Peloton shares rose faster than my heart rate during one of their cycling classes after the company announced significant changes in a push towards profitability. 😮

In today’s announcement, the company told employees it is cutting about 780 jobs, closing a significant number of its stores, and hiking prices on some equipment. These changes mark the second major shakeup for the company this year. In February, its founder passed the reigns to new CEO Barry McCarthy as the company slashed 2,800 jobs.

Its CEO Barry McCarthy said in today’s memo, “We have to make our revenues stop shrinking and start growing again,” also stating, “Cash is oxygen. Oxygen is life.” 😮💨

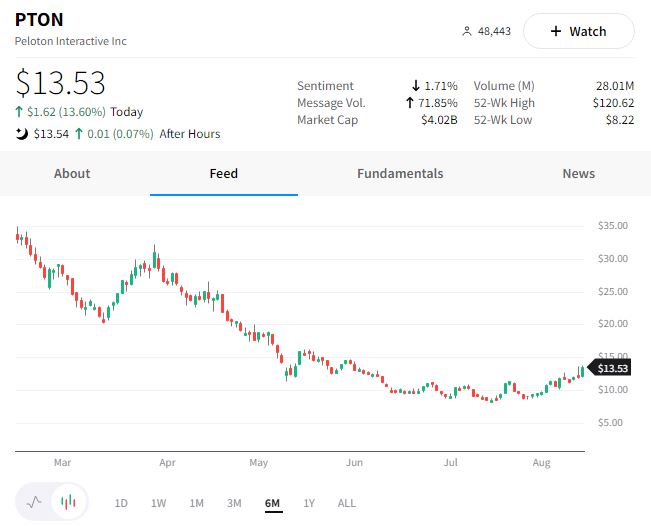

The struggling at-home fitness company has seen its value plummet from a high near $50 billion just ~18 months ago to under $3 billion as of mid-July, which many would say warrants an aggressive strategy shift. 🔻

It’s been a big year of change for the company, and some investors seem to be coming around to its turnaround story. With today’s rally, the stock is at its highest level in about three months, though it still has a lot of work to do to get back to its post-IPO price and pandemic-fueled highs.

Maybe the primary driver of the stock’s gains is the rebound in the overall market or the tech sector. Or maybe it’s that investors are truly believers of the new strategy…only time will tell. ⌛

In the meantime, you can read the full memo here and hop on the $PTON stream to let us know your thoughts! 💭