No matter the day, there seems to be an endless stream of electric vehicle (EV) industry news. Let’s get into today’s headlines. 📰

First up is China’s Nio, which just received an additional $2.2 billion investment from Abu Dhabi’s CYVN Holdings, which raised its stake to 20.1%. The fund had last invested in Nio during July, with a $1 billion investment.

The funding is fresh air for investors concerned about the company’s runway. Price wars with Tesla and other competitors pressured margins, with the company already running at a loss. CYVN’s new investment of 294 million shares at $7.50 per share will give the business more liquidity while allowing CYVN to nominate two directors to Nio’s board. 🗳️

$NIO shares jumped 5% on the day and continue to make progress since the last time we posted this chart. Technical analysts say the stock has made good progress at stabilizing near $7.00 and is beginning to shift its trend higher. We’ll have to wait and see if that shift continues. 👀

Meanwhile, Nikola founder Trevor Milton was finally sentenced to prison for fraud. 🧑⚖️

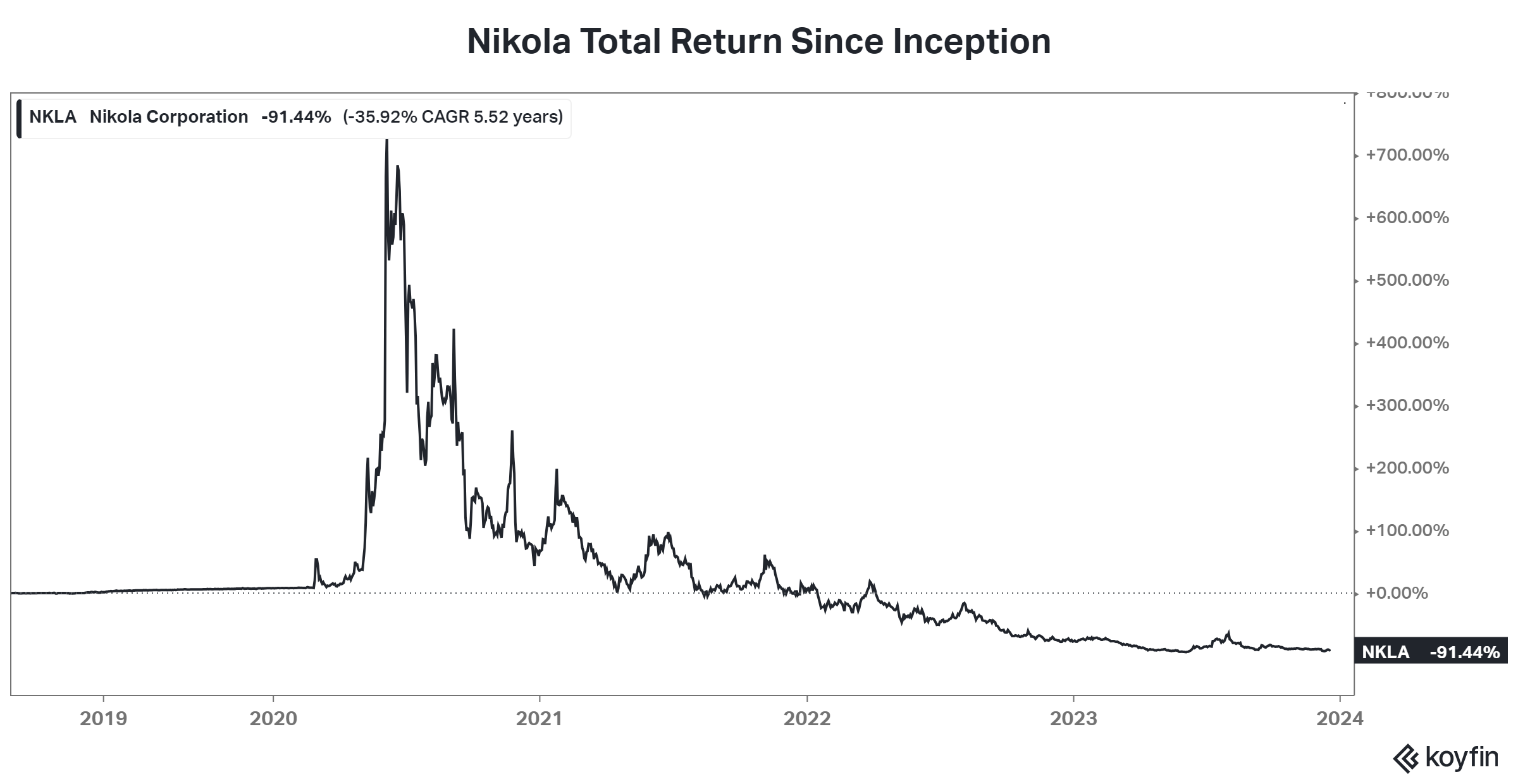

For those unfamiliar with the story, Milton became a billionaire when he took Nikola public through a SPAC deal in June 2022. Despite the stock reaching a peak valuation of more than $30 billion, a report identifying false and misleading statements by short-seller Hindenburg Research began the stock on its downward spiral.

In September 2022, Milton resigned from his CEO and executive chairman roles but remained the company’s largest shareholder. Since then, the stock has been trending lower as the business fails to bring its electric and hydrogen-powered trucks to life. 😬

Regulators say using the SPAC process instead of a traditional IPO allowed Milton to make many misleading or fraudulent statements.

Damian Williams, U.S. attorney for the Southern District of New York, said, “Trevor Milton lied to investors again and again — on social media, on television, on podcasts, and in print. But today’s sentence should be a warning to start-up founders and corporate executives everywhere — ‘fake it till you make it’ is not an excuse for fraud, and if you mislead your investors, you will pay a stiff price…”

Milton was convicted in October 2022 on two counts of wire fraud and one count of securities fraud. Prosecutors had looked to put him in jail for 11 years while the defense was looking for probation. Ultimately, they landed on four years and potential other remedies for investors like the forfeiture of property. ⚖️

Unfortunately, many believe it’ll be too little too late for Nikola investors, as $NKLA shares have been on a downward trajectory since peaking in mid-2020. 📉