The CCData Exchange Benchmark Report for April 2023 has some interesting highlights for CEXs (Centralized Exchange) and DEXs (Decentralized Exchanges).

You can read the full 61-page deck here, but we’ve also summarized some main points.

CCData Exchange Benchmark Report: Key Highlights

Centralized Exchange Highlights:

- Transparency increased with 20% implementing Proof of Reserves or alternative

- Security standards improve with 30% possessing ISO 27001, SOC2 certificate, or similar

- Market quality data availability grows, but data quality declines

- Bitstamp holds the only AA rating, followed by Coinbase with a grade A

- Exchange KYC practices improving with only 15% deemed to have inadequate practices

Decentralized Exchange Highlights:

- Uniswap received the highest score and is the only DEX eligible for an A rating

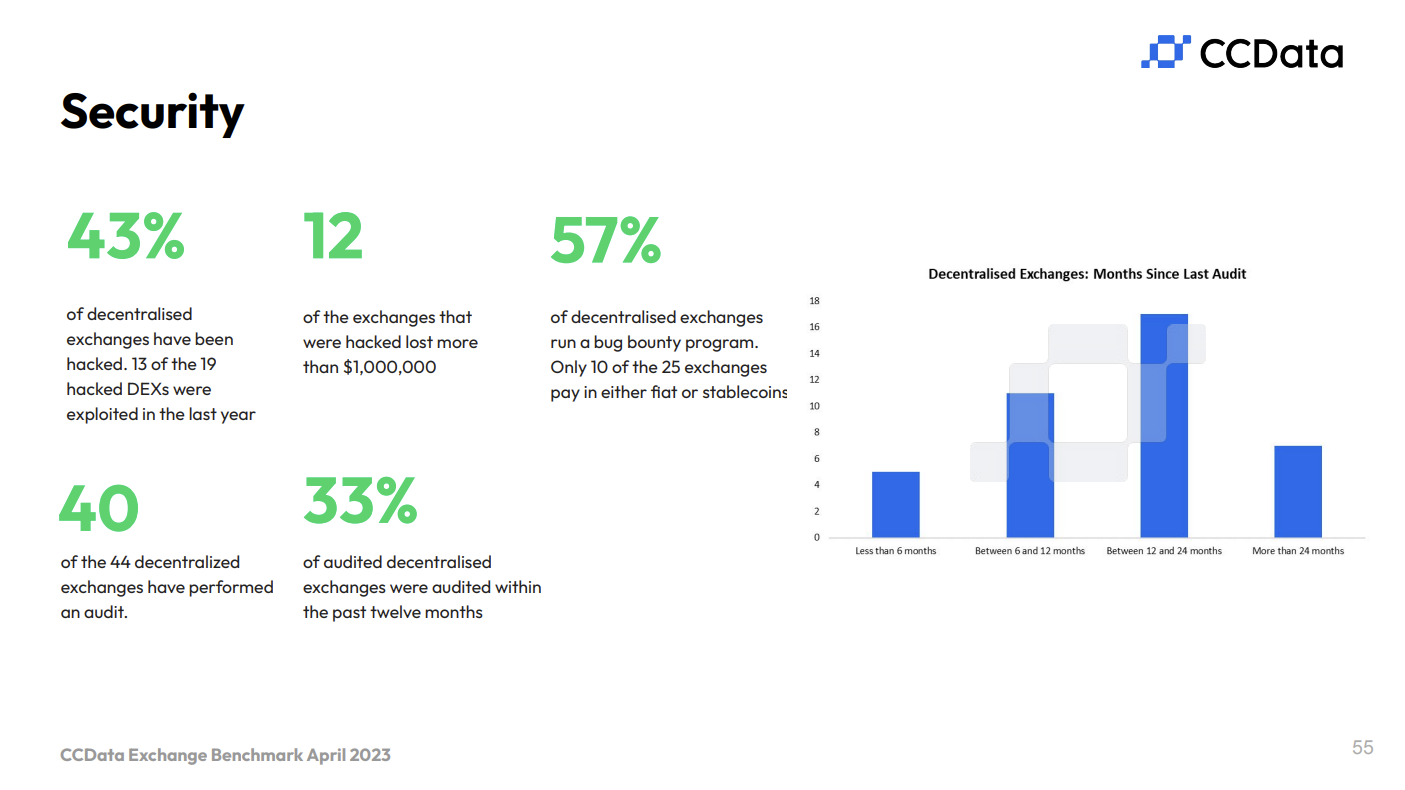

- Security vulnerabilities remain prevalent with 43.2% of DEXs covered hacked previously

- Governance participation is declining, and only 4 DEXs experienced an increase in voter turnout

- Total Value Locked (TVL) dropped to $16.9 billion, down from $21.7 billion in October 2022

Market Quality and Liquidity:

- Top-Tier volume from exchanges scoring BB and above with 23 rated Top-Tier in DEXs

- ADV (Average Daily Volume) on leading DEXs, Uniswap and Curve, surpassed volumes on some top centralized exchanges

- In March 2023, 71% of total volumes were from Top-Tier exchanges based on updated grading, compared to 92% in October 2022

And to close out this summary, look at page 55’s info on the percentage of DEXs that have been hacked.:

Can’t wait to see how things go for DEXs in CCData’s next report.