Price action is fun, but it turns out there’s a lot of different ways to gauge the amount of value moving around the crypto ecosystem. One metric called Total Value Locked (TVL) captures a different kind of value than market caps or price per coin. Simply put: it looks at how much money is stewing in protocols and on blockchains. If it helps you remember, think of “TVL”/”Total Value Locked” as Assets Under Custody.

It’s not always an exact science, but TVL has become a trusty metric when it comes to stacking up various blockchains and protocols. Not only does it gauge “confidence” (which can be measured by the amount of money in an ecosystem) in various chains or protocols, but it can value cryptos in a more inclusive manner and even foresee coming shifts in the world of DeFi and crypto.

That’s why we’re going to spend more time looking at TVL in The Litepaper, including “lookbacks” like these every month. We’ll use trusted sources like DeFi Llama and other sources as our north star. These might take on the form of bullets, screenshots, and some other tidbits along the way. However, it’s all intended to plot some dots on a chart and let you form your own conclusions:

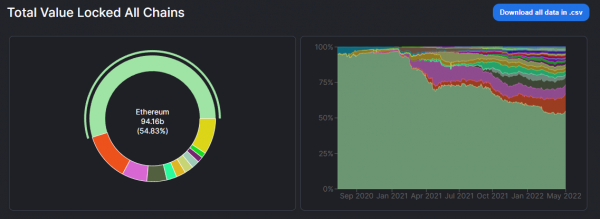

📊 In TVL dominance for the month of April, Ethereum was still up top and in charge at more than 54.8% dominance according to DeFi Llama. There was more than $94 billion in TVL on Ethereum being tracked by the site, which was majority-held in Curve, MakerDAO, and Aave.

⚓ The next chain in the pecking order was Terra, which sat at a TVL of $21 billion. The majority of that money was stewing in Anchor Protocol, which represented more than 78% of the chain’s total value locked. That can be credited to Anchor’s sky-high interest rate offering on the $UST stablecoin. Terra was the only chain in the top 10 chains (both ranked by TVL and market cap) to see a one-month increase in its TVL.

🌌 A lesser-known chain called Aurora saw its TVL nearly double in the last month, eclipsing a $1 billion TVL. The lesser-known chain has, in its own words: “Ethereum compatibility, NEAR Protocol scalability, and industry-first user experience through affordable transactions.” The crypto has dumped over the same period, with investors citing concerns about the crypto’s available supply.

📈 Aave V3 saw a 2,732% MoM change in TVL. This makes a lot of sense, because Aave V3 launched on Mar. 16, 2022. The protocol’s third version offers support for a swath of “EVM chains” (which are chains that operate on the same foundational tech as Ethereum), including Optimism and Fantom.

👀 Among the fastest-growing protocols and projects from the month over a $50 million TVL were:

- WingRiders, a Cardano-based DEX;

- Risk Harbor, an insurance protocol popular on the Terra blockchain;

- and Aperture Finance, a protocol on Terra which specializes in cross-chain investments.

We’ll make sure to cover chains and protocols on the rise as relevant news arises, but let this stand as our model “first edition” for an aspirational segment of the Litepaper where we demystify where money is moving on chain.