthly Cloud for 2023 starts at $10,000 and then moves dramatically higher until it reaches $33,000 in June 2023 before slowly increasing towards the $34,400 level in December 2023.” – September 2, 2022, Litepaper.

Next stop, January 4, 2023. 🚊

“From an Ichimoku perspective, Bitcoin is sitting in a position that makes me want to nerd out – the next three months are going to be exciting to watch.

Why? Because of Patel’s Two Clouds Theory (at least, that’s what I call it).

In Manesh Patel’s book, Trading with Ichimoku Cloud: The Essential Guide to Ichimoku Kinko Hyo Technical Analysis, Patel calls attention to an Ichimoku phenomenon that no other modern Ichimoku analyst has called attention to in book form. This is what he observed:

When a major trend change occurs, the Future Cloud is thin, with both the current Senkou Span A and Senou Span B pointing in the direction of the Cloud.

It’s a rare condition that is currently present on Bitcoin’s monthly chart:” – January 4, 2023, Litepaper

That brings us to Bitcoin’s current monthly chart: 📈

February 2023 was the flattest month in Bitcoin’s history – but it still closed above the Cloud.

March is almost halfway finished, and until this past Saturday (March 11), things looked bleak for the bulls.

Given that Bitcoin has been trading above the Cloud, it is unsurprising that it has exhibited persistence in remaining above it.

However, what deserves close attention is the state of price action in relation to the current structure of the Cloud, as outlined by Manesh Patel.

TL;DR

So, the question is this: if bulls want to keep Bitcoin moving higher, where will Bitcoin need to close to keep that momentum moving?

Answer: at or above $23,800.

If bears want to take control, where do they need to close March?

Answer: Below the Tenkan-Sen, at or below $20,367.

Ethereum

The first chart we’re looking at is from the February 1, 2023 Technically Speaking article. 📆

The primary takeaway for $ETH in that article was analysts warning that a massive rally for Ethereum in February might not be a good thing:

Bulls might not want to see a massive rally for Ethereum in February because of a Kumo Twist in March 2023.

A behavior of price action with the Ichimoku system with Kumo Twists is that they can sometimes identify where a turn in the market may occur.

If an instrument is trending strongly in a single direction into the Kumo Twist, then there is a high probability of the market facing a new major/minor swing.

Kumo Twists can help answer the question of when something might happen.

Fast forward to today, and this is what it looks like. 📆

Note that February did close above the Tenkan-Sen. In the February 1 article, special attention was made because that was a significant event:

Ethereum is now above the monthly Tenkan-Sen for the first time since December 2021 – 14 months. – February 1, 2023, Litepaper

TL;DR

As long as bulls can close Ethereum’s monthly chart at or above $1,518, the upside potential remains strong.

For the bears, it’s a harder road compared to Bitcoin’s monthly chart. There are significant support structures near the psychologically important $1,000 value area.

We’ll update these as time progresses. Thanks for reading! 🤗

Feel out of the loop with what the heck is going on with the bank fears and doom and gloom over the past couple of weeks? I’ll try and make it as simple, fast, and painless as possible. 🤕

This means a nice big chunk of the nitty gritty details won’t be in here, but you can read them in the fantastic article from last Friday’s Daily Rip.

Also, I loved picture books as a kid (probably why I like charts) and thought a picture book-ish version would make it easier.

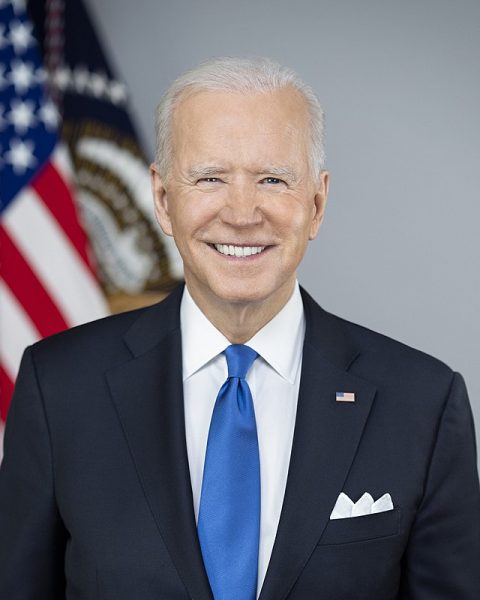

Let’s start with this guy:

When his dumpster fire FTX collapsed, fallout led to people doing this:

which affected this crypto bank:

that made ‘big money’ in the tech and fintech world go:

and do virtual versions of this:

that spooked more investors and then spread to this hugenormously important bank:

The shite storm with Silicon Valley Bank came to a head late last week, with experts fearing this would happen in the financial system:

Then, over the weekend, a familiar entity arrives to save the day:

And finally, to put everyone’s concerns to rest, an elected official who typically reserves surprise television broadcasts for new wars, terror attacks, or impending zombie apocalypses made a surprise television broadcast to reassure us that everything is okay:

And that’s where we are today.

Bullets

Bullets From The Day:

👍 Cathie Wood stated that $BTC and $ETH have remained strong despite the ongoing banking crisis in the United States. Wood believes the current financial system is becoming increasingly fragile, and decentralized cryptocurrencies such as Bitcoin and Ethereum can provide a viable alternative. She also stated that she remains bullish on Bitcoin and Ethereum, predicting that their prices will continue to rise over the long term.

😞 A moment of silence for those with short positions in the crypto market. Over $238 million has been liquidated over the past 24ish hours. The liquidations occurred across various exchanges and involved a range of cryptocurrencies, with traders being forced to sell their positions due to margin calls. Short squeeeeeeeeeeze. Despite the volatility (which has been on the bearish side the last few weeks), some analysts remain optimistic about the long-term prospects of Bitcoin and the wider cryptocurrency market.

🪐 Fed forced to pivot? Some analysts believe that the Fed may need to change its approach to address the challenges posed by cryptocurrencies; others argue that the Fed’s policies are primarily driven by the broader macroeconomic environment and are unlikely to be influenced by the rise of digital assets alone. The Fed’s actions in bailing out lost deposits in shuttered banks have led to speculation that the first cracks in the Fed’s quantitative tightening cycle are imminent and that the Fed may have to backpedal.

😎 The use of Decentralized Exchanges (DEX) and Decentralized Finance (DeFi) exploded over the weekend. Curve Finance ($CRV) tweeted on Saturday they experienced their highest single volume day in history. Roughly $6.03 billion in stablecoin transactions occurred on Saturday, generating $4.9 million in fees for the DEX’s liquidity providers. Similarly, Uniswap ($UNI) reported its $USDT-$USDC and $DAI-USDC pools hit $6 billion and $1.4 billion, respectively.

Links

Links That Don’t Suck:

😵 Digital asset funds experience biggest weekly outflows on record

💵 HSBC acquires Silicon Valley Bank’s UK Division for £1

🤯 916 million XRP moved by Ripple as third crypto-friendly bank crashes

🔒 Okcoin suspends USD deposits in wake of Signature Bank closure

🌉 Crypto payments specialist Stellar bridges fiat and stablecoins to Polkadot

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: