The return of the unprofitable initial public offering (IPO) has us feeling like it’s 2021 all over again. With animal spirits roaring, social media giant Reddit hopes the current market environment will help it successfully make a public market debut. 🤑

Late today, the company filed to list on the New York Stock Exchange (NYSE) under the ticker $RDDT. Its S-1 filing boasts 100k+ active communities, 73 million average daily active unique, 267 million average weekly active unique, and over 1 billion cumulative posts.

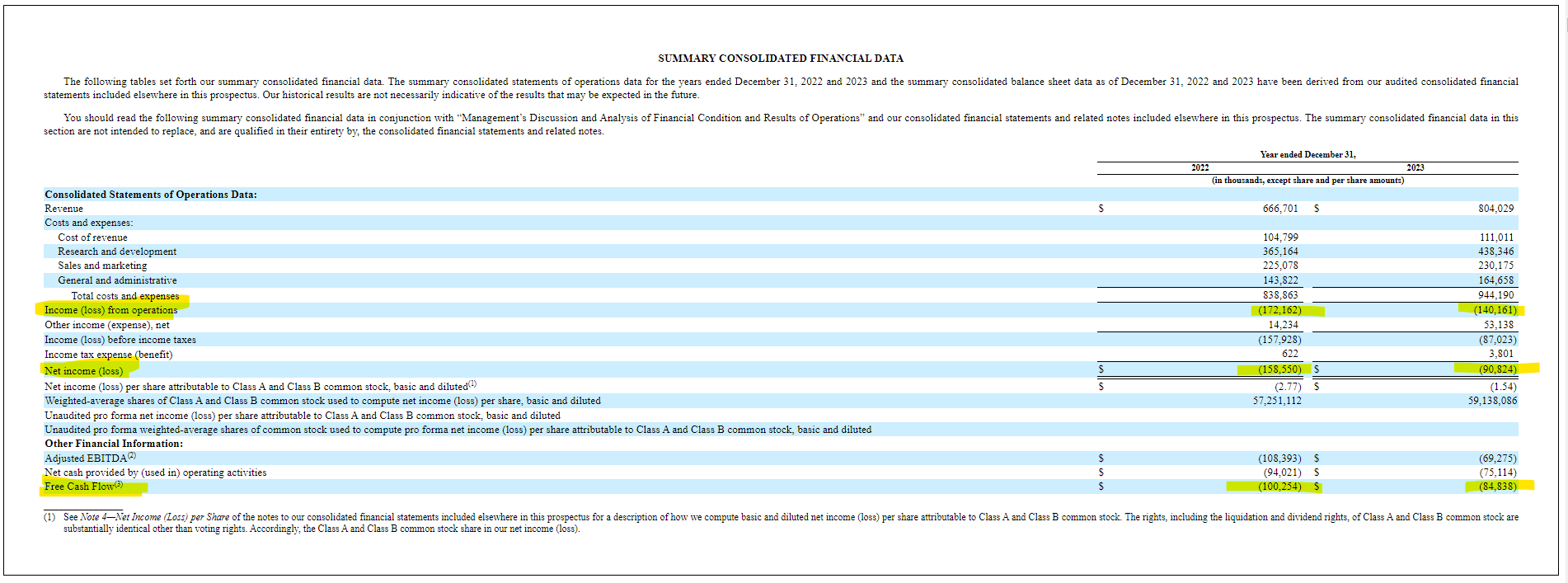

However, the bears were quick to point out that the stats that matter are its financials, which leave a lot to be desired. The summary of its financial data shows the company posted losses from operations and negative free cash flow for the last two years. And if a company can’t generate cash from operations…it’ll get it from investors (or debt). 💸

Overall, details like its offering price and exact trading date have yet to be determined, but the filing shows that the company is close. We should see this happen within the next month, if not sooner. In the meantime, it’s cutting deals left and right to help bolster its revenue numbers. Its latest is with Google to use its data for AI training purposes. 🤝

The conversation around the company is already picking up around the interwebs. With an already active stream, it’s gotten nearly 500 followers on our platform so far.

A lot will be happening in the weeks ahead. So, to stay on top of everything ahead of its IPO, follow the $RDDT symbol page on Stocktwits. We’ll see you over there! 👍