Every fourth Friday of June, the popular Russell indexes are reconstituted, shaking things up for traders and investors alike. 📋

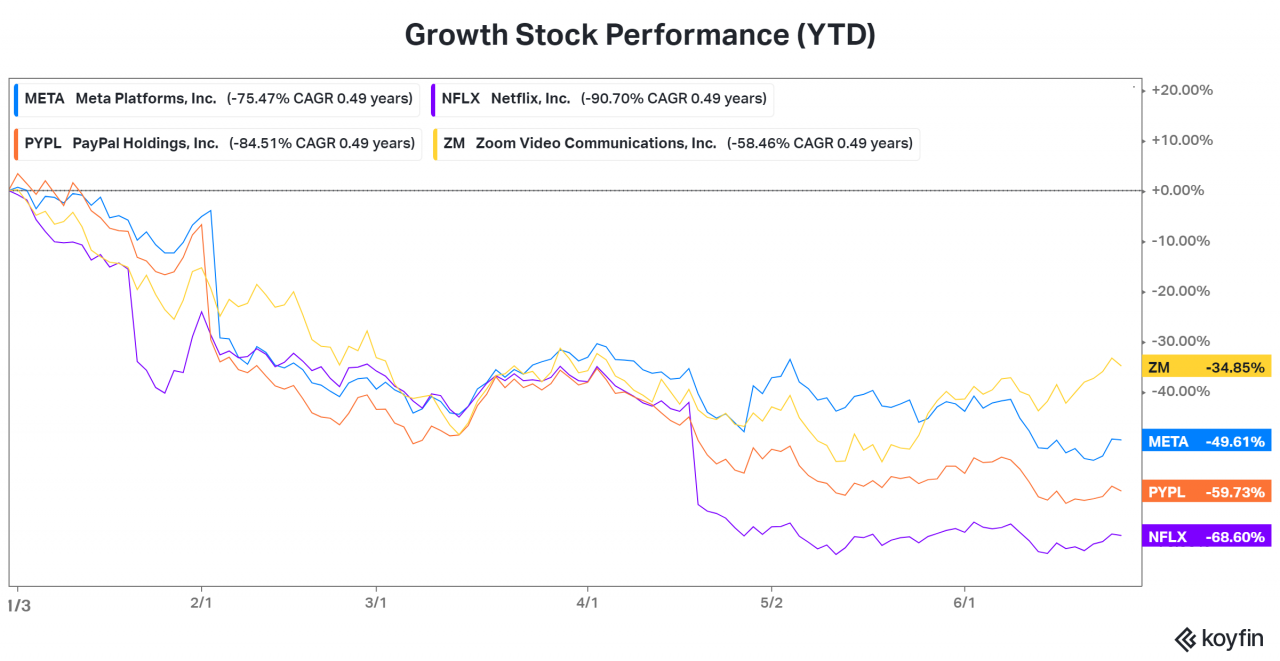

Among this year’s rebalance, one of the most significant changes was the shift of Meta, Netflix, Paypal, and Zoom from the Russell 1000 Growth Index into the Russell 1000 Value Index. 🐌

These high-flying tech names have cooled significantly, with shares plummeting year-to-date and over the last year. 🥶

As interest rates rose over the last year, companies like these faced a double whammy.

Higher interest rates made financing their growth more expensive, and it reduced the multiple that investors were willing to pay for their earnings. 📉

As a result, you saw their businesses slow and stock prices re-rated to the downside as investors moved the capital to more cyclical or “value” areas of the market like financials, industrials, materials, etc.

These stocks have been hammered and now have lower price-to-book and growth values, so they’ve met the index provider’s “value index” specifications. 📊

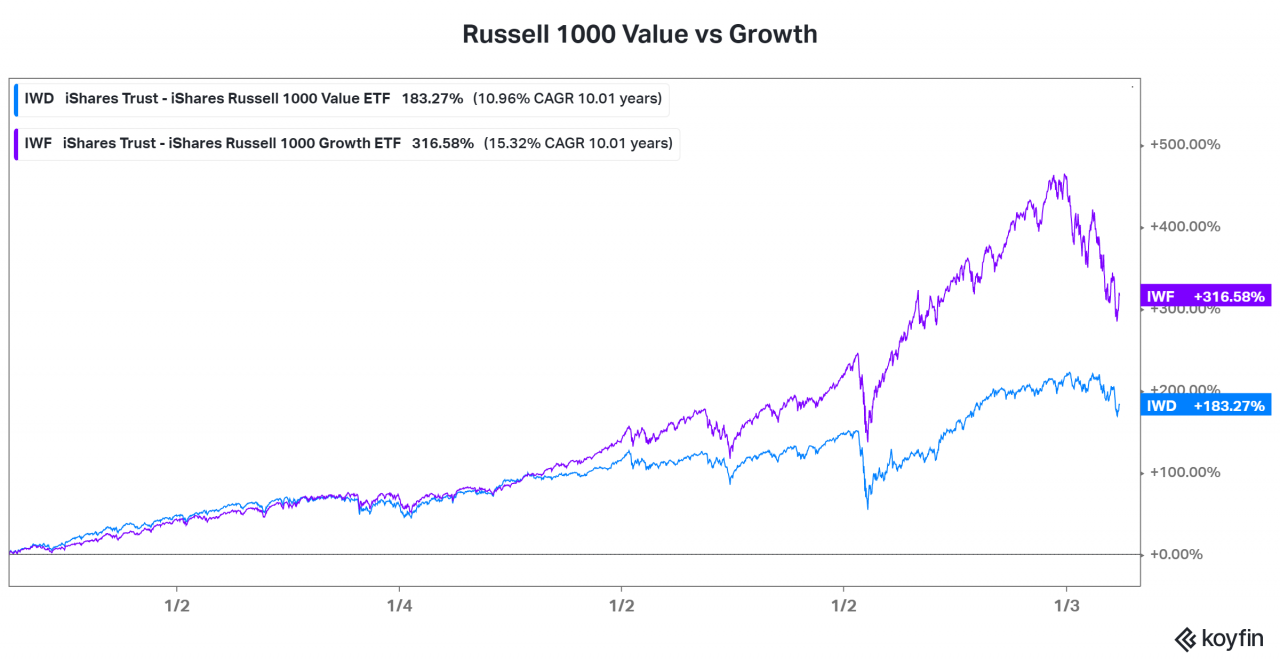

The last decade has been all about growth stocks, but value stocks have outperformed on a relative basis over the last year or so. Whether or not that continues remains to be seen, but this shakeup in index constituents is worth paying attention to.

You can read the full summary of this year’s reconstitution here. 👀