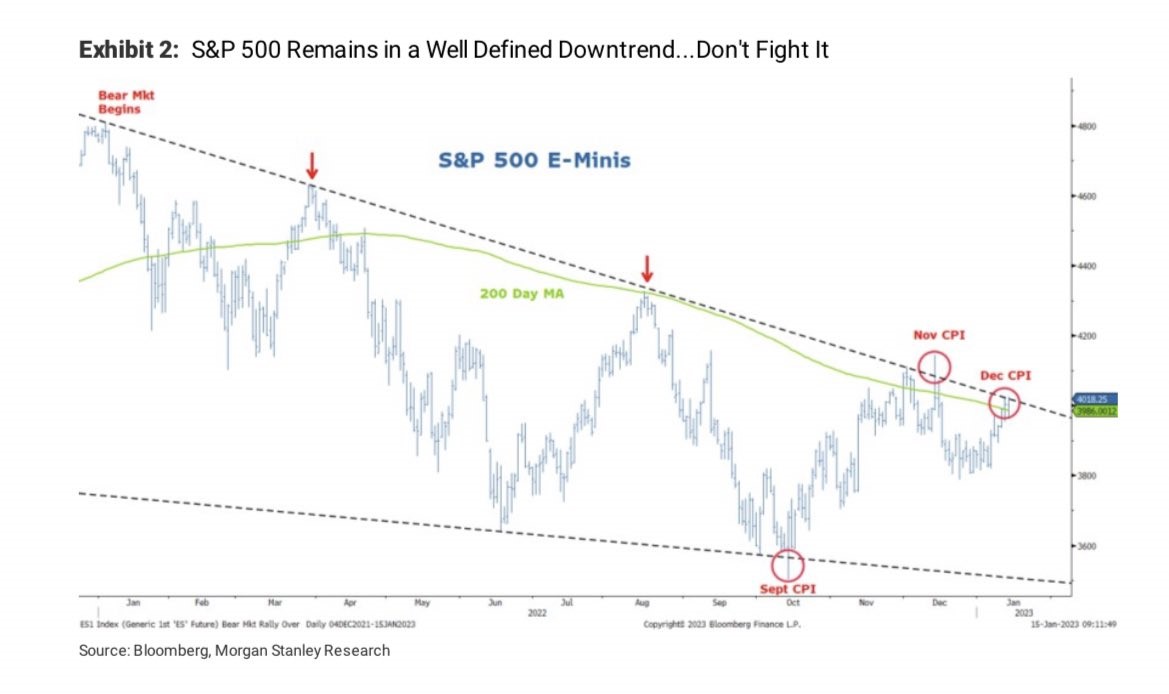

Six weeks after the Stocktwits community discussed the S&P 500’s downtrend line and 200-day moving average, it’s back again. But this time, it’s in a note from Morgan Stanley.

Carl Quintanilla’s tweet shares some insights from a recent Morgan Stanley research. However, its main point is that the firm believes the market will see lower lows ahead. Their thesis suggests that stocks remain vulnerable until this key resistance level is broken convincingly.

Another thing our community is watching is the “coiling” that’s occurring in the S&P 500. Technical analysts suggest that this pattern signals indecision in the marketplace but that once a direction is picked, then the move will be significant.

Whether prices break out or break down from here remains to be seen. But what’s clear is that it’s almost decision time for the market. ⌚👈

In the meantime, hop over to our Stocktwits post and share your thoughts. 🗯️