The market has been a consistent sea of red lately, but a few tickers today offered a glimmer of hope ✨ — among them was $AFRM, the buy-now-pay-later (BNPL) company, which reported its Q3 earnings and soared +23.31% at the close and another +28% after hours.

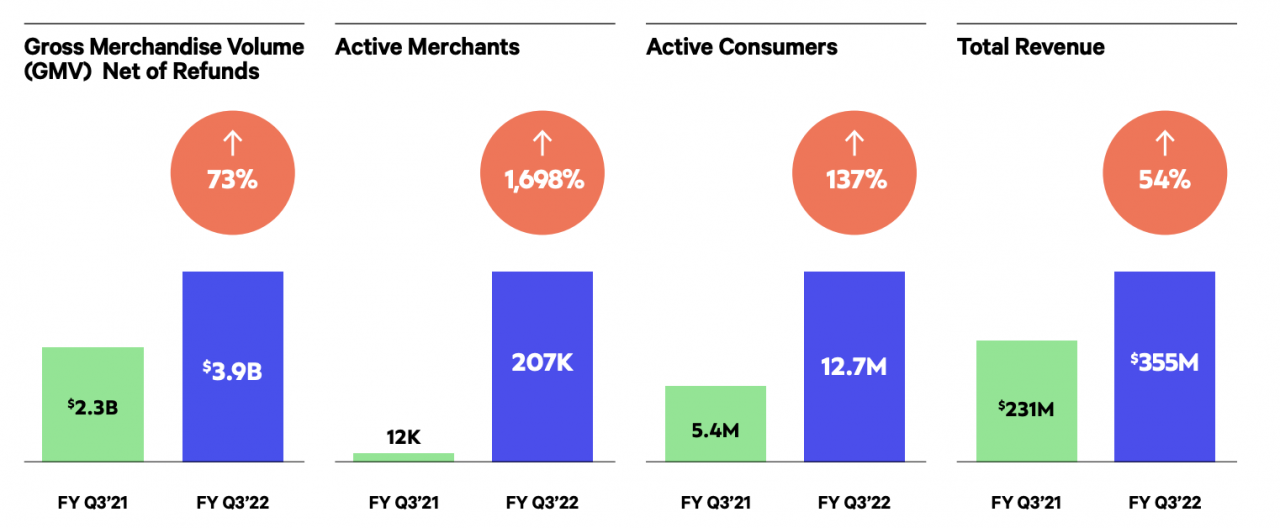

In the company’s FY 2022 presentation, Affirm provided exciting growth numbers that wow-ed investors. 🤗 Specifically, Affirm posted +73% YoY growth in gross merchandise volume, a +137% YoY increase in the company’s number of active consumers, and a +54% YoY gain in revenue.

Affirm’s quarterly revenue clocked in at $355 million, down from $361 million last quarter. However, the company was able to lower its transaction costs in Q3. Here’s a figure demonstrating Affirm’s strong performance across the board in the third quarter:

Clearly investors were stoked about the news, because $AFRM took off today. 🚀 Here’s its intraday chart: