While most of the market focused on the spot Bitcoin ETFs beginning to trade today, the second-largest company in the world made a move on its sole competitor. 🔮

This morning, Microsoft’s market capitalization briefly crossed that of Apple’s, making it the largest company in the world. While it didn’t last, it does beg the question of which stock will lead the market going forward.

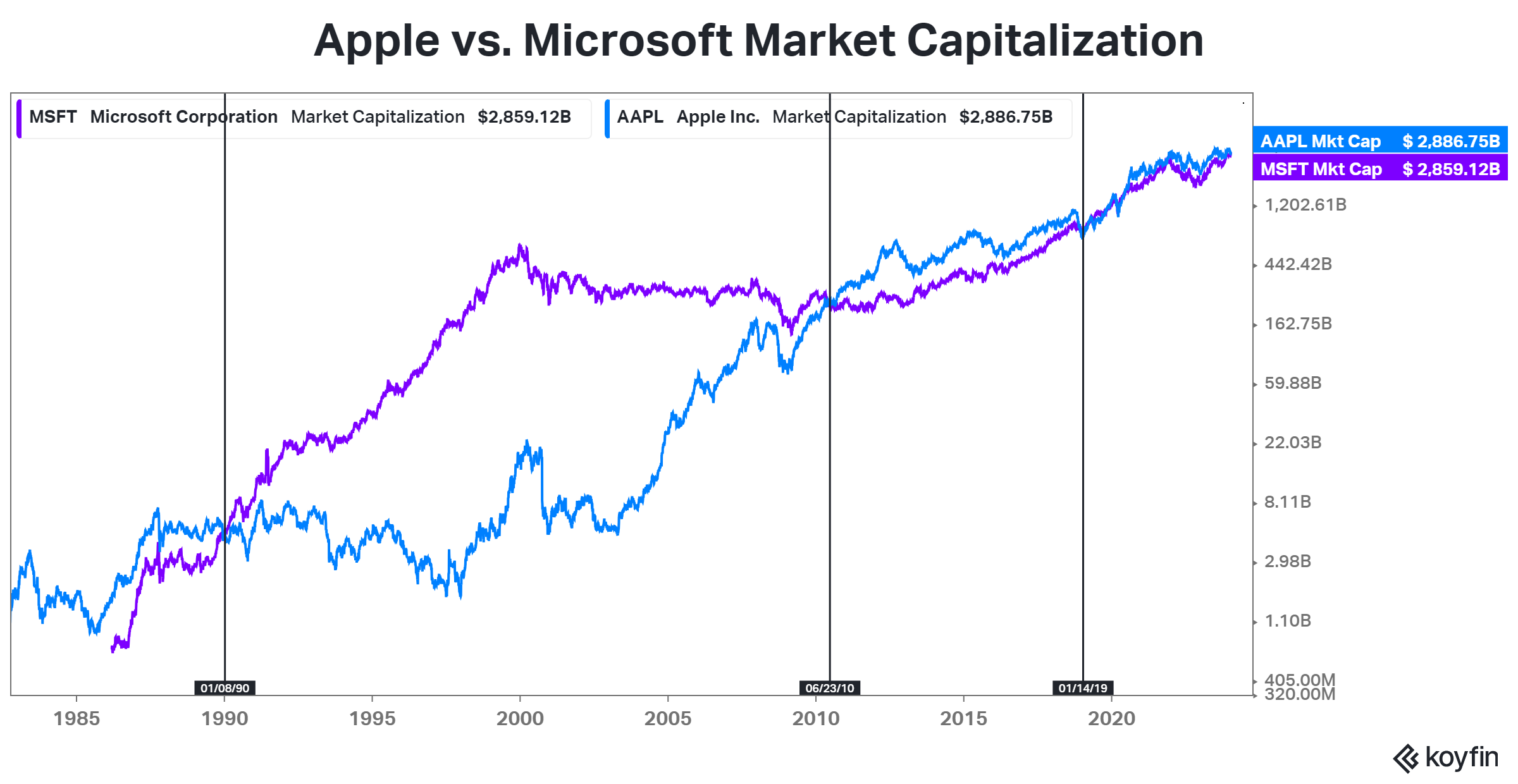

The chart below shows that Microsoft and Apple have been battling it out since 2019, when their valuations met around $800 billion. Apple had just become the first stock to hit a $1 trillion market cap and had pulled back, allowing Microsoft to take the lead for a short period. 🤏

Since then, Apple has been slightly ahead of Microsoft. Before that, Microsoft had a roughly 20-year period of outperformance between 1990 and 2010.

While investors look to identify which stock is the better bet going forward, it appears that many see Microsoft as having more tailwinds. Its cloud business and artificial intelligence efforts are expected to generate significant earnings in the years ahead, especially if the company can maintain its leadership position in the budding industry. 🤖

Meanwhile, Apple’s business remains constrained by its ability to create innovative consumer technology products. Its revenues contracted throughout 2023, driven by a sluggish personal computer and smartphone backdrop and a lackluster iPhone cycle. Although the company is diversifying its revenue streams through higher-margin offerings like services, concerns remain that it will lack a growth catalyst without new, innovative products to drive consistent demand. 📱

Time will tell which side is correct, but for now, it certainly appears that Microsoft has the edge. Get it, because it has a product called Microsoft Edge? Terrible jokes aside, we’ll see if it can capitalize on it and reach its own $3 trillion market cap milestone in the weeks ahead.

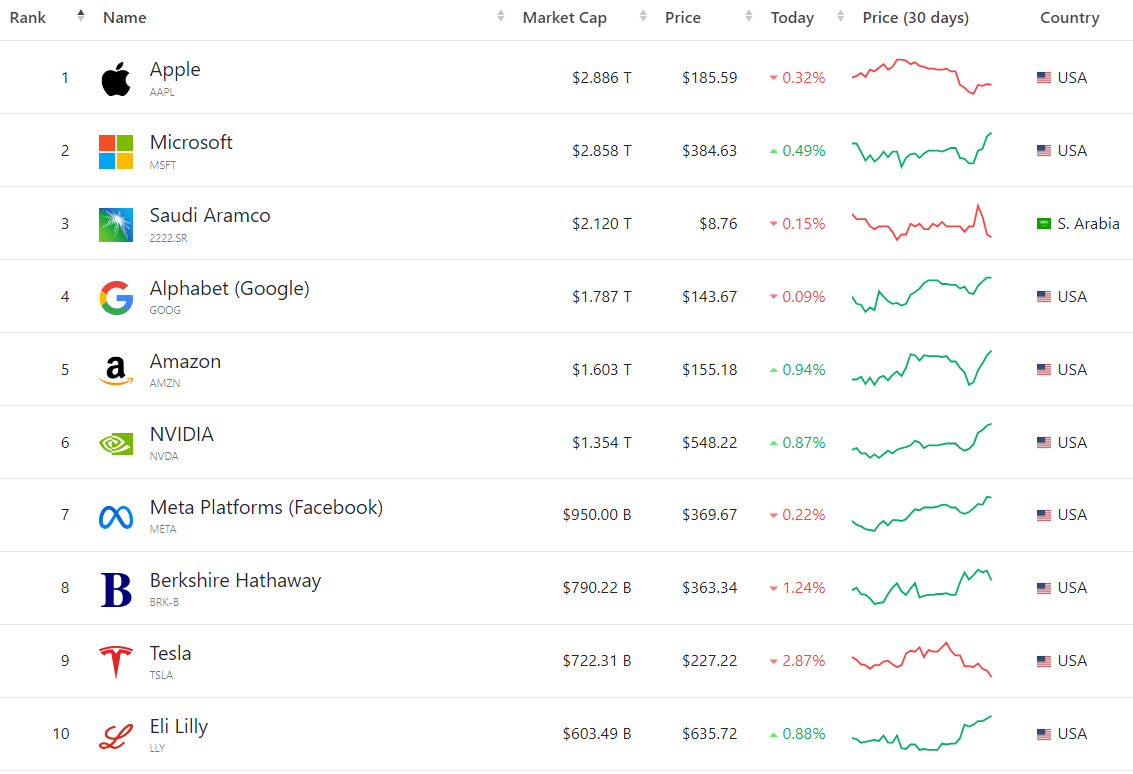

To put these big numbers into proper context, it’s important to remember the global market cap for roughly 8,000 public companies is $97 trillion. The top ten stocks, most technology-related and based in the U.S., account for about 16% of that total value. 👇

How this list will look over the next decade remains to be seen. For now, the market is certainly acting like artificial intelligence (and technology) will remain the key theme of the future. 🔮