While we’ve already touched on gold moving to fresh all-time highs over the last two weeks, other precious metals are also catching a bid after a rough few years. 👀

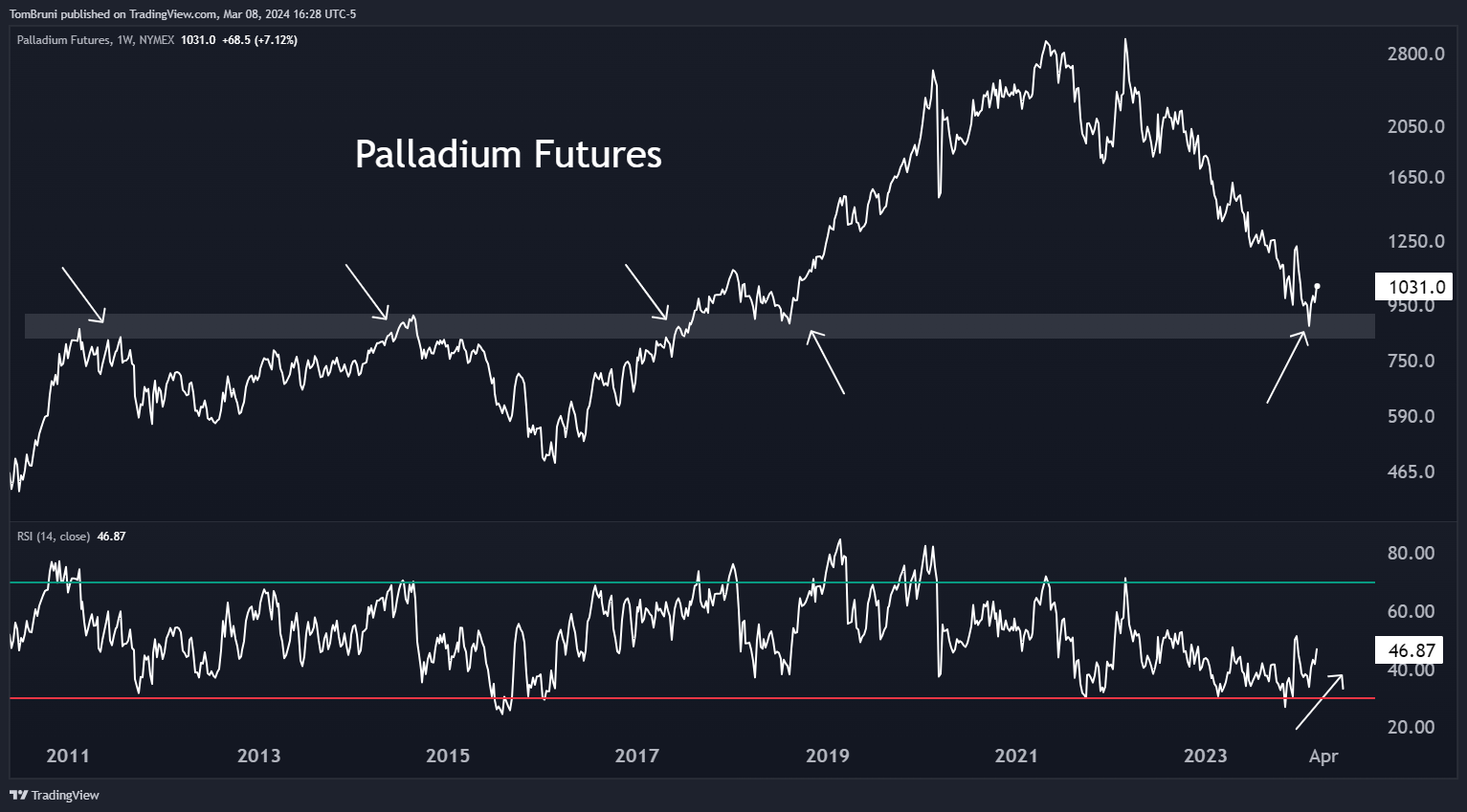

Below is a chart that technical analysts have been eying this week as palladium futures attempt to reverse their downward course. The weekly line chart goes back to 2010 and shows prices bouncing back from the $800 to $900 region, which has served as a transition area for buyers/sellers over the last 14 years. 📊

Additionally, technical analysts say the relative strength index (RSI) shows momentum improving even as prices made new lows earlier this year. This is what they refer to as a “bullish divergence” and is often looked at as a signal of a coming trend reversal. 🔺

In addition to the improving price action and momentum, some traders say speculators are positioned poorly for this market, holding record short positions. That means commercial hedgers, who are the actual companies dealing with physical palladium on a daily basis, are loading the boat long. And they wouldn’t be doing that unless they had a hunch that prices were heading higher. 🤔

Now, commercial hedgers have very deep pockets and are often way early to trend reversals. But, analysts say the combined factors above paint a compelling case for prices to continue rising from here…especially if the rest of the precious metals space continues to perform well, too. 🤷