Just when you think you’ve tackled the cryptocurrency universe, something new always seems to pop up. One of the newer creations in crypto is the rise and use of Exchange Tokens. You might have heard of a few of them: Cryptom.com’s Cronos ($CRO.X), Binance’s Binance Coin ($BNB.X), and the now infamous FTX’s token, $FTT.X.

Exchange tokens are really nothing more than a type of cryptocurrency known as a utility token. They can be bought and sold just like Bitcoin ($BTC.X) or Ethereum ($ETH.X) – but they have the added benefit of doing something if you’re using it on the native crypto exchange.

So what do exchange tokens do? That depends on the token. But in a nutshell, exchange tokens are mostly used as an incentive for users to keep using the same exchange with some type of utility or benefit, like decreased trading fees. Let’s look at two of the biggest exchange tokens.

Crypto.com’s Cronos

Easily one of the most popular and most traded exchange tokens is Crypto.com’s Cronos (CRO). Hodlers of CRO have certain benefits depending on the amount of CRO they choose to stake (deposit for a certain amount of time).

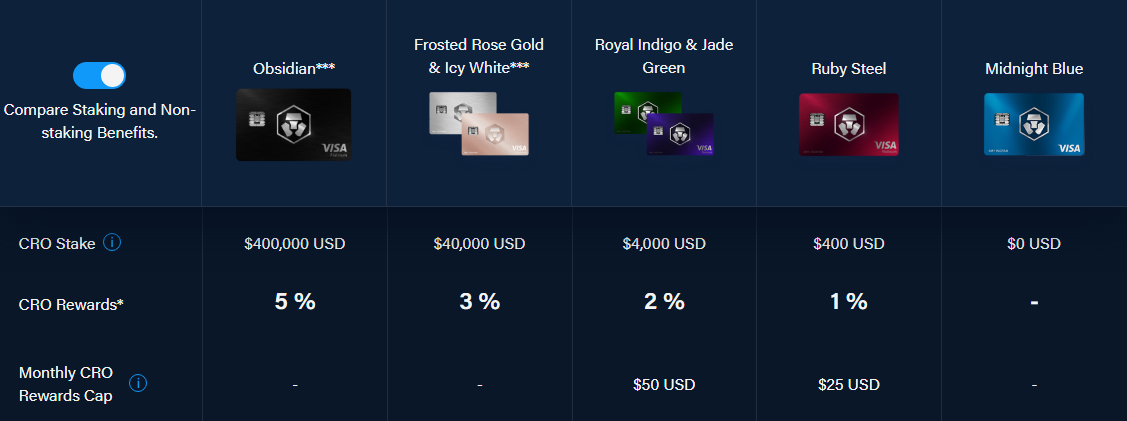

Crypto.com has its own debit card that anyone who uses Crypto.com can get, but if you want all the fancy bells, whistles, and benefits, you’ll have to pony up some CRO and stake it. And when I say pony up some cash we mean several ponies, stud horses, hay, and stables:

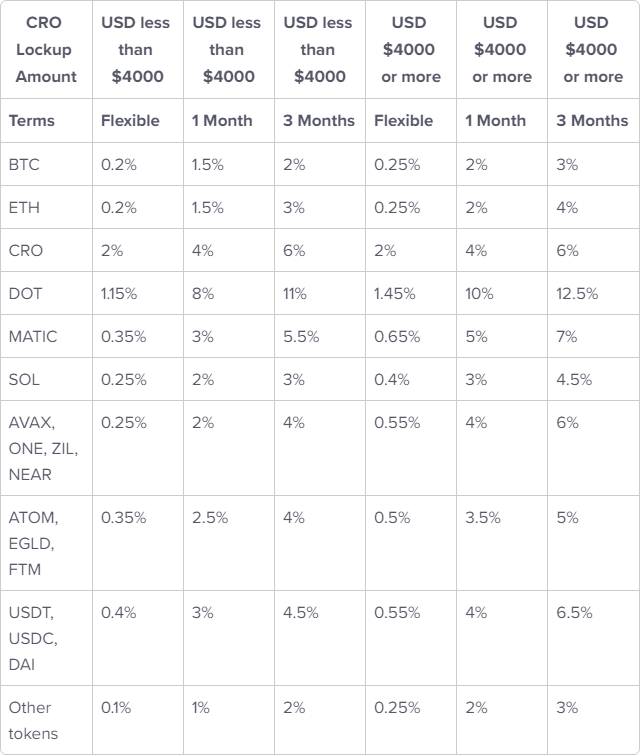

In addition to the debit cards offered, Crypto.com has a feature called Earn, which allows you to earn interest on certain cryptocurrencies and stablecoins. As with the debit cards, the interest rate varies depending on how much CRO you have staked and how long you choose to stake:

However, you should know that many of the cryptocurrencies CRO offers in their Earn program yield less than staking the asset natively.

For example, Polkadot ($DOT.X) has a nominal return between 8% and 14% – but Crypto.com will only pay you, at max, 12.5%, and you have to commit quite a bit of CRO to pay for the privilege of earning less than you could just staking on your own.

Binance’s BNB

Binance’s BNB token is an entirely different beast than CRO. BNB is the native token used on Binance’s blockchain/ecosystem, BNB Chain.

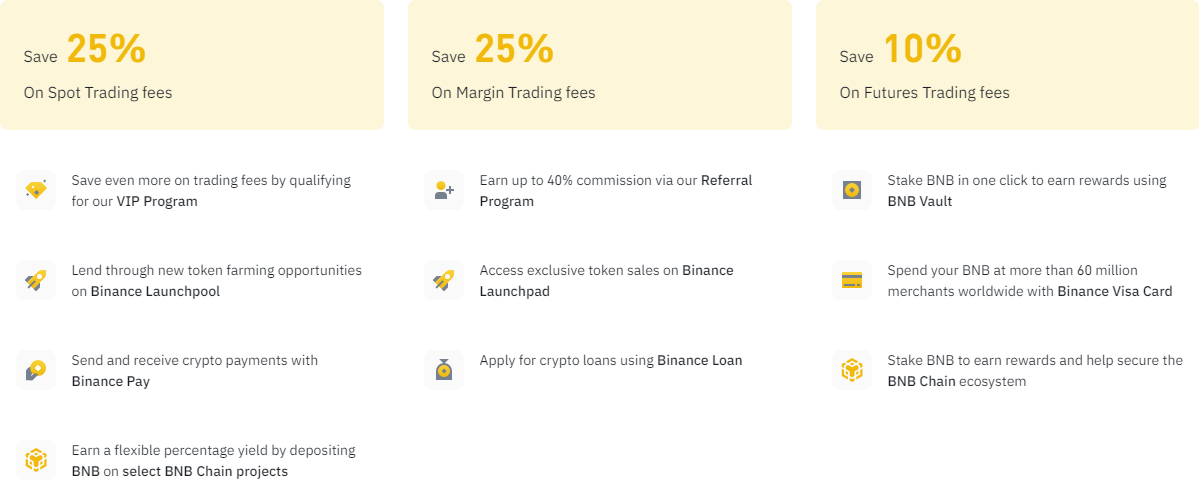

For traders, BNB can be used to save on trading fees, margin fees, and future trading fees.

BNB also has an interesting Burn mechanic (BNB is removed from circulation, like burning physical currency) to help stabilize the price and supply of BNB. Read more about Binance’s burn here.

While BNB might seem very limited compared to CRO, the use cases and focus differ. The primary focus of the BNB token is to ‘power’ the ever-expanding BNB Chain.

Does Binance offer staking like Crypto.com? Yes – but Binance leaves out the requirement of staking BNB to get Binance’s full range of staking benefits.

While CRO And BNB are just two examples of exchange-based tokens, you can see that while similar, they also have some big differences. So be sure to do that thing called due diligence and read the fine print.

Risks

Cryptocurrencies are arguably the riskiest of risk-on-type assets. At the time of writing this article (November 2022), 2022 has been one of the ugliest years for the cryptocurrency industry. Participants have seen entities like Terra ($LUNA.X), Voyager ($VG.X), Celsius ($CEL.X), and now FTX ($FTT.X) go bankrupt due to negligence, fraud, or both.

A common theme with the four entities listed above is this: they all have/had their own exchange token.

Unlike an instrument like Bitcoin, Ethereum, or Cardano ($ADA.X), most exchange tokens’ value is contingent upon the exchange’s success as a business. Exceptions would be exchange tokens that are also smart contract platforms like BNB.

When an exchange fails like Celsius or FTX, customers may be S.O.L. when it comes to getting anything of value back from those tokens. Assets like Bitcoin retain their value, but it’s unlikely that a failed exchange token like FTT will be of value to anyone anymore.

Are exchange tokens like CRO in the clear? Not by a long shot. Exchanges can make big changes to their incentives with little to no warning, causing massive shocks in the token’s value. In May 2022, Crypto.com significantly changed the staking rewards and benefits of staking CRO. CRO swiftly lost over 30% of its value.

Additionally, exchange tokens on Nexo ($NEXO.X) and Zoom ($ZOOM.X) eliminated all staking rewards for US customers in response to the SEC’s massive fine against BlockFi ($BLOCK.P). While neither of those exchanges suffered as significant a drop as CRO, the benefit of staking and holding NEXO or ZOOM was significantly reduced.

While exchange tokens have very enticing benefits, recent history should be a big reminder to make sure everyone does their own due diligence and researches where they put their money very, very carefully.

If something looks or sounds too good to be true, it often is. 👩🎓