- Buterin warned that prediction markets are drifting toward short-term bets and “dopamine-driven” speculation.

- He proposed transforming them into hedging tools, potentially reducing reliance on fiat-backed stablecoins like USDC.

- The debate unfolds amid regulatory pressure, including Nevada’s civil action against Polymarket.

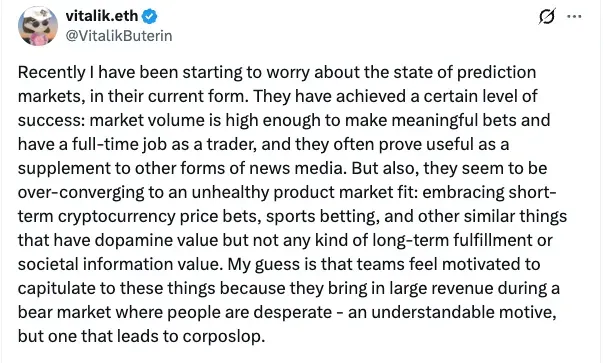

Ethereum (ETH) co-founder Vitalik Buterin raised concerns on Friday that prediction markets are heading in the wrong direction, calling for a reset toward hedging and real-world utility.

Buterin wrote that recently, he had started to worry about the state of prediction markets. While acknowledging their success, including high trading volumes and usefulness as information supplements, he argued that prediction markets were increasingly adopting “short-term cryptocurrency price bets, sports betting, and other similar things that have dopamine value but not any kind of long-term fulfillment.”

Buterin argued prediction markets relied too heavily on “naive traders,” participants who lost money due to poor judgment, creating an unhealthy incentive structure. He cited an example, describing investors who used election outcome contracts to hedge equity risk.

Instead, he proposed a shift toward hedging use cases. “My current view is that we should try harder to push them into a totally different use case: hedging, in a very generalized sense,” he wrote.

He outlined how people could use prediction markets to reduce exposure to political, economic, or sector-specific risks. He described investors using election outcome contracts to hedge equity risk. Buterin also proposed personalized baskets of prediction market shares tied to future expenses, potentially reducing reliance on fiat-based stablecoins such as USD Coin (USDC), the dollar-backed token used for settlement on platforms like Polymarket.

“Build the next generation of finance, not corposlop,” Buterin concluded.

Ethereum (ETH) was trading at $2,089.64, up 1.7% in the last 24 hours. On Stocktwits, retail sentiment around Ethereum remained in ‘bearish’ territory, as chatter remained at ‘low’ levels over the past day.

Prediction Markets And Regulatory Debate

Platforms such as Kalshi, which operated as a CFTC-regulated exchange in the United States, and Polymarket have gained huge popularity since the 2024 US Presidential election. Prediction markets are available nationwide and allow participation from users aged 18 and above, fueling debate over whether they function as financial tools or gambling products.

“These types of markets have been around for quite a long time,” Rutgers statistics professor Harry Crane told The Guardian, noting they historically faced strict U.S. gambling laws.

Regulatory friction around prediction markets has continued. In January 2026, the Nevada Gaming Control Board filed a civil enforcement action against Polymarket, arguing that its event contracts constituted unlicensed wagering under Nevada law and seeking to halt its operations in the state. In response, Polymarket suspended all users in Nevada.

CFTC-regulated exchanges like Kalshi are bringing prediction-style contracts into mainstream finance. However, there are currently no major SEC-registered ETFs directly tracking prediction markets like Polymarket in the US.

Read also: Solana Outperforms Bitcoin And Ethereum In Daily Gains, Pushes Co-Founder Yakovenko To The One Billion Club

For updates and corrections, email newsroom[at]stocktwits[dot]com