Advertisement|Remove ads.

LG Electronics upbeat on business recovery, aims to return to double-digit growth

Atul Khanna, Chief Accounting Officer at LG Electronics India, expects the new BEE ratings coming into effect in January 2026 to act as a growth driver. He said the mix of new-rating and old-rating models available in the market will help boost the air-conditioner business.

LG Electronics India, which recently debuted on the stock exchanges, expects its business momentum to improve in the coming quarters. "We improved our market share and after GST cut, the affordability of our product and sentiments of consumers are very high," said Chief Sales Officer Sanjay Chitkara.

The company believes it can return to its earlier pace of expansion. LG has delivered around 13% compound annual growth in recent years, and Chitkara said they hope to get back to consistent double-digit revenue growth.

A key near-term driver, especially for the air conditioner segment, is the rollout of new Bureau of Energy Efficiency (BEE) star rating norms in January.

Chitkara said the additional cost of these new energy-efficient products has already been absorbed by the GST cut, meaning the price increase will not be passed on to consumers. "Things are very positive and we are very optimistic. things will fall in place," he added.

In the July–September quarter (Q2FY26), LG Electronics India reported revenue of ₹6,174 crore, a profit after tax of ₹389 crore, and a margin of 8.9%.

The soft performance was due to an unusually cool summer, geopolitical uncertainty, and a timing gap caused by the GST rate transition. GST was announced in mid-August but implemented late September, prompting customers and distributors to delay purchases. The demand has recovered sharply after the transition.

The company's Chief Accounting Office Atul Khanna said the inventory levels are now normalising. He sees the new BEE ratings effective January 2026 as a catalyst. "There would be a good combination of new BEE rating stocks as well as the old rating stocks, which will give a boost to the air conditioner business," Khanna stated.

He highlighted the significant growth potential, with AC penetration in India currently at a low 12-13% and projected to rise to 19-20% in the next three to four years.

The government's reduction of the GST rate on ACs to 18% is also seen as a major booster, making the product more affordable.

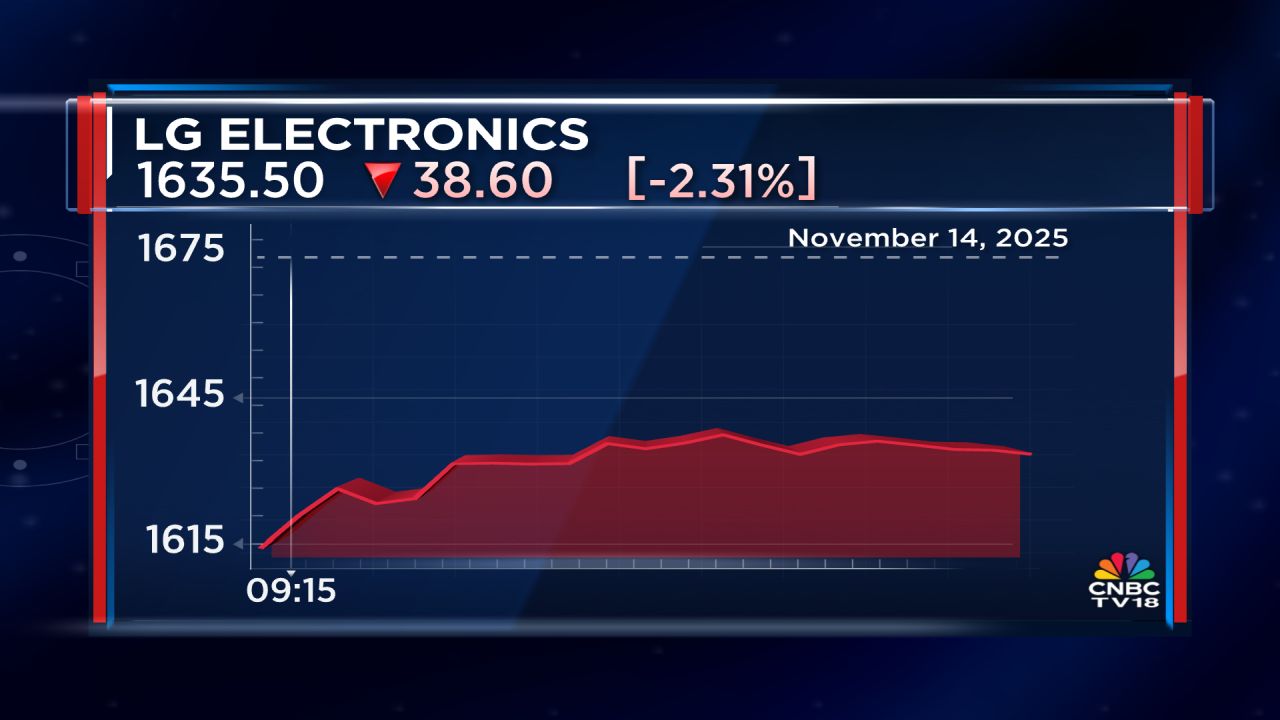

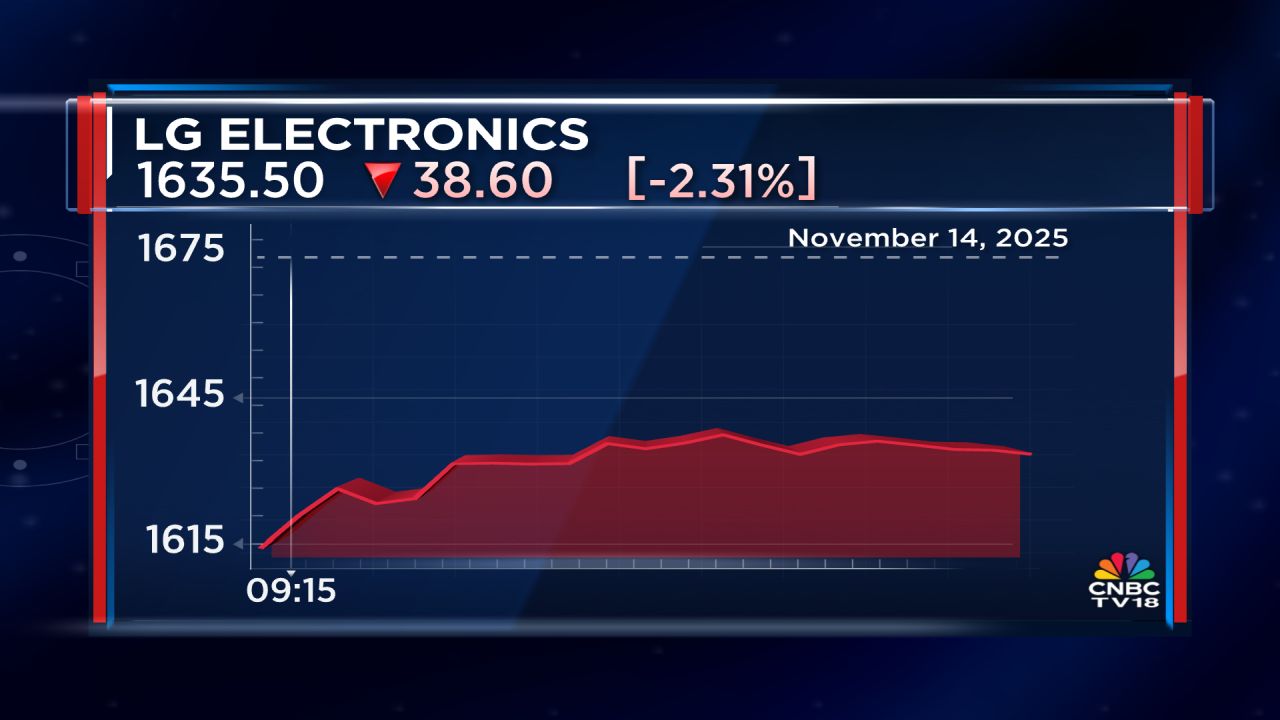

LG Electronics India’s current market capitalisation is ₹1,10,979 crore. The stock is trading at ₹1,635 on the NSE as of 9:33 am and has declined 2% since its listing.

Follow our live blog for more updates on Q2 results

The company believes it can return to its earlier pace of expansion. LG has delivered around 13% compound annual growth in recent years, and Chitkara said they hope to get back to consistent double-digit revenue growth.

A key near-term driver, especially for the air conditioner segment, is the rollout of new Bureau of Energy Efficiency (BEE) star rating norms in January.

Chitkara said the additional cost of these new energy-efficient products has already been absorbed by the GST cut, meaning the price increase will not be passed on to consumers. "Things are very positive and we are very optimistic. things will fall in place," he added.

In the July–September quarter (Q2FY26), LG Electronics India reported revenue of ₹6,174 crore, a profit after tax of ₹389 crore, and a margin of 8.9%.

The soft performance was due to an unusually cool summer, geopolitical uncertainty, and a timing gap caused by the GST rate transition. GST was announced in mid-August but implemented late September, prompting customers and distributors to delay purchases. The demand has recovered sharply after the transition.

The company's Chief Accounting Office Atul Khanna said the inventory levels are now normalising. He sees the new BEE ratings effective January 2026 as a catalyst. "There would be a good combination of new BEE rating stocks as well as the old rating stocks, which will give a boost to the air conditioner business," Khanna stated.

He highlighted the significant growth potential, with AC penetration in India currently at a low 12-13% and projected to rise to 19-20% in the next three to four years.

The government's reduction of the GST rate on ACs to 18% is also seen as a major booster, making the product more affordable.

LG Electronics India’s current market capitalisation is ₹1,10,979 crore. The stock is trading at ₹1,635 on the NSE as of 9:33 am and has declined 2% since its listing.

Follow our live blog for more updates on Q2 results

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2197302742_jpg_7c686734dd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/bharat-electronics.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/06/chandrababu-naidu-2024-06-5c6ea0c5142fe9dcfc0589c8f8197c1d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_gopro_logo_jpg_b28c6aef68.webp)