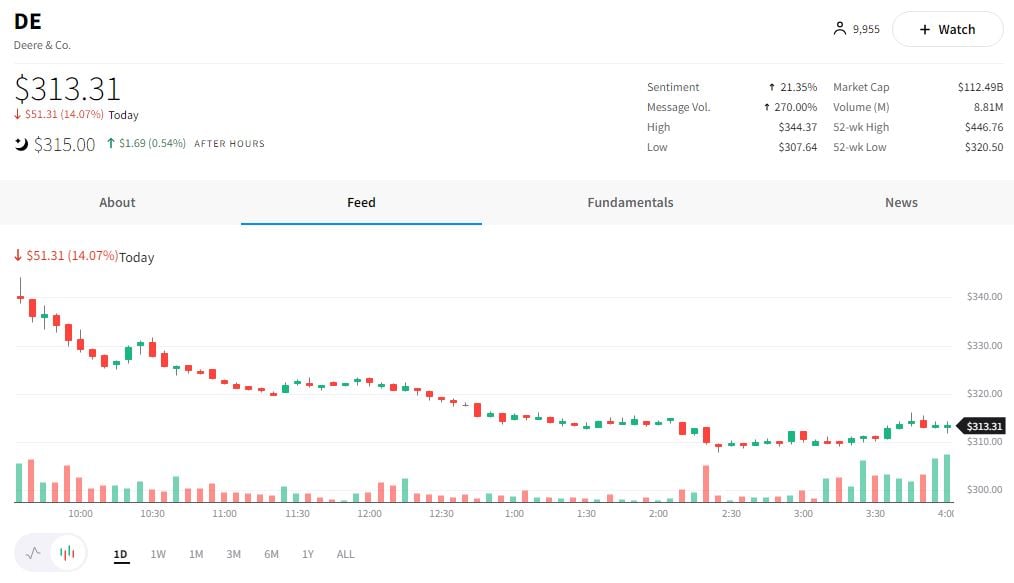

Deere & Company trended lower today as investors looked past its earnings/revenue beat and ahead to its supply troubles. 👀

The company’s earnings per share beat the $6.71 expected by analysts, coming in at $6.81. Revenues also exceeded expectations at $13.37 billion vs. $13.16 billion. 🟢

The company also raised its full-year earnings forecast to $7.0 to $7.4 billion, among other forecasting highlights: ☀️

- Sees fiscal 2022 Small Ag & Turf net sales up about 15%

- Sees fiscal 2022 Construction & Forestry net sales up 10 to 15%

- Sees fiscal 2022 Production & Precision Ag net sales up 25 to 30%

Despite the seemingly positive news, investors focused heavily on the fact that many of the machines it could’ve sold are on hold because of supply-chain issues. 🚚

Ryan Campbell, Chief Financial Officer, had this to say: “Given the strong fundamentals in agriculture, coupled with the underlying supply constraints, we do not see the industry being able to meet all of the demand that exists in 2022.”

While having more demand than you’re able to keep up with may seem like a good problem to have in this environment, sellers still took the stock down ~14% today. 📉

Check out the full report and join the conversation on the $DE stream. 💬