Green, green, and more green today before we set off into the weekend. 🟩

In today’s Litepaper, we’re starting off with a look at the historical performance of Bitcoin during the month of June.

Following that, we dive into a surprising revelation – Peter Schiff’s NFT on the Bitcoin blockchain went on sale today. Yes, you heard it right, the same Peter Schiff who often denounces Bitcoin.

We will also be discussing Coinbase’s recent introduction of BTC and ETH futures for institutional investors and delve into the details of a new proposed legislation that was just introduced today.

Here’s how the market looked at the end of the trading day:

| Filecoin (FIL) | $4.97 | 4.92% |

| XRP (XRP) | $0.525 | 3.74% |

| Solana (SOL) | $21.36 | 3.35% |

| Litecoin (LTC) |

$95.35

|

3.33% |

| Stellar (XLM) |

$0.092

|

2.87% |

| Ethereum (ETH) | $1,909 | 2.56% |

| Cardano (ADA) | 0.379 | 2.55% |

| Bitcoin (BTC) | $27,285 | 2.15% |

| Uniswap (UNI) | $5.09 | 2.10% |

| Dogecoin (DOGE) |

$0.073

|

1.87% |

| Altcoin Market Cap |

$583 Billion

|

1.79% |

| Total Market Cap | $1.112 Trillion | 1.91% |

So, this is kind of a big deal:

According to lawyers representing Binance and its founder CZ, SEC Chair Gary Gensler offered to serve as an advisor to Binance’s parent company in 2019. 😱

The lawyers claim that documents filed by the SEC indicate Gensler’s involvement, stating that he had conversations with Binance executives and Zhao and even had lunch with Zhao in Japan that same month. At the time, Gensler was a professor at MIT, but he was later appointed head of the SEC in 2021 and has since been leading a crackdown on the crypto industry.

The recent filing by Binance’s legal team suggests that Gensler was initially trying to establish a friendly relationship with the company before turning against it. The Wall Street Journal had previously reported on their relationship based on internal Binance messages and a source close to Gensler. The lawyers also mention that Zhao maintained contact with Gensler after their meeting, including participating in an interview for a cryptocurrency course taught by Gensler at MIT.

Although Binance requested Gensler’s recusal from any actions involving the company due to their previous ties, the SEC has not acknowledged their request. The SEC’s investigations into Binance and its US subsidiary began in 2020 and 2021, respectively, which was after the alleged interactions between Gensler and Zhao. 🥷

Crypto

The Atomic Wallet Hack

Last weekend, the crypto world was rocked by a hacking incident that affected Atomic Wallet ($AWC), a popular non-custodial digital asset storage platform. 😱

Despite the company’s claim that less than 1% of its monthly active users were impacted, the attack resulted in the loss of over $35 million in various digital assets, including $BTC, $ETH, and $ADA, among others. Atomic Wallet is now working with major exchanges to block the attackers’ addresses.

At the moment less than 1% of our monthly active users have been affected/reported. Last drained transaction was confirmed over 40h ago.

Security investigation is ongoing. We report victim addresses to major exchanges & blockchain analytics to trace and block the stolen funds.

— Atomic – Crypto Wallet (@AtomicWallet) June 5, 2023

This comes on the heels of the backlash faced by Ledger, a leading hardware wallet, for potential software updates that could compromise user security (the Ledger Recover debacle). 😧

Interestingly, Least Authority raised concerns about Atomic Wallet’s vulnerabilities over a year ago in February 2022:

The Atomic Wallet devs hired Least Authority to do a security audit. Least Authority is now taking the unusual step of warning the public that user funds are at risk.https://t.co/QQroqFqSQQ

— zooko❤ⓩ🛡🦓🦓🦓 (@zooko) February 10, 2022

Atomic Wallet did give their customers and the crypto community as a whole an update last night:

Atomic is committed to helping as many victims of the recent exploit as possible. We’ve engaged @chainalysis a leading Crypto Incident Investigator. To trace stolen funds and liaise with exchanges and authorities.

— Atomic – Crypto Wallet (@AtomicWallet) June 7, 2023

We’ll keep you updated.

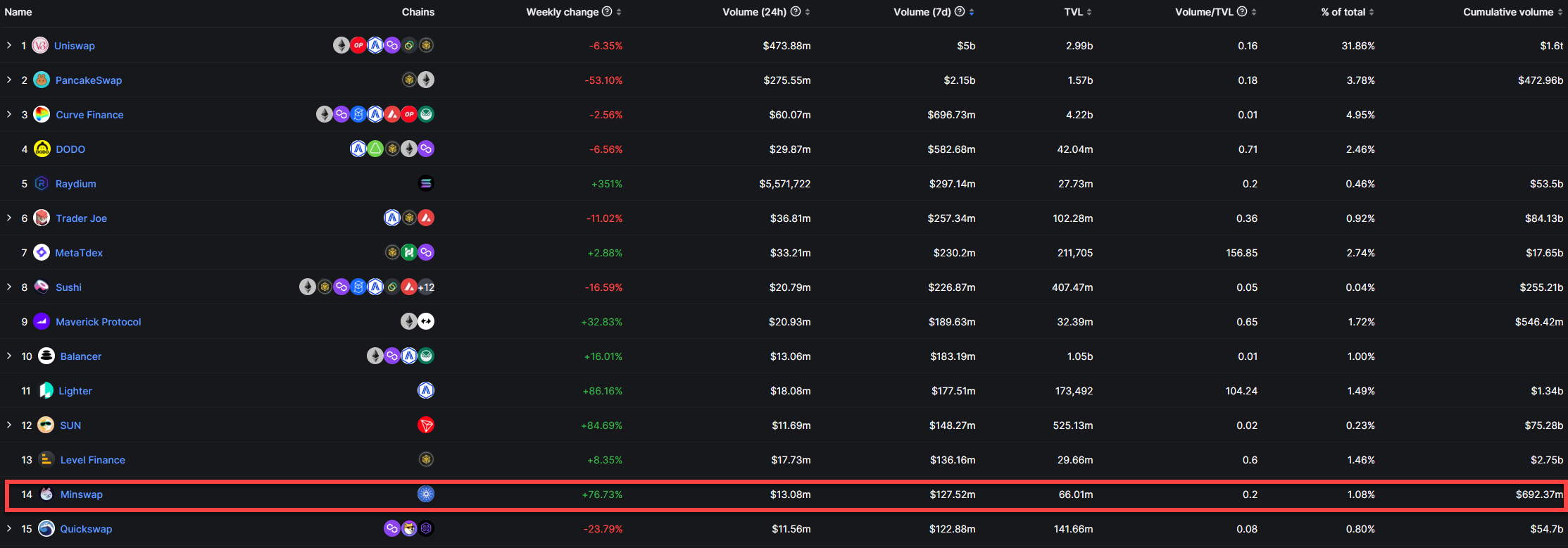

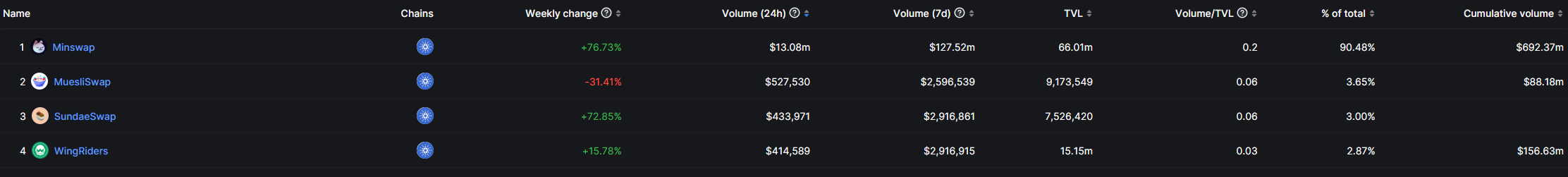

Minswap’s ($MIN) weekly volume pushed it above Quickswaps ($QUICK) for the past seven days, putting Minswap in 14th place. 🤯

Recently, Cardano’s native token, $ADA, saw a notable upswing in large transactions amounting to an impressive $2.5 billion within a single day.

Almost all of the activity has been due to Minswap – look at the 24h volume and the 7d volume. 👀

Alongside, the total value locked (TVL) in the blockchain’s decentralized finance (DeFi) segment displayed significant growth, catapulting to more than $180 million.

There’s also a noticeable uptick in the trading volume on Cardano’s decentralized exchanges (DEXs), which suggests a growing interest in decentralized trading and the increased liquidity of ADA tokens.

The DeFi ecosystem on Cardano also set new records with an all-time high of 463 million ADA tokens, symbolizing consistent DeFi expansion on the network. In addition, the TVL in Cardano’s DeFi sector has seen a steep rise from around $50 million at the year’s start.

Even as ADA’s short-term price movement displays some volatility, the consistent inflow of large transactions underlines sustained confidence in the long-term potential of Cardano and its associated assets.👌

A crucial part of the crypto world, decentralized exchanges, or DEXs, enable traders to transact directly with each other without the need for intermediaries like banks or traditional exchanges. Instead of relying on a central authority to oversee and authorize transactions, DEXs utilize blockchain technology to facilitate and validate peer-to-peer trades.

Key characteristics of DEXs:

- Peer-to-peer trading 🤝: In a DEX, the trading process involves a direct exchange between two parties.

- Non-custodial 💼: DEXs do not hold your funds. Instead, you retain complete control of your assets.

- Operates using smart contracts 🤖: Trades are executed and facilitated through smart contracts, self-executing contracts with the terms of the agreement directly written into the code.

The Inner Workings of DEXs

DEXs operate on blockchain networks that support smart contracts, such as Ethereum and Binance Smart Chain ($BNB). When a trade is initiated on a DEX, the platform’s smart contract kicks into gear, automatically executing the transaction following its predetermined set of rules. This ensures that the terms agreed upon by both parties are adhered to without the need for trust or the oversight of a third party.

💡Remember: In a DEX, the platform itself never comes into contact with your funds. Everything is managed within the blockchain through the smart contract!

Advantages of DEXs: Trading with Freedom and Privacy

Decentralized exchanges bring a host of unique advantages to the table:

Bullets

Bullets From The Day:

🔫 A former regulator is taking a lead role at Binance. Richard Teng, the former CEO of the Financial Services Regulatory Authority of Abu Dhabi Global Market, has been appointed to oversee Binance’s markets outside the United States, positioning him as a potential successor to Changpeng Zhao (CZ). This move comes as CZ reportedly plans to reduce his stake in Binance.US, possibly to address concerns from American regulators.

😖 Glassnode suggests that Bitcoin has been gradually shifting away from the United States during the 2022 bear market. The analysis reveals a redistribution of BTC supply towards Asia, with a notable decrease in the amount held and traded by U.S. entities. Since mid-2022, the dominance of U.S. supply has fallen by more than 10%, while Europe’s share has remained relatively stable. Glassnode researchers observed a significant increase in supply dominance across Asian trading hours. The data is based on the Year-over-Year Supply Change metric.

🎇 Get your arm floaties ready, the PoolTogether lawsuit is done. The 2-year-long lawsuit against the (DeFi protocol PoolTogether has finally been dismissed by a US federal judge. PoolTogether’s co-founder, Leighton Cusack, announced the news on Twitter, expressing excitement over the court’s decision. The lawsuit, filed by Joseph Kent, the former head of tech for Senator Elizabeth Warren’s presidential campaign, alleged that PoolTogether ran an illegal lottery and casino in New York. However, the judge ruled in favor of the defense, stating that while there were concerns about PoolTogether’s legality, the matter should be addressed in a state court rather than a federal court.

Here is some of what’s inside today’s curated NFT news collection:

The promising future of NFT gaming on blockchain, tackling legal complexities of Bitcoin NFTs, discussing All Nippon Airways’ forthcoming NFT venture, the 72-hour open mint of Gamified Storytelling Project Axis Mundi’s NFTs, and the collaboration between BBC Studios and Reality+ to introduce Doctor Who into The Sandbox metaverse.

Links

Links That Don’t Suck:

😆 Mark Cuban on Coinbase crackdown: “No One Trusts” The SEC

⛱️ The Sandbox owner Animoca Brands to focus on non-US customers

🔊 Bitcoin, Ethereum, & other assets have registered an increase in volumes

🆒 New crypto traders need ‘cooling-off’ period rules UK watchdog

🥘 Bittrex US request to return customer funds ‘premature,’ government argues

🫠 South Korea lead prosecutor says Do Kwon likely to spend most of life in prison