When regular people talk about March Madness, they’re referring to college basketball. But when traders and investors talk about March Madness, they’re referring to a regional bank stock imploding.

We’re about a year out from three regional banks failing and/or being rescued, and now the sharks are circling New York Community Bancorp. The long story short, until today, is that the regional lender has too much commercial real estate exposure, weak internal controls over financial reporting, and a new CEO trying to right the ship. 🗞️

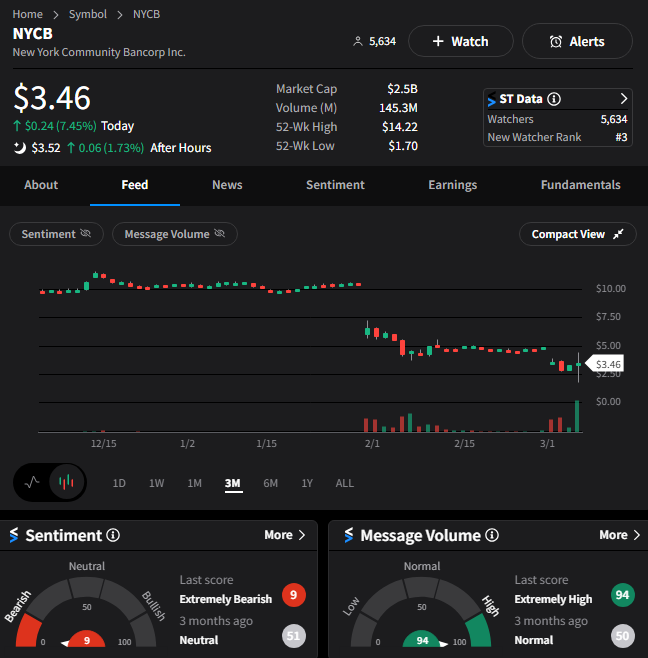

This morning, the stock was halted and then plummeted on news that it had hired advisors to help it raise equity capital. In other words, it would sell stock and probably not at a price that the market liked. As a result, shares fell more than 40% to fresh lows.

But, by the end of the day, a cohort of investors (including former U.S. Treasury Secretary Steven Mnuchin’s firm) stepped in to provide $1 billion of financing at $2 per share. That helped ease some of the short-term liquidity concerns and get the stock back into the green for the day. 💸

While it’s clear that this bank’s individual issues likely led it to this point, investors are worried about more structural headwinds that could impact the broader industry. Much like last year’s crisis, this situation has caused investors to look into other regional banks that might be left vulnerable by their fundamentals. 🕵️

We’ll have to wait and see how it develops throughout the month. But for now, the Stocktwits community remains extremely bearish on the stock and remains cautious on bank stocks. And we can’t say we blame them, given what happened less than a year ago. 🤷