The path of least resistance in stocks remains to the upside, as earnings surprises and Powell’s rate cut hints offset the persistent weakness in several “magnificent seven” stocks. Let’s see what else you missed. 👀

Today’s issue covers the Internet of Things breaking out, BJ’s and Kroger beating out Costco, and energy charts continuing to capture our community’s attention. 📰

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. To help ensure our emails keep making it to your inbox, please whitelist newsletter@thedailyrip.stocktwits.com.

Here’s today’s heat map:

10 of 11 sectors closed green. Communications (+1.62%) led, & financials (-0.15%) lagged. 💚

The European Central Bank kept interest rates steady once again but hinted at a June rate cut while trimming its inflation (and economic growth) forecasts. Meanwhile, Jerome Powell’s second day of Congressional testimony contradicted yesterday’s, with him saying that the Fed is “not far” from cutting interest rates. ✂️

The housing market remains insane, with the Biden Administration proposing $5,000 credit for first-time homebuyers and credit for families selling starter homes. Critics quickly pointed out that such a small measure would not address the massive supply vs. demand imbalance plaguing housing. 🏘️

This week, we discussed Neobanks, such as Dave taking off in the current environment. MoneyLion rose 28% after beating results and offering upbeat guidance. Other struggling stocks like DocuSign also continue to catch a bid with even a hint of decent news. 📈

Novo Nordisk shares surged 9% after the Wegovy-maker announced positive early trial data for a highly anticipated new obesity drug. The move pushed its market cap beyond $600 billion, passing Tesla and Visa to become the 12th largest company globally. 💊

Rivian shares jumped 13% after the company revealed a new $45,000 EV model that will launch in the first half of 2026 and outlined $2.25 billion in cost savings. ⚡

Other symbols active on the streams: $LKNCY (-6.95%), $NOVA (-9.54%), $NYCB (+5.78%), $IMRN (+175.74%), $MNMD (+51.52%), $CERO (+20.78%), $LYT (+276.62%), & $SKYX (+1.60%). 🔥

Here are the closing prices:

| S&P 500 | 5,157 | +1.03% |

| Nasdaq | 16,273 | +1.51% |

| Russell 2000 | 2,085 | +0.81% |

| Dow Jones | 38,791 | +0.34% |

Earnings

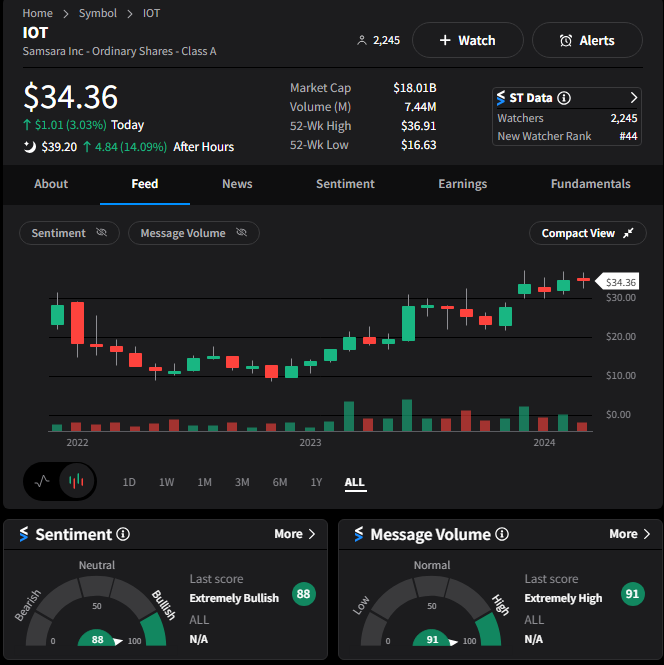

The Internet Of Things Grows Wings

While sentiment surges around crypto and artificial intelligence, it’s no surprise to see that hype around the “Internet of Things” company Samsara is also popping off. 🤩

The stock jumped to fresh all-time highs in the after-hours session following better-than-expected results. Its fourth-quarter revenues of $276.3 million topped estimates of $258.3 million, with its adjusted loss also narrower than anticipated. 💪

The company ended the year with $1.1 billion of ARR, representing 39% YoY growth. Investors were happiest to see the path of profitable growth, with the company also posting its first year of positive adjusted free cash flow.

Executives expect the momentum to continue this year, targeting $1.19 to $1.20 billion in revenues and $0.11 to $0.13 in earnings per share. Both numbers beat Wall Street’s estimates.

$IOT shares jumped 14% after the bell to all-time highs, with the Stocktwits community pushing the extremes of our bullish sentiment readings. 🐂

Speaking of internet-related things, Reddit officially set a date for its IPO. It will begin trading on the NYSE under the ticker symbol $RDDT on March 20th. 👀

Trends With Friends Macbook Pro Giveaway:

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on “Trends With Friends.”

In this week’s episode, the friends discuss:

- Crypto: Exploring the growth drivers, risks, and behavior of Bitcoin’s historic rally ₿

- Behavior: Michael Saylor’s all-in strategy and Bitcoin as an on-ramp to the degenerate economy 🤑

- Markets: Deteriorating breadth and the “Magnificent 7” turning into the “Malevolent 7” 💔

- Giveaway: One lucky subscriber will win a Macbook Pro on March 17 by entering here 💻

Watch it now on YouTube and Spotify, and subscribe to catch each episode when it goes live!

Earnings

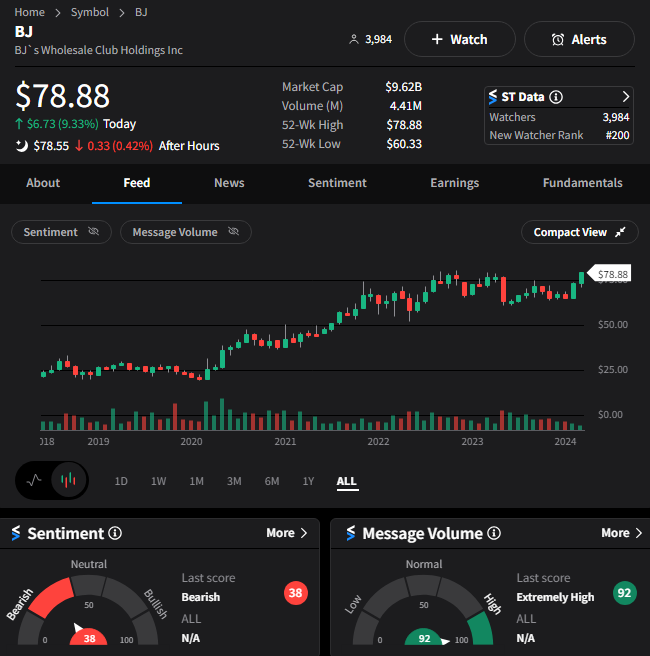

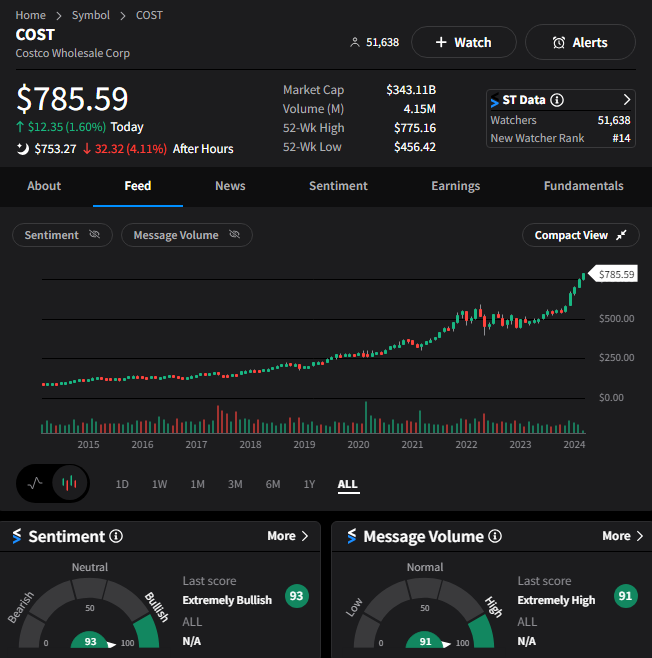

BJ’s Beats Costco For The Day

Today’s action shows that BJ’s may have a branding problem in the retail investing community. Despite the company’s results topping expectations today, sentiment readings from are community are still weaker than you’d expect. 🤔

BJ’s Wholesale Club revenues grew 8.70% YoY to $5.357 billion, with adjusted earnings of $1.11 per share. While earnings topped expectations, revenue was slightly below, with executives citing an uncertain macroeconomic environment as the primary driver.

$BJ shares jumped nearly 10% on the news and are just shy of all-time highs. Despite that, the Stocktwits community sentiment reading is sitting in bearish territory, as there seems to be some skepticism about the company’s ability to keep pace with Costco. 👎

Meanwhile, Costco shares are selling off because its sales grew just 5% YoY to $58.4 0 billion. Like BJ’s, its adjusted earnings of $3.92 per share easily beat estimates of $3.61, but the overall pressure on sales in the membership-based retail space remains. 🪪

Despite that overall headwind, the Stocktwits community seems to believe more in Costco than BJ’s because sentiment is still in “extremely bullish” territory. 🐂

We’ll have to see how this divergence develops in the coming weeks and months. In the meantime, Kroger is a sleeper that continues to kill it. Despite the overhang of its blocked merger, the company continues to deliver strong earnings and revenue growth, driving the stock up another 10% today. 🛍️

Elevate Your Investing Game:

Unleash your investing potential with our new Edge subscription plan—featuring unique social data, an ad-free experience, and more!

Stocktwits Spotlight:

As we’ve discussed for many weeks, traders and investors are finding opportunities across sectors and industry groups in the current environment. Earlier this week, we pointed out that the energy sector is heating up, and activity around these names seems to be increasing. 🔥

Stocktwits user upsidetrader pointed out Devon Energy’s weekly chart today. It seems to be stabilizing at its 200-week moving average and turning higher. After a roughly 50% correction over the last 21 months, some investors feel the company could be at a longer-term turning point. 🤔

Despite the price action seemingly improving over the last month, Stocktwits community sentiment remains in bearish territory. 🐻

Either way, we’ll keep an eye on this setup and know that upsidetrader will too. If you want to follow along and see more technical setups like this, follow him on Stocktwits! 👀

Bullets

Bullets From The Day:

🍽️ Applebee’s and IHOP launch co-branded locations to regain market share. Two of America’s iconic chain eateries are combining forces, with the parent company announcing it has begun opening dual-branded locations. It’ll combine the back-of-the-house cooking areas and blend the front-of-the-house dining areas, each featuring its own discrete entrances. It aims to reduce costs while maximizing revenues by attracting customers dining at different parts of the day to the same location. NBC News has more.

🔐 Max is the latest streaming service to crack down on password sharing. Warner Bros. Discovery says it plans to start a similar crackdown on other competitors in late 2024 and into 2025, hoping to follow in the success of Netflix. When asked by analysts about the impact, executives said it represents a “meaningful opportunity,” but they did not want to oversell it given that Netflix has 260 million subscribers compared to Max’s nearly 100 million. Still, as streamers chase profitability, this trend will only accelerate further. More from The Hollywood Reporter.

🤦 Elon Musk retracts tweet after targeting Jeff Bezos’ ex-wife. Apparently, the billionaire hasn’t had his fill of controversy yet because he decided to criticize McKenzie Scott for donating billions of dollars to charities. His tweets complained that her philanthropy efforts support organizations that deal with “issues of race and/or gender” and called her foundation “the ultimate expression of the most awful group in the U.S.” Now, whether you agree with these charities’ mission or not, calling out people attempting to do social good is not a great look, which Musk probably realized because he took the tweets down. Quartz.com has more.

Link

Links That Don’t Suck:

🤑 MarketSmith is now MarketSurge–check out the new features today and get 80% off the regular price*

🛍️ Aldi to add 800 new U.S. grocery stores by 2028

🔥 Power line ignited the largest wildfire in Texas history, officials say

💸 US salaries are falling. Employers say compensation is just ‘resetting’

🌭 Oscar Mayer launches plant-based hot dogs and sausages for grilling season

🔥 Single dose of LSD provides immediate and lasting relief from anxiety, study says

😡 Customers blast Five Guys prices after receipt goes viral. Here’s how much items cost.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.