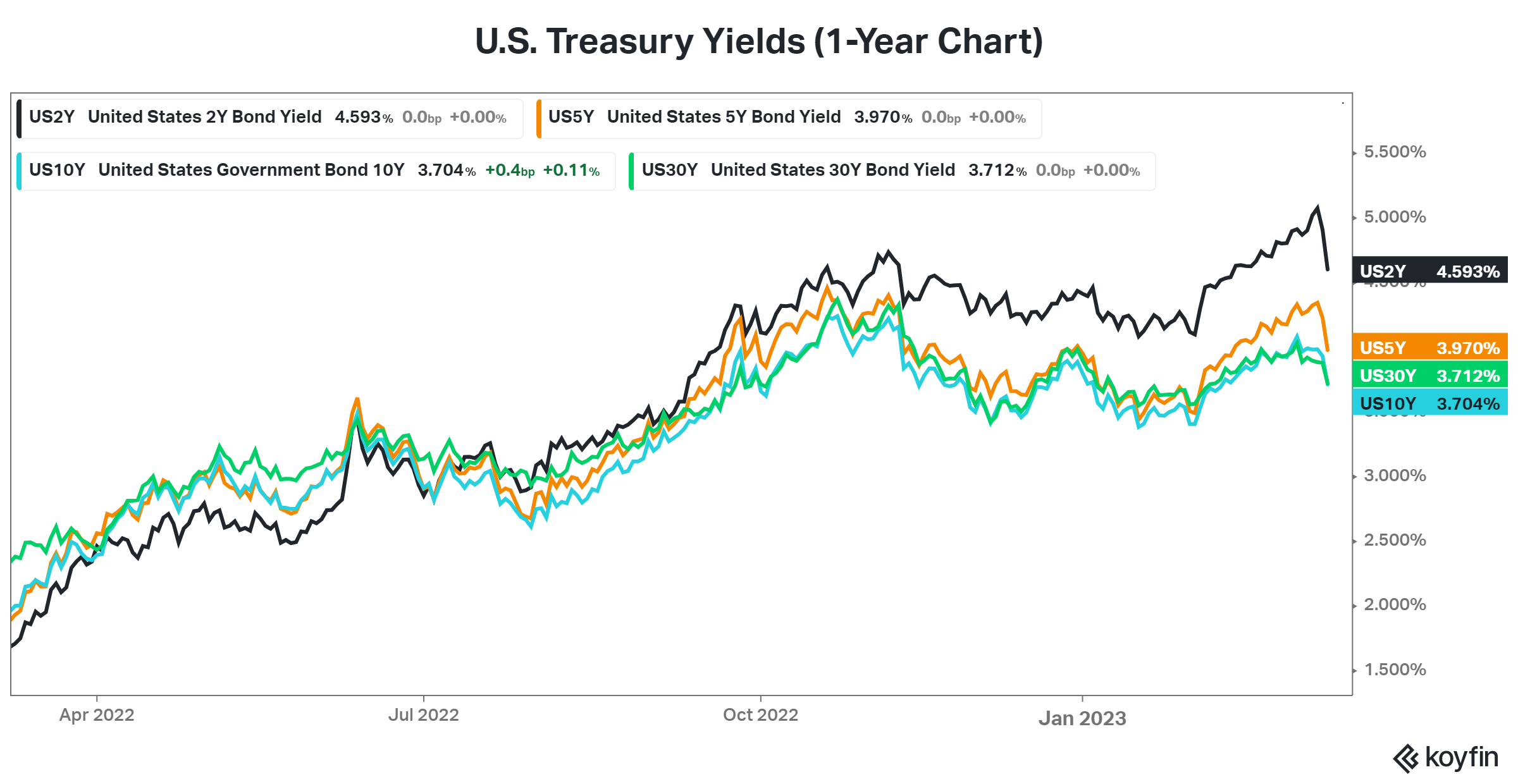

One of the market’s biggest beneficiaries of the current market turmoil has been bonds. Just days after the U.S. 2-Year Treasury Yield broke above 5%, it’s fallen roughly 50 bps in one of its sharpest declines ever. 😮

Analysts say Treasuries are again acting as a “flight to safety” trade. But they also benefit from the market adjusting its views on the Fed’s next move. Given what’s happening in the financial sector, the bond market has priced in the potential for the Fed to be less aggressive than currently expected. Or at least intervene in some way to restore confidence in the financial system.

We’ll have to see whether or not that theory comes true, but for now, Treasuries are “cool again” among active market participants. 🤷