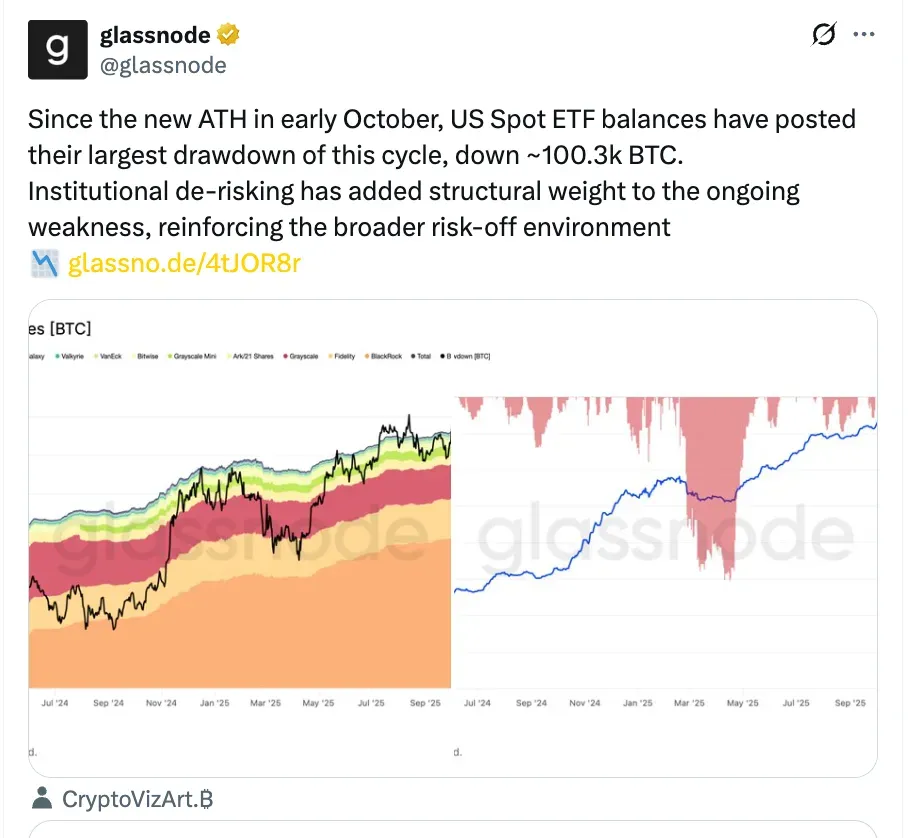

- Glassnode data shows that U.S. spot Bitcoin ETF balances are down by about 100.3K Bitcoin from their October peak.

- The 30-day average of net ETF flows for both Bitcoin and Ethereum has stayed negative for most of the past 90 days, and there is no clear sign of renewed demand.

- Ethereum ETFs have had more inflow days than Bitcoin ETFs in the last two weeks, as BlackRock moves forward with its staked Ethereum ETF.

According to Glassnode, U.S. spot Bitcoin ETF holdings have seen the steepest decline since the price peak in early October.

Glassnode pointed out that the ETF balances fell about 100.3K BTC from the cycle high in aggregate balances. The firm presented it as part of a larger wave of de-risking that has been giving the tape more structural weight.

Glassnode says that investors aren't rushing to sell, but demand for Bitcoin ETFs has gone down, and holdings are slowly going down, which can lower prices further. Changes in how investors act in one big ETF matter more than changes in how investors act in smaller products, since most of the ETF exposure is in that one big fund. In general, this doesn't look like panic selling; it looks more like big investors slowly lowering their risk, which can slow down how quickly prices go back up until new demand comes back.

Previously, Glassnode pointed out that the 30-day moving average of net flows for Bitcoin and Ethereum spot ETFs has been negative for most of the past 90 days and that there is "no sign" of renewed demand yet.

Bitcoin (BTC) was trading at $68,100.94, up 0.9% in the last 24 hours. On Stocktwits, retail sentiment around BTC remained in ‘bearish’ territory, as chatter remained at ‘low’ levels over the past day.

Ethereum ETFs Log More Inflow Days Than Bitcoin

In the last two weeks alone, Sosovalue data shows that Ethereum ETFs had more green days than Bitcoin ETFs, suggesting steadier allocation even amid overall risk-off flows.

BlackRock is pushing the Ethereum ETF category way beyond its current iShares Ethereum Trust ETF (ETHA), even as it continues to reduce its balance on its Bitcoin ETF. In a revised filing with the US Securities and Exchange Commission for its iShares Staked Ethereum Trust ETF (ETHB), BlackRock said it plans to stake 70%–95% of the trust's Ether under normal conditions.

According to Arkham Intelligence, BlackRock will also maintain a 5% to 30% "liquidity sleeve" of tokens unstaked to handle creations and redemptions. The filing also says that the sponsor and the prime execution agent will get 18% of the total gross staking consideration, with the trust keeping the rest. There will also be a 0.25% sponsor fee, temporarily reduced to 0.12% for the first $2.5 billion in assets for 12 months after listing.

Read also: Prominent Chartist Reveals New XRP Target After Bullish Analysis

For updates and corrections, email newsroom[at]stocktwits[dot]com.