As Elon Musk waits to close his deal to buy Twitter for $44 billion, the Tesla CEO just sold a whopping $8.5 billion worth of Tesla stock. 💰 💰

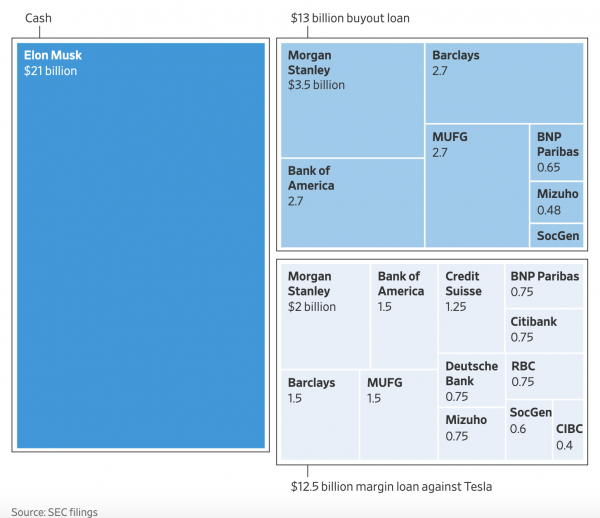

Musk sold 9.6 million shares of $TSLA stock, selling each share within the ranges of $822.68/share to $999.13/share. Analysts say the giant sale implies that Musk is trying to come up with more cash for the Twitter deal. Here’s a great graphic from the WSJ’s coverage of the story showing Elon’s financing for the $44 billion deal:

After selling the block of shares, Musk retains a 16% stake in Tesla. Yesterday, the world’s richest man tweeted that he didn’t plan on selling any more $TSLA stock: “No further TSLA sales planned after today.”

$TSLA closed down 12% today, the stock’s worst day since September 2020.