Accounting is the practice of using numbers to tell the story of a company’s past, present, and future. For an investor, these numbers and stories are the foundation of all decisions, so it’s imperative that they’re done correctly. And generally, they are.

But lately, there’s been an uptick in the number of accounting mishaps making their way into the financial markets. Today we got a few more instances of this problem, so let’s take a look. 📝

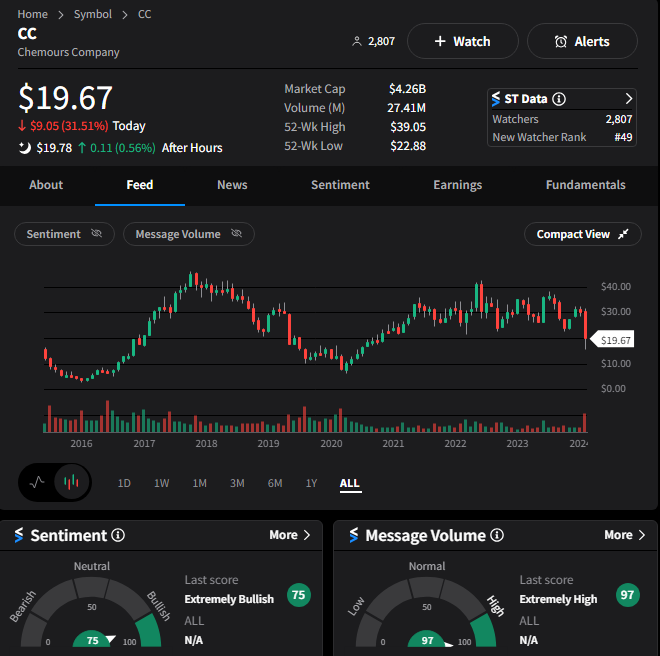

First up, we had chemical maker Chemours plunging to more than a three-year low after placing its top three executives on administration leave. It says it’s looking into potential “material weaknesses” in its financial reporting, which could further delay the reporting of its fourth-quarter and full-year results. 😮

Analysts say what was perceived as a relatively minor accounting hangup when initially disclosed two weeks ago has escalated into something with much wider and material ramifications.

$CC shares fell more than 30% as investors digested the news. Interestingly, the Stocktwits community remains “extremely bullish” on the stock despite the selloff, with some viewing it as a potential buying opportunity. 🤔

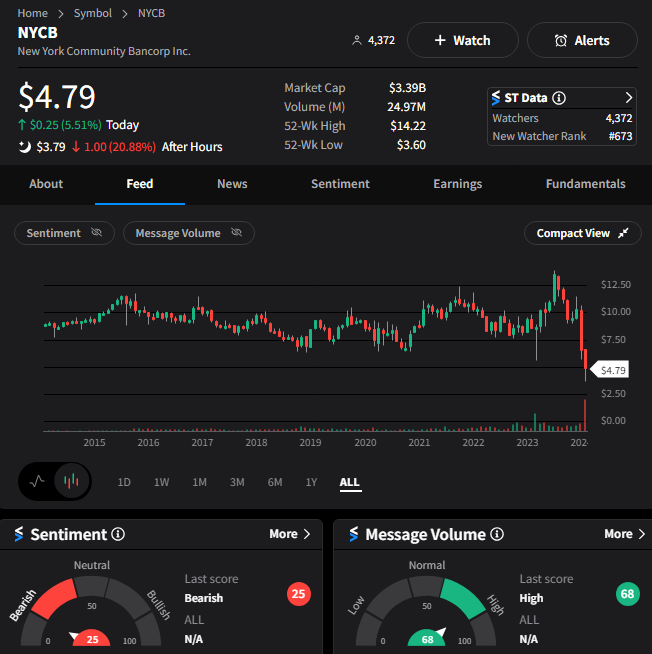

Regional bank New York Community Bancorp’s struggles continue, with the company announcing its executive chairman, Alessandro DiNello, is taking on the roles of president and CEO immediately. It also amended its fourth-quarter results, adding a disclosure about its internal risk management. ⚠️

Internal controls over financial reporting are pretty important for a bank (or any company, really). As a result, $NYCB shares plunged another 21% after hours as investors assessed the bank’s longer-term prospects. Unlike Chemcour, Stocktwits community sentiment is more mixed on this stock given its ongoing structural problems. 🏦

And lastly, the Securities and Exchange Commission is charging Lordstown Motors with exaggerating demand for its EV pickup. As the quote “lies, damned lies, and statistics” implies, you can definitely lie with numbers. But unfortunately, if you “fake it until you make it” in the financial markets, you’ll be expected to pay the piper if you end up never making it. 🤷