Two months after we last spoke about it, pharmacy retailer Rite Aid is back in the news again. Unfortunately, for a similar reason as last time. 👎

In August, the drugstore chain warned it was preparing for bankruptcy as it buckled under mounting debts and lawsuits over its role in the opioid epidemic. Today, the company officially filed for Chapter 11 bankruptcy protection in New Jersey, appointing a new CEO to lead the restructuring plan. 📝

It reached a deal with creditors on a restructuring plan that involves evaluating its retail footprint and closing underperforming stores. Additionally, its lenders extended $3.45 billion in new funding, which will “provide sufficient liquidity” to execute its restructuring plan.

Like its peers CVS Health and Walgreens Boots Alliances, the drugstore chain has faced several headwinds. They include slowing discretionary spending, reduced pharmacy sales in a post-pandemic world, and trouble keeping its pharmacy staff happy during a worker shortage. However, unlike its larger competitors, the smaller chain is far less diversified and has seen its brand’s market share eroding as Amazon and others enter the space. 🏬

Most recently, the company’s quarterly revenue fell 6% YoY to $5.65 billion, with it expecting to lose $650 to $680 million for the fiscal 2024 year that ends in February. And although its pharmacy business has held up decently well in the face of its headwinds, it’s not enough to offset the rest of the business’ weakness. 📊

To lead the turnaround, the company added Jeffrey Stein to its board of directors and made him chief executive officer (and chief restructuring officer). The board hopes his strong track record in guiding companies through financial restructurings will help Rite Aid come out on the other side with a more sustainable business.

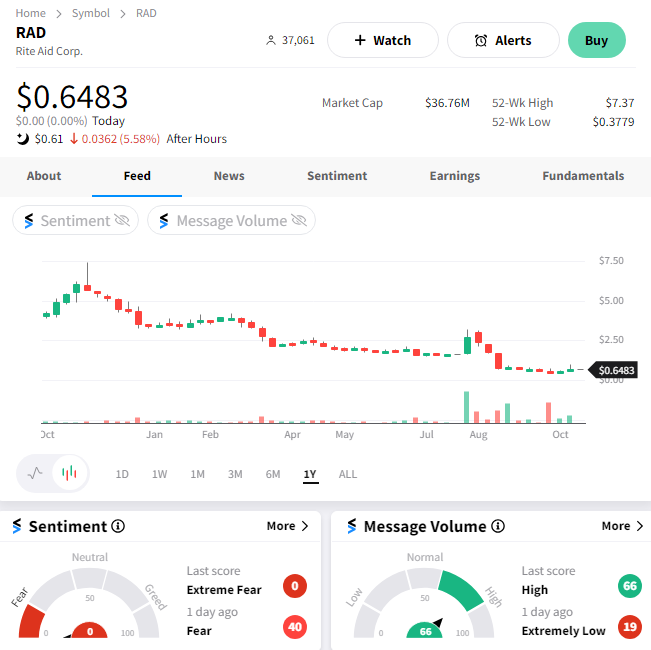

$RAD shares were down 6% pre-market before being halted. They did not reopen for trading, but the company’s bonds were sold heavily throughout the day. Many investors and traders are fearful of another potential plunge once trading resumes. However, others are eyeing the situation given its “meme stock” potential. Time will tell. 😬