Cardano’s ($ADA.X) primary development team, Input Output Group (IOG), is stepping into a type of cryptocurrency that has a very, very bad reputation:

Algorithmic-stablecoins.

If you don’t know what algorithmic stablecoins are (or regular stablecoins, for that matter), check out our Crypto 101: Stablecoins article.

The most recent algorithmic stablecoin disaster was the collapse of Terra’s TerraUSD ($UST.X) – which was the first domino that triggered the 2022 crypto collapse.

So what makes Cardano’s stablecoin different than Terras?

No friggen clue. That’s why I’ve reached out to IOG to explain it like I’m 5. Why would IOG need to explain it like I’m 5?

Good Lord, look at the differences between Do ‘Con’ Kwon UST’s 15-page long middle-school report titled: Terra Money, Stability and Adoption and Djed’s Russel Crowe I mean Jonathan Nash-ish 86-page mathematical sorcery titled: Djed: A Formally Verified Crypto-Backed Pegged Algorithmic Stablecoin.

This is the most complicated math stuff in Do ‘Con’ Kwon’s UST whitepaper:

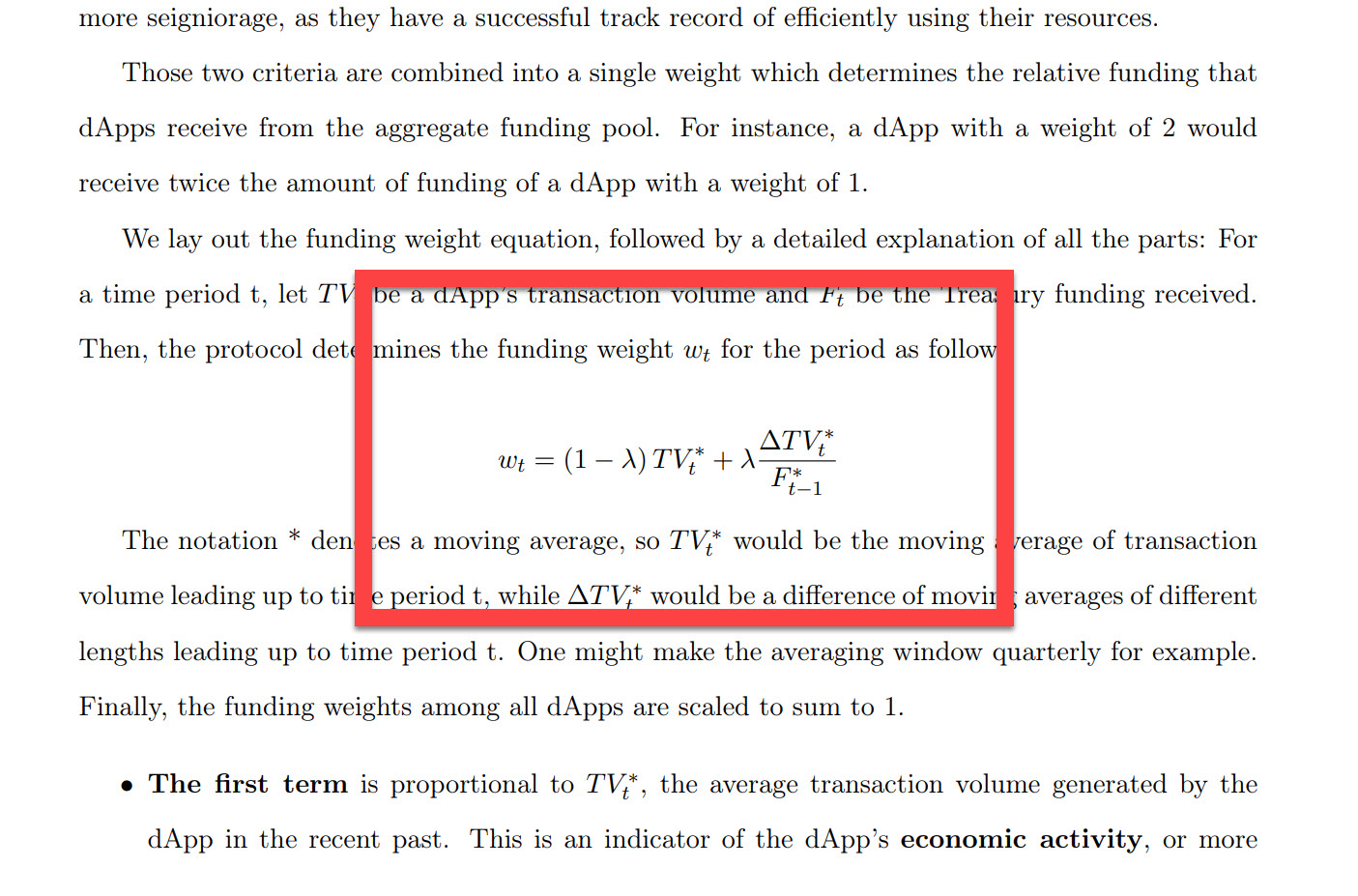

And this is just one page of many pages of the A Beautiful Mind-esque jibba-jabba hoobly-boobly math in Djed’s whitepaper:

We’ll keep you updated if/when IOG gets back to us from whatever alien planet or 5th dimension of reality they reside in. 🔬