It has been a wild few weeks for retail’s favorite stocks, ranging from AMTD Digital to Bed Bath & Beyond. 🤪

Over the last few days, a new player emerged but has quickly fallen out of favor. That company is Magic Empire Global Ltd., which is a financial services provider in Hong Kong. 🏦

The firm operates in Hong Kong under Giraffe Capital Limited (“GCL”) but is listed in the U.S. under Magic Empire Global Ltd. ($MEGL), a British Virgin Islands-incorporated holding company.

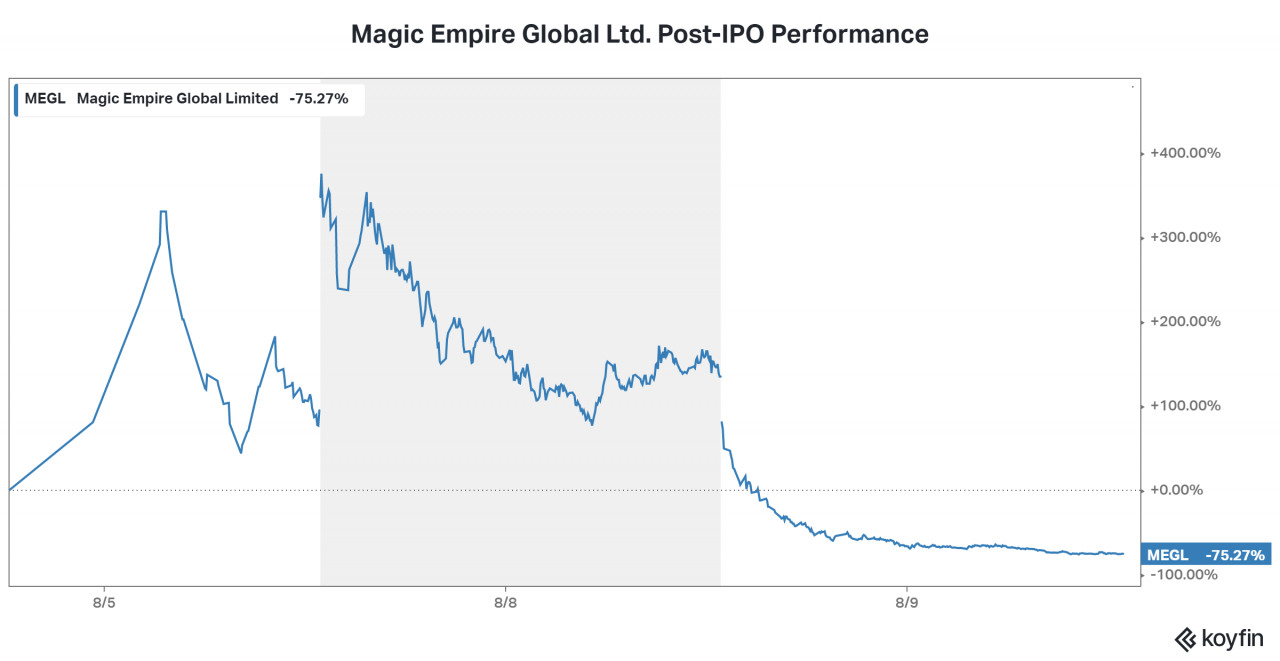

Its prospectus filed with the SEC showed that it intended to offer 5,000,000 ordinary shares (25% of its total) for $4.00 per share. But, despite its low IPO price, the stock actually opened for trading at around $50 before rocketing higher to $250 on Monday. 🙃

Many have speculated that the stock’s run-up was due to coordinated buying from message board users, but nobody really knows what is happening here. 🤷♂️

Today was the stock’s third day of trading, and it fell 89.47% as traders saw their magical gains disappear as fast as they appeared. 📉

While it’s been a relatively quiet August for the major indexes, animal spirits remain alive and well in the markets. Bulls, bears, and pigs — the whole lot. 🐖

Stay safe out there y’all. 🧙♂️