Despite yesterday’s relief rally, the market appears to be turning on Powell and the Federal Reserve again.

Papa Powell tried to soothe the market with a 75bp rate hike and some smooth talk, but after some time to mull over his message, the market isn’t buying it.

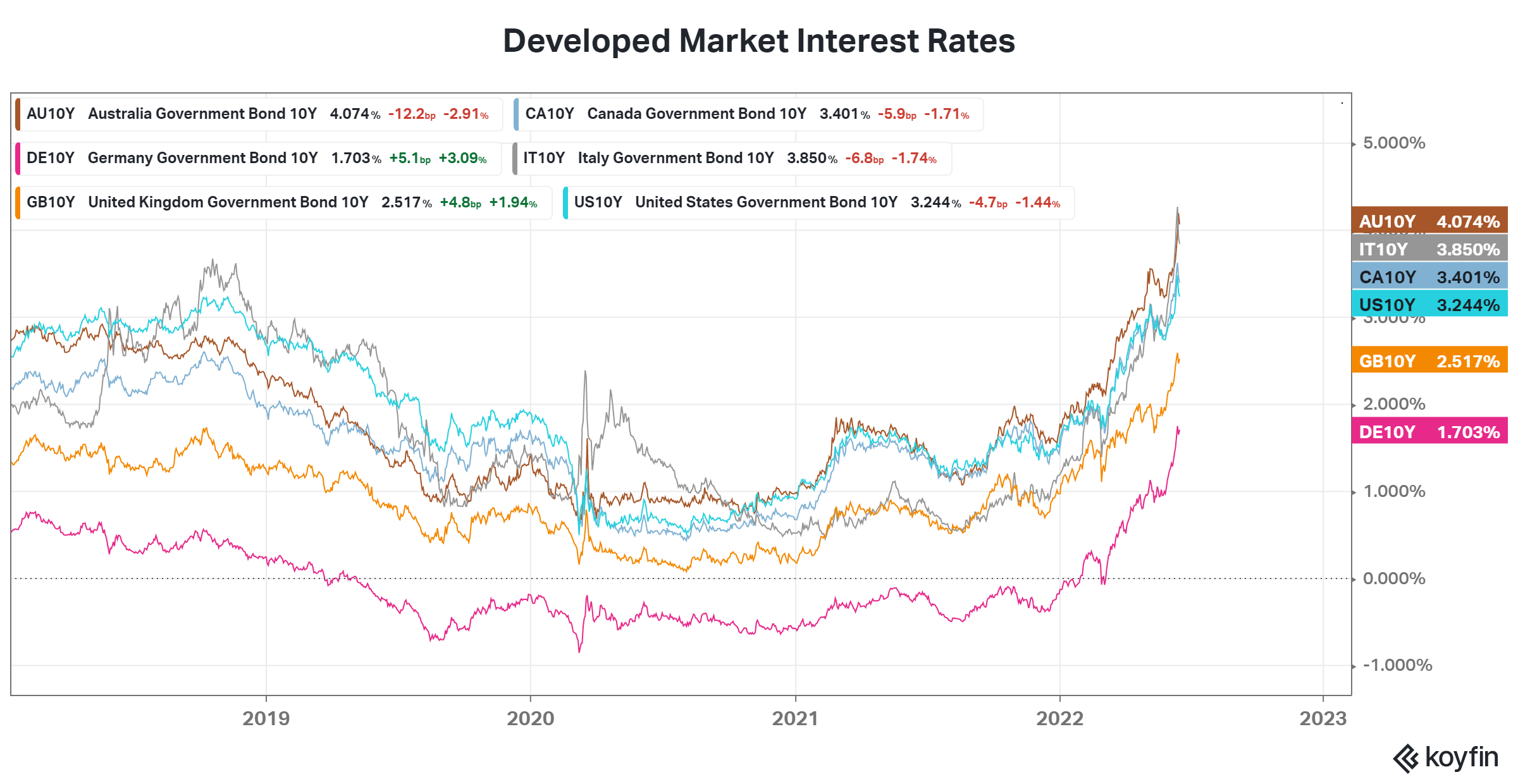

Recession fears are picking up around the globe, with stocks making new cycle lows across many U.S. and international indexes. Risk-off action is occurring simultaneously as many central banks are raising rates at their most aggressive pace in decades to curb record-high inflation. 🥵

In the last few weeks, we’ve seen moves from the U.S. Federal Reserve, Reserve Bank of Australia, the Bank of England, the Swiss National Bank, the Bank of Canada, the Reserve Bank of India, the Central Bank of Argentina, and others…

This great chart from global-rates.com summarizes them all. 📈

Commentary from many of these central bankers suggests that they will fight hard to bring inflation down, even if that means sacrificing some economic growth.

This view contrasts their thoughts from just a few months ago that bringing inflation down while keeping the economy intact was not only possible but probable.

Some say that the unlikeliness of that scenario was telegraphed by the move in government bond markets, which rallied aggressively since January as inflation expectations grew.

That preemptive tightening in the bond market highlights what we all know deep down but don’t want to admit.

Central banks don’t *entirely* control interest rates. Instead, the market controls interest rates, and central banks do their best to use the tools at their disposal to meet their objectives.

And right now, many in the market are calling bullshit on the Fed and other central banks’ idea that inflation will come down without hurting the economy.

Whether or not the market is correct remains to be seen. However, softening economic data, record pessimism among consumers/business leaders, and big bets from hedge fund titans like Bridgewater are anticipating more pain ahead.

Who do you think is going to be right? Let us know your thoughts! 💭

P.S. we haven’t even talked about the Bank of Japan and the Japanese Government Bond market, but that needs a post of its own. For now, just know that speculators are playing chicken with the central bank, betting that it won’t be able to keep rates as low as they originally planned. 😬