- Boeing CEO said the company is now focused on completing 777X development and stabilizing operations.

- In the third quarter, the company beat revenue estimates, but loss per share came in higher than expected.

- Boeing returned to positive free cash flow for the first time in nearly two years, fueled by strong jetliner deliveries.

Boeing (BA) CEO Kelly Ortberg said he was “disappointed” by further delays to the 777X program, which led to a $4.9 billion charge in its third quarter earnings.

BA’s stock dipped more than 1% in pre-market trade even as the company returned to positive free cash flow for the first time in nearly two years, driven by strong jetliner deliveries. Boeing was among the top trending tickers on Stocktwits, with retail sentiment on the platform improving to ‘bullish’ from ‘bearish’ territory over the past day, despite the dip in BA’s share price. Meanwhile, chatter increased to ‘high’ from ‘low’ levels.

Cash Flow Recovery Driven By Jetliner Deliveries

Ortberg stated that while 777X continues to perform well in flight testing, completing the development program remains critical to restoring the company’s performance and maintaining stakeholder trust.

"While we are disappointed in the 777X schedule delay, the airplane continues to perform well in flight testing, and we remain focused on the work ahead to complete our development programs and stabilize our operations in order to fully recover our company's performance and restore trust with all of our stakeholders.”

– Boeing CEO Kelly Ortberg.

Ortberg, who returned from retirement in August 2024, continues to focus on stabilizing Boeing’s supply chain and production lines

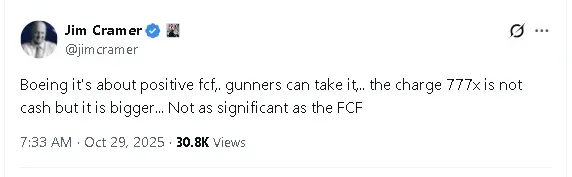

In a post on X, CNBC’s Jimmy Cramer said that, despite the 777X charge, positive free cash flow indicates underlying strength.

Boeing’s Q3 Earnings Fine Print

Despite the charge, Boeing returned to positive free cash flow for the first time in nearly two years, fueled by strong jetliner deliveries. The company delivered 440 aircraft in the first nine months of 2025, up from 291 in the same period last year.

Boeing reported revenue of $23.2 billion, above analysts’ estimate of $22.1 billion, according to Koyfin data. Loss per share came in at $7.47, exceeding the forecast of $2.38.

BA’s stock has gained more than 21% this year and 46% over the past 12 months.

Read also: Bitcoin Slips Ahead Of Fed Rate Cut Decision — Ethereum, Dogecoin Lead Declines

For updates and corrections, email newsroom[at]stocktwits[dot]com.