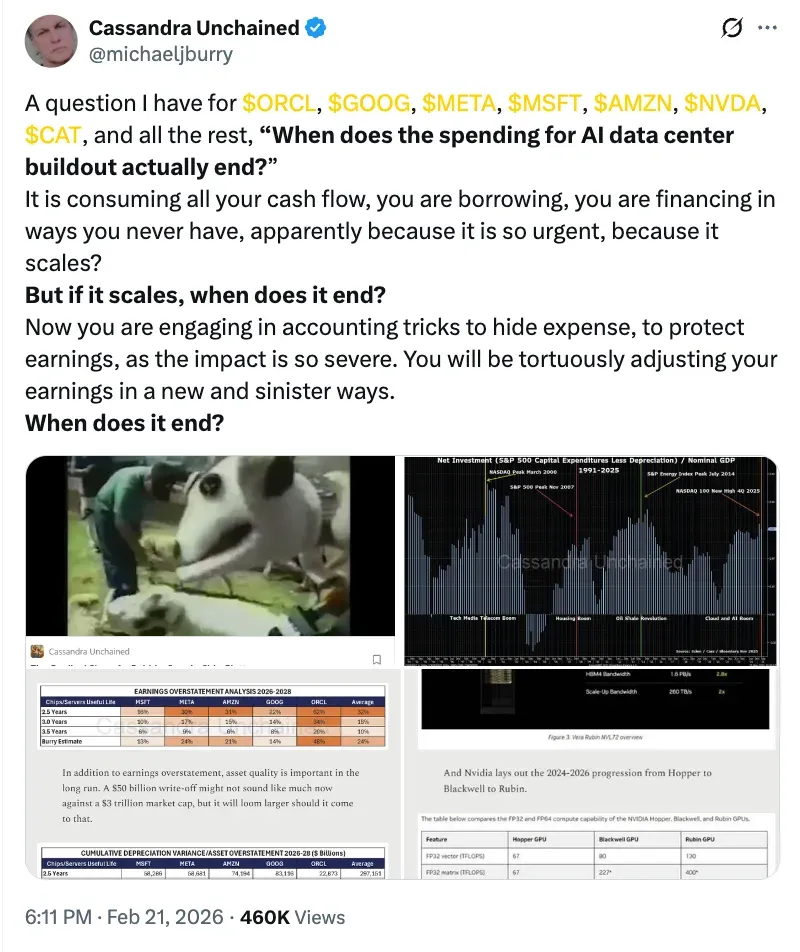

- Michael Burry asked when the AI data center spending cycle would end, saying that it was taking money out of cash flow and forcing Big Tech to borrow a lot of money.

- He added that earnings quality could suffer if companies use accounting tricks to hide rising costs and depreciation.

- Burry warned that the AI buildout is following similar ‘patterns’ to the dot-com boom.

At the heart of the AI boom on Wall Street, Michael Burry asked a sharp question in a series of X posts, saying, “When does the spending for AI data center buildout actually end?" and what happens to reported earnings if it doesn't.

‘The Big Short’ investor wrote in a post that the AI buildout is "consuming" cash flow and forcing companies to act in ways they aren't used to when it comes to financing.

Burry Questions AI Capex Sustainability

He directed his comments at a group that included Oracle (ORCL), Google (GOOG), Meta (META), Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA), and Caterpillar (CAT). He then said that companies might use "accounting tricks" to protect their profits if they were under enough pressure to do so.

This would make it more likely that they would have to restate their earnings, write them down, or see their earnings shrink more slowly as amortization and operating costs gradually catch up.

Burry wrote, “The total revenues of Amazon, Apple, Alphabet, Microsoft, Meta, and Nvidia together do not make up $2 trillion. So you see why leverage is being used to build those data centers.”

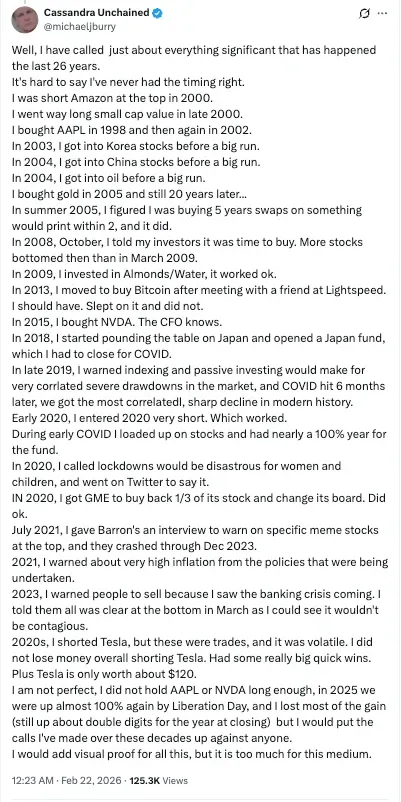

Burry backed up his claims in a separate post that read like a credibility ledger. In it, he listed a long timeline of past calls and trades, from the dot-com era to the financial crisis and COVID, to counter the market watchers who believed that his "timing" was always off.

Burry acknowledged past inconsistencies he made; however, he believes the current situation looks like “imitating the data connectivity buildout circa 2000.” In 2000, the dot-com bubble peaked to highs and immediately fell by over 78% by 2002. Burry warned that the same could happen to the AI bubble bursting.

Why Burry Thinks AI Spending Could Strain Big Tech’s Finances

Burry argues that companies can start to feel the pressure in simple ways if AI data center spending keeps rising without a clear end in sight. As they spend more money on servers and buildings, they have less money left over after paying their bills. This can make them borrow more money or get new investors to keep the buildout going.

At the same time, profits can look better on paper than in real life because the costs of large pieces of hardware are often spread out over years through depreciation, even though the equipment may become outdated much sooner.

According to Burry, the important things to look for are what hyperscalers are saying about their future capital expenditures, whether free cash flow is improving or worsening, and any disclosures that show a growing gap between how long the assets are actually useful practices and how they’re being accounted for.

For updates and corrections, email newsroom[at]stocktwits[dot]com.