Bitcoin briefly pushed to new highs but lacked the “oomph” needed to keep going as the broader tech sector sold off. Weakness in Apple, Microsoft, and Amazon weighed down the major indexes, even as Jeff Bezos passed Elon Musk as the world’s richest person. Let’s see else what you missed. 👀

Today’s issue covers Target hitting its mark with a membership push, fintech company Dave riding the speculation wave, CrowdStrike bucking the cyber selloff, and an interesting question about the current market environment. 📰

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. To help ensure our emails keep making it to your inbox, please whitelist newsletter@thedailyrip.stocktwits.com.

Here’s today’s heat map:

3 of 11 sectors closed green. Energy (+0.74%) led, & technology (-2.46%) lagged. 💚

ISM Services PMI expanded for the 14th straight month, with S&P Global Services PMI also topping expectations in February as that sector of the economy remains hot. Consumer confidence ticked down again in March, with the RealClearMarkets/TIPP Economic Optimism Index stuck in negative territory since September 2021. 😐

Apple suffered its fifth straight day of losses after analyst firm Counterpoint Research suggested the tech giant’s sales in China have dropped 24% through the first six weeks of 2024. The firm suggests competition from Huawei and other local smartphone firms is eating into Apple’s market share. 📵

Lithium miner Albermarle tumbled to a new cycle low after beginning the sale of $1.75 billion of depository shares. It’s using the proceeds to fund the construction and expansion of operations in China and Australia, repay short-term debt, and fund general operations. SoFi Technologies also fell 15% after registering a $750 million convertible senior note offering, which it’ll use to pay down higher interest financing. 💸

Despite consumers continuing to spend their discretionary income on experiences like travel and live events, Vivid Seats fell to fresh all-time lows after its earnings came in well below expectations. Notably, its revenues beat estimates easily, but investors are still favoring profitable growth. 🛒

Meta’s primary platforms, Facebook, Instagram, and Threads, all experienced a two-hour outage today, yet the stock outperformed the broader Nasdaq 100. That had investors and traders questioning what would need to happen for this stock to go down materially. 🤷

Bitcoin prices briefly made a new all-time high before quickly reversing and selling off sharply. Although crypto rebounded at the end of the stock market’s trading day, the milestone felt like it marked a short-term shift in momentum. Microstrategy shares also plummeted 21% after selling $600 million in convertible senior notes to buy more Bitcoin and for working capital. ₿

Other symbols active on the streams: $AISP (+200.00%), $OCEA (+28.92%), $SMCI (+1.53%), $NYCB (+17.95%), $PHUN (+18.61%), $JL (+26.07%), $PEPE.X (-23.17%), & $GSTSOL.X (+321.69%). 🔥

Here are the closing prices:

| S&P 500 | 5,079 | -1.02% |

| Nasdaq | 15,940 | -1.65% |

| Russell 2000 | 2,054 | -0.99% |

| Dow Jones | 38,585 | -1.04% |

Once companies discovered that membership and loyalty programs drove additional customer visits and spending, there became apps for everything. Trust me, I’ve got the McDonald’s app on my phone because I get free fries or something with my occasional purchase… 📱

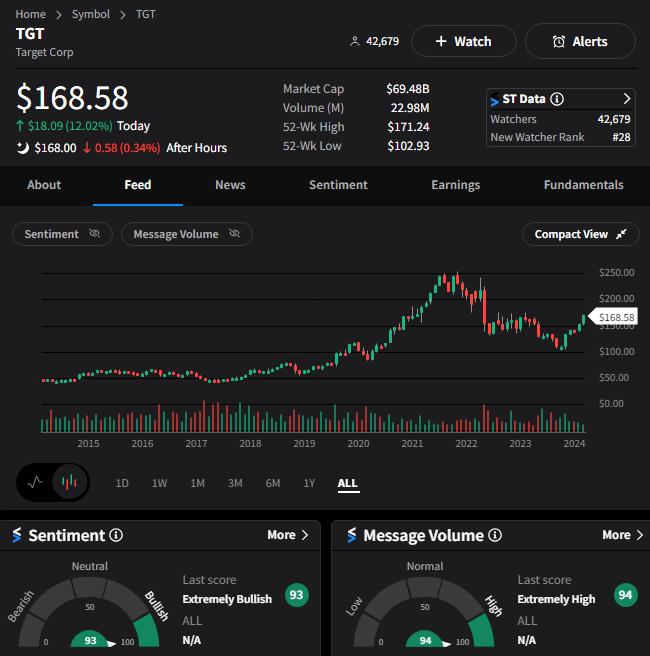

Nonetheless, this shit clearly works, and everyone wants a part of it. Given Target’s recent struggle, it’s not surprising that it’s jumping on the bandwagon as part of its turnaround strategy.

Its new subscription-based program, Target Circle 360, will launch in early April and cost $99 annually. It’ll take on Amazon Price, Walmart+, and other competitor programs with unlimited free same-day delivery for orders over $35, free two-day shipping, and several other perks. 📦

The move comes after the big box retailer reported an annual sales decline for the first time since 2016 and expects sales to be flat to +2% in the year ahead. Target’s middle-class customer base has pulled back on discretionary goods, so Target has also focused on expanding its private-label necessities brands to help boost sales.

Cost-cutting helped get earnings back on track, so now the company will return to growing sales by focusing on customer value and convenience. Whether or not this membership program ever rises to the likes of Amazon or Walmart remains to be seen. But with the number of people we all know who live at Target, there’s surely going to be some takers. 🤪

Overall, investors seem happy with the overall direction. Shares rose 12% to their highest level in 11 months, with Stocktwits sentiment pushing into “extremely bullish” territory. 🐂

Earnings

Dave Rides The Speculation Wave

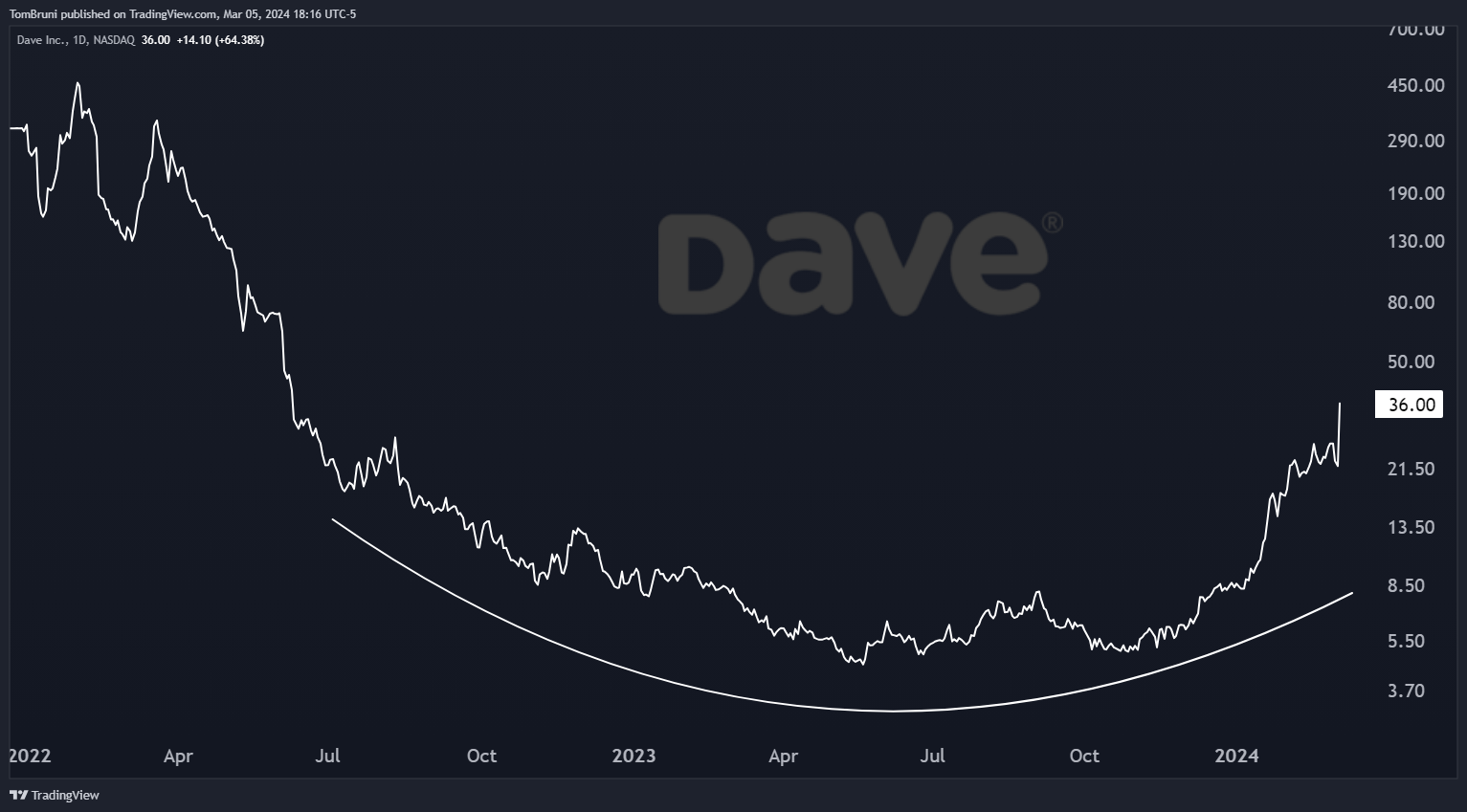

Neobanks that came public during the pandemic at insane valuations and got crushed over the last few years are roaring back in the current environment. 🏦

Dave Inc. is a digital banking service primarily focusing on cash advances, working off tips and subscription fees rather than overdraft fees. That was a solid business in the ZIRP era of cheap money but faced a reckoning in a higher interest rate environment. 💸

With that said, the company may have found its balance recently, reporting a significant profitability milestone during its latest quarterly results. While its revenue growth has slowed from 45% in Q4 2022 to 23% YoY in 2023, its adjusted EBITDA of $10 million marked its first positive quarter.

That was enough to help squeeze the beaten-down stock higher, with $DAVE shares rising 64% on the day. Technical analysts have also pointed out the stock’s “monster’ basing pattern from the last eighteen months that it’s now breaking firmly out of. In the renewed age of speculation, plays like this continue to catch traders’ attention big time. 🤑

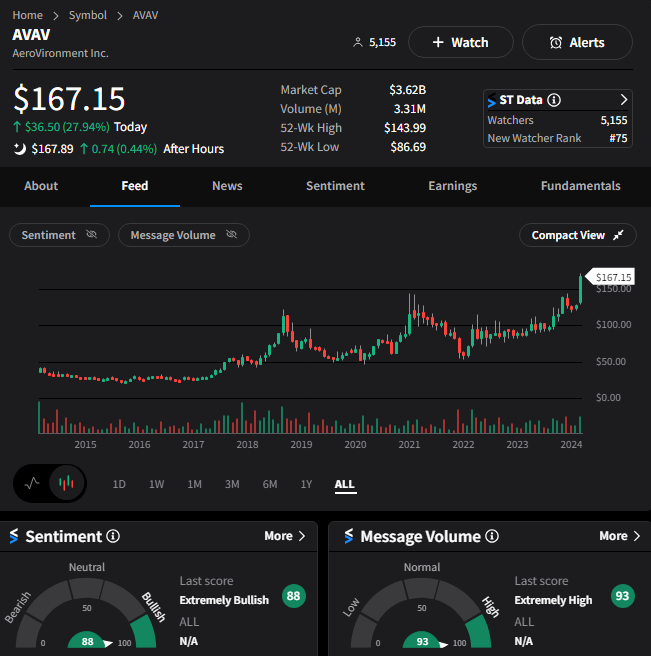

Speaking of somewhat speculative plays, AeroVironment soared to new all-time highs after its third-quarter results and full-year guidance topped analyst expectations. ✈️

The defense supplier topped quarterly estimates and boosted its guidance as demand for unmanned aircraft missiles and ground vehicles remains robust. Investors were also to see a solidly funded backlog from the company, which means it’s got significant orders still to fulfill. 📝

$AVAV shares soared 28% to fresh all-time highs on the news, with the Stocktwits community continuing its “extremely bullish” stance. 👍

Earnings

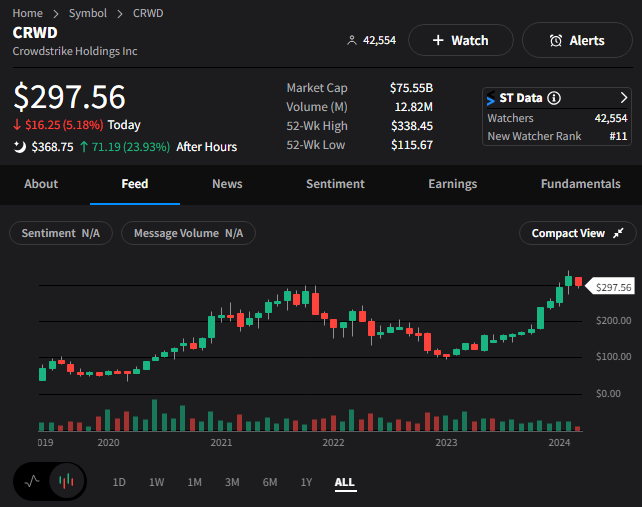

CrowdStrike Bucks The Cyber Selloff

After Palo Alto Networks and other cybersecurity stocks failed to meet expectations, the market highly anticipated CrowdStrike’s earnings after the bell. And unlike its peers, the company delivered big time, so let’s take a look. 👇

Adjusted earnings per share of $0.95 beat expectations of $0.82, while revenues of $845 million topped the $839 million anticipated. Notably, the firm has reported GAAP net income for the past four quarters, and management expects that trend to continue. 💵

Full-year revenue was up 36% YoY, with executives reiterating their 2030 goal of reaching $10 billion in annual recurring revenue. On top of that, it’s acquiring Flow Security for an undisclosed price in a cash-and-stock deal. In recent months, the company has been stepping up its merger and acquisition activity to drive further growth.

That news and first-quarter guidance topping Wall Street estimates caused $CRWD shares to soar 24% to all-time highs. 📈

Stocktwits Spotlight:

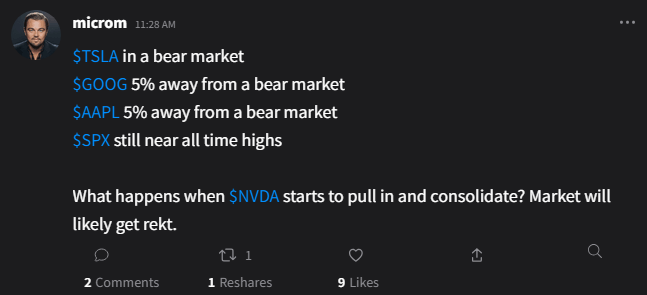

While the major U.S. indexes are sitting just below all-time highs, several of the “Magnificent Seven” stocks that have driven a good chunk of the recent gains are surprisingly weak. 🔻

Stocktwits user Microm picked up on this today, showing that Tesla is already in a bear market, with Alphabet and Apple just shy of entering that territory. That poses the question, what happens if the other leaders like Nvidia begin to pull back as well?

Microm believes the market will not fare well in that type of environment. But we want to hear your perspective on it, so go reply to his post with your view and make sure to tag the @Stocktwits handle as well. We’ll highlight some of the best answers from that thread tomorrow on social. 👀

Bullets

Bullets From The Day:

📰 LinkedIn looks to fill the news void as rivals retreat. The professional social media network is investing more in journalism while others are pulling back on investing in and featuring that type of content. While it won’t be able to make up for the drastic reduction in traffic referrals to news publishers, it does offer outlets and journalists a platform to grow their audiences materially. News publishers have amassed a collective following of over 240 million on LinkedIn, with about 4.4% of LinkedIn’s member base engaging with their content weekly. Axios has more.

🚫 Google aims to squash spam and AI in its search results. The search giant is rolling out a few new changes to its ranking systems in search, designed to help surface good content in your results and hide some of the worst. More specifically, it’s doing a better job of downranking content that exists only to summarize other content and combatting some of the tricks people and organizations use to game its ranking systems. Ultimately, it’s sending a message to the web that spammy, sketchy behavior is ending. More from TheVerge.

💳 Business groups battle back as Biden looks to cap credit card late fees. The Biden administration is seeking to impose a new $8 limit on credit card late fees, which the consumer credit and banking industry is pushing back. While the cap could save some consumers a cumulative $10 billion, industry experts argue it could impact other consumers through higher interest rates to help subsidize the losses in fee revenue. Cracking down on junk fees has been a significant focus for regulators, even if they sometimes lead to unintended consequences. NBC News has more.

Link

Links That Don’t Suck:

🤑 MarketSmith is now MarketSurge–check out the new features today and get 80% off the regular price*

🗳️ Arizona Sen. Kyrsten Sinema will not seek re-election

😬 $12.5B fraud trial: Vietnamese tycoon Truong My Lan faces death

👍 Oregon OKs right-to-repair bill that bans the blocking of aftermarket parts

🍪 Cookie Monster complaint about “shrinkflation” sparks response from White House

📺 Who’s going to pay $50 a month for a sports streamer that doesn’t have all the sports?

🎧 Stocktwits founder Howard Lindzon joins Real Vision’s “Daily Briefing” to talk all things markets

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.