- O’Leary said institutions have done the math and favor Bitcoin and Ethereum for delivering most of crypto’s upside amid volatility.

- He remains bullish on Bitcoin but expects institutional allocations to remain limited to around 3%.

- He noted that large investors are also increasingly concerned about the threat that quantum computing could pose to crypto.

- Bitcoin’s price has fallen nearly 46% since its record high in October.

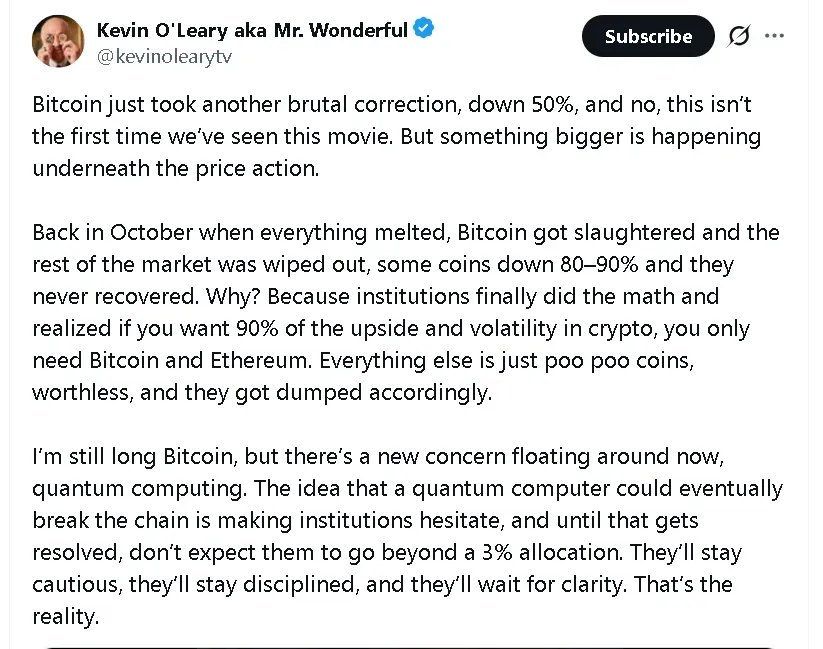

Shark Tank judge Kevin O’Leary said Monday that the cryptocurrency market’s correction from October weeded out ‘poo-poo’ coins, leaving Bitcoin (BTC) and Ethereum (ETH) as the primary institutional focus.

In a post on X, the Shark Tank investor, also known as “Mr. Wonderful,” said Bitcoin’s recent correction from its October record high indicates that there’s a “bigger” shift that’s happening under the volatile prices.

“If you want 90% of the upside and volatility in crypto, you only need Bitcoin and Ethereum,” he wrote. “Everything else is just poo poo coins, worthless, and they got dumped accordingly.”

According to a December report by CoinGecko, there were more than 11.6 million cryptocurrency failures in 2025 alone, with the fourth quarter accounting for over one-third of all token collapses on record. It added that the meme coin sector saw the most casualties because its low barriers to entry and speculative trading left many projects at risk as market conditions deteriorated.

Bitcoin And Ethereum Prices Struggle

Bitcoin’s price was trading at around $68,400 on Monday night, down 0.4% in the last 24 hours, after a short-lived rally to around $70,000 earlier in the day. This puts it nearly 46% below its record high in October, which was over $126,000. On Stocktwits, retail sentiment around the apex cryptocurrency improved to ‘neutral’ from ‘bullish’ territory over the past day, but chatter remained at ‘low’ levels.

Ethereum’s price rose around 1% in the last 24 hours, dipping to around $1,985 after briefly crossing $2,000 earlier in the session. Retail sentiment around the leading altcoin on Stocktwits trended in ‘bearish’ territory over the past day, also amid ‘low’ levels of chatter.

Institutions Are Capping Crypto Exposure At 3%

O’Leary said he remains long Bitcoin but added that institutional participation is likely to remain measured. He estimated most large investors are unlikely to allocate more than 3% of their portfolios to crypto under current conditions.

He also suggested that there are growing concerns about how quantum computing could pose a threat to Bitcoin. “They’ll stay cautious, they’ll stay disciplined, and they’ll wait for clarity,” he wrote.

Read also: Bitcoin’s $70K Tease Turns To Tumble, ETH Dumps Below $2K – Fed Minutes, PCE Data On Traders Radar

For updates and corrections, email newsroom[at]stocktwits[dot]com.