Happy Sunday, TDR fam!

Equity indexes and crypto found a little bit of sauce this week, with stock indexes going three-for-four in the green and crypto’s two largest coins rallying more than 5% this week. Good news in mind… is it too early to celebrate?

Let’s dig a little bit into that index action: the Nasdaq clawed back 2.14% this week after falling -6.38% last week. The S&P 500 collected a 1.73% gain after falling -5.18% last week, and the Dow Jones was up 1.92% after a 4.8% dip last week. Whether the indexes are on sale, or trapping bulls, is hard to say for the short-term.

The only index that lost was… (you guessed it) the Russell 2000, -0.9% this week. 🙄

The crypto market, broadly speaking, wasn’t much better off this week than last week. However, HODLers of $BTC.X and $ETH.X were treated to a pleasant green week. Crypto’s two star-studded cryptos rose 6.7% and 5.6% respectively this week.

They were joined in the green by $BNB.X (+1.7%). Every other top-10 crypto traded down, including $ADA.X (-3.4%), $SOL.X (-3.5%), and $XRP.X (-0.46%). Most notably, $LUNA.X collapsed more than -30% this week and stands to lose its #10 position in the crypto market cap list. 😱

Ultimately, the story right now on whether we’re looking up is… divergent at best. We can appreciate a green week, but we know not to get our hopes up too quick. It’s not too early to celebrate the small wins, but it’s way too early to relax. 😂

Reflections aside, here’s what went down this week:

| S&P 500 | 4,431 | +1.73% |

| Nasdaq | 13,770 | +2.14% |

| Russell 2000 | 1,968 | -0.90% |

| Dow Jones | 34,725 | +1.92% |

Bullets

Bullets from the Week

Elliot and Vista reportedly nearing deal to buy Citrix. Cloud computing company Citrix Systems might being going private. Elliot Management and Vista Equity Partners will reportedly acquire the company for $104/share, or $13 billion. The deal is not final, and it’s still a rumor at this time, but the rumor mill has been churning ever since Bloomberg reported the deal on Jan. 14. Shares of Citrix closed north of the rumored offering price on Friday. Read more in The Wall Street Journal.

Pentagon warns Putin still adding Russian troops near Ukraine. Pentagon spokesman John Kirby indicated that Russia has continued to add troops near the border of Ukraine, giving members of the international community something to worry about, just weeks from China’s Winter Olympics. As we reflected on in a previous edition of The Daily Rip, such an event could have devastating effects on markets (especially on Russia’s own markets) and on the political fabric of Europe. Read The Daily Rip Take on the Ukraine Situation from Jan. 24.

Biotechs suffer worst start since 2016 amid market-wide derisk. After a wild 2020, biotech lost big in 2021. So far, 2022 is shaping up to be even worse. Investors are calling it “March 2020-like”, referring to the COVID-era crash that shocked investors. Maybe they have a point, too. The SPDR S&P Biotech ETF is down more than 23% YTD, and more than 44% on the year. Biotech M&A, which was confounded by excessive valuations, might kick back up in 2022 given the discounts. However, it will only go so far for firms hoping to make deals involving stock, rather than acquiring in all-cash. Here’s Bloomberg’s take.

Northwestern University suit overturned in SCOTUS. A lawsuit levied against Northwestern University in 2016 was given new legs in the Supreme Court this week, much to the dismay of retirement plan sponsors. The lawsuit, filed in 2016 by employees of the university, alleged that the university violated its fiduciary responsibility by choosing investment options and plans with higher-than-necessary fees. The Supreme Court will now send the case back to be reviewed in appeals court, new instructions in tandem, for prosecuting the case. The SCOTUS has previously ruled that fiduciaries have an “ongoing duty to monitor plan investments.” Read more about the case and what it might mean for the industry.

Spotify acknowledges Rogan Boycott. Spotify spent nearly half a billion dollars to acquire Joe Rogan, his podcast, and his millions of monthly listeners. But this week, they paid a far greater price. The company lost more than $3 billion in market cap as users cancelled their paid subscriptions in response to Rogan’s disinformation about the COVID-19 vaccine. #SpotifyExodus trended on Twitter, while high-profile artists pulled their music from the service. Spotify acknowledged that it would add an advisory to podcast episodes mentioning the COVID-19 pandemic. Read CEO Daniel Ek’s blog post about the situation.

Sponsored

A Major Shift in Solar Technology is Coming

Graphene & Solar Technologies (OTCQB: GSTX) is forging a path to manufacturing transparent solar panels for commercial use. Using the unique material graphene, GSTX will be making lighter and more efficient solar panels, positioning them for massive growth as the solar market continues to boom.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s a summary of important earnings and economic data for the trading week ahead.

Economic Calendar

2/1 ISM Manufacturing Index (10:00 AM ET)

2/2 ADP Employment Change (8:15 AM ET)

2/2 EIA Crude Oil Inventories (10:30 AM ET)

2/3 Initial & Continuing Claims (8:30 PM ET)

2/3 ISM Non-Manufacturing Index (10:00 AM ET)

2/4 Payrolls & Unemployment Rate (8:30 AM ET)

2/4 Avg. Hourly Earnings & Average Workweek (8:30 AM ET)

Peep the full Economic Calendar provided by Briefing for all the reports this week.

Earnings this Week

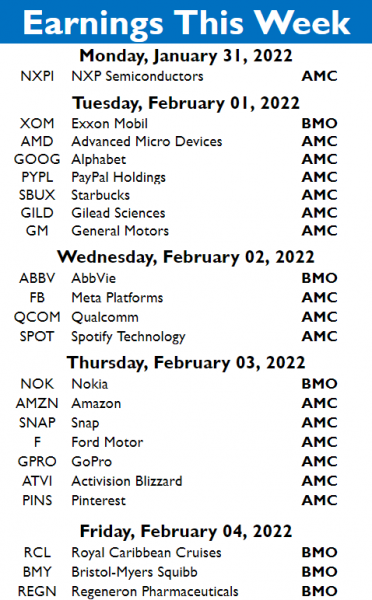

The earnings are coming quick now… and there’s no shortage of them this week. Here’s what’s on deck for the trading week starting Jan. 30, 2022:

We couldn’t possibly fit the 390 companies that the Stocktwits community is tracking in earnings this week, so be sure to check out all the companies reporting this week Stocktwits earnings calendar.

Links

Links That Don’t Suck

🍫 How One British Laboratory Protects the World’s Chocolate

✏️ What To Do On a Sunday, By Liza Donnelly (A Cartoonist for The New Yorker)

🖼️ Absolute Madman Buys Two More Bored Apes, Now Owns 107 Digital Monkeys

🤔 How UBS Plans to Use Wealthfront, the Robo-Advisor They Bought for $1.4 Billion