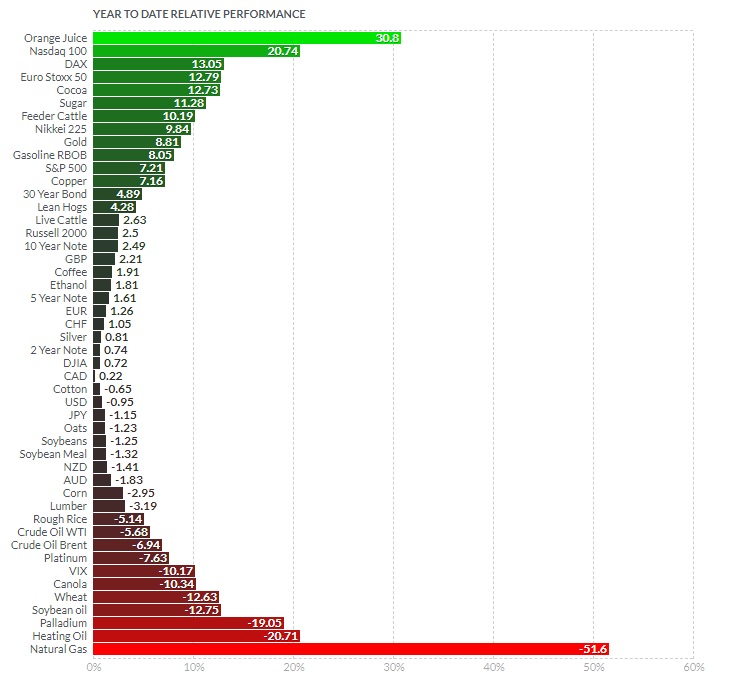

We’ll do a more comprehensive recap next week, but let’s quickly look at how the major asset classes did in the first quarter. Below is a Finviz chart outlining the performance of various futures contracts for the U.S.’s most closely-followed assets. 👀

At the chart’s edges, we see the best and worst performers were commodities. The asset class had a wide range of returns, but orange juice and natural gas experienced outsized moves. After a decline in February, U.S. Treasury bonds have recovered and were positive across the board. And the U.S. Dollar is marginally negative but essentially stuck in a trading range.

As for equities, the tech-heavy Nasdaq 100 was the top performer, rising about 21%. Developed markets outside the U.S., like the German DAX, Euro Stoxx 50, and Nikkei 225, outperformed the rest of the U.S. indices. With that said, the S&P 500, Russell 200, and Dow Jones Industrial Average were all marginally positive on the year. 💚

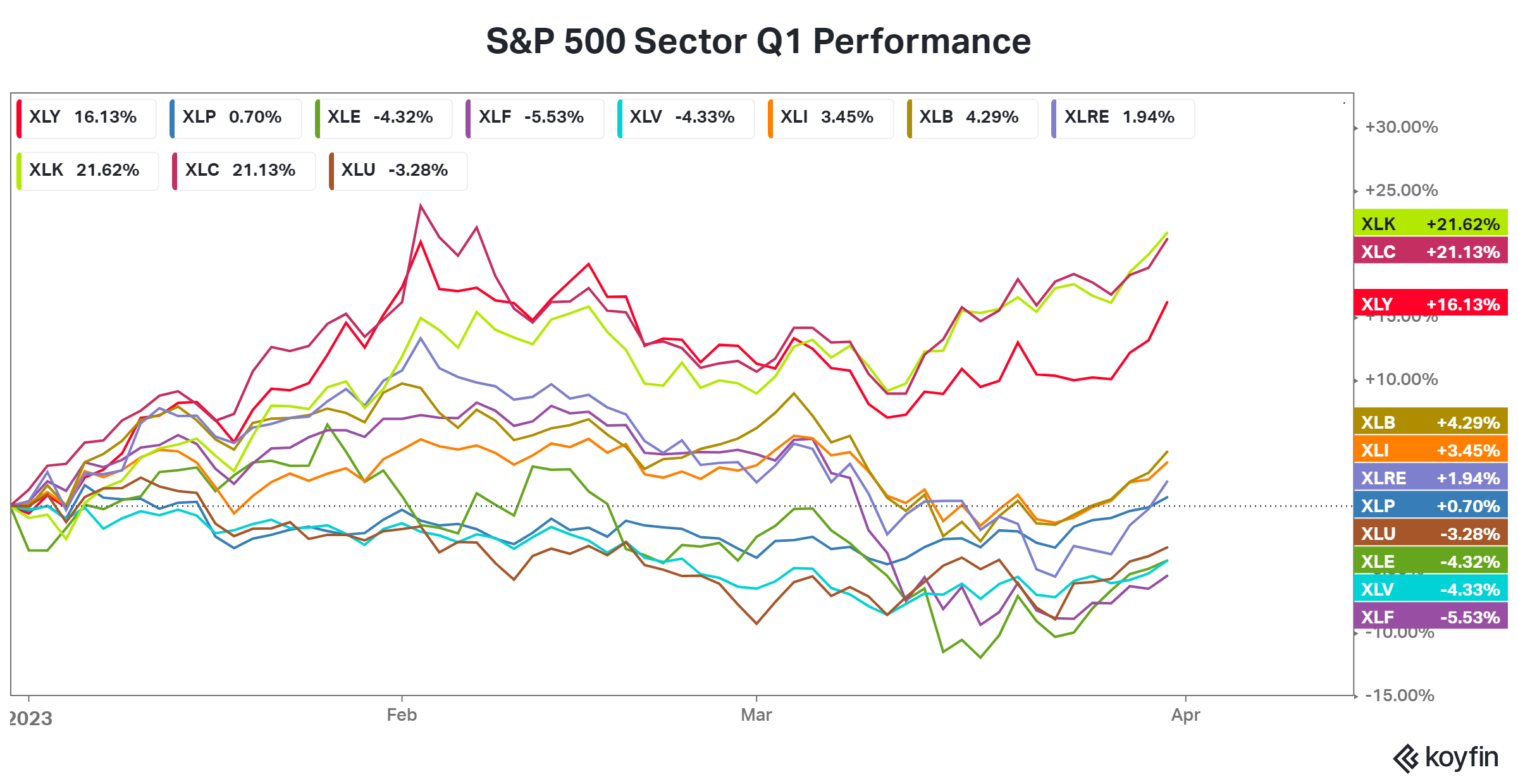

Moving onto sectors, the “risk-on” sectors of the market, like technology, communication services, and consumer discretionary, led after being the worst performers last year. The other major standout is energy, which has experienced a lot of volatility after gaining nearly 60% in 2022. 💚

Overall, investors are betting on a recovery from the beaten-down growth names of 2020 and 2021. Many companies in these sectors have shifted their focus to profitability instead of growth at all costs. And a potential Fed “pivot” to looser monetary policy would be another tailwind for these sectors that investors are betting on.

Clearly, 2023 is off to a much different start than we experienced last year. As always, we’ll have to wait and see what the remaining quarters have in store. 🤷