It may be the last week of the year, but many companies are rushing to get deals done before year-end. Two significant transactions in the biotech space were announced today, so let’s dive in. 👇

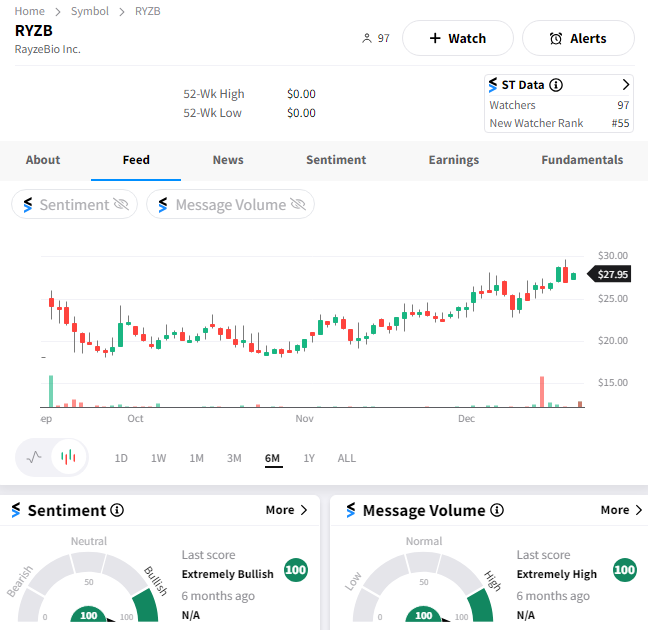

The first deal involves RayzeBio, which raised $358 million via an initial public offering (IPO) just three months ago. However, its time as a public company is being cut short by Bristol Myers Squibb, which is acquiring the radiopharmaceutical therapeutics company for $62.50 per share in cash. 💰

That represents a 100% premium to Friday’s closing price and values the company at $4.1 billion. Bristol Myer’s CEO said, “This transaction enhances our increasingly diversified oncology portfolio by bringing a differentiated platform and pipeline, and further strengthens our growth opportunities in the back half of the decade and beyond.”

$RYZB shares doubled on the day, giving investors a rare, quick win in the 2023 IPO market. 🤑

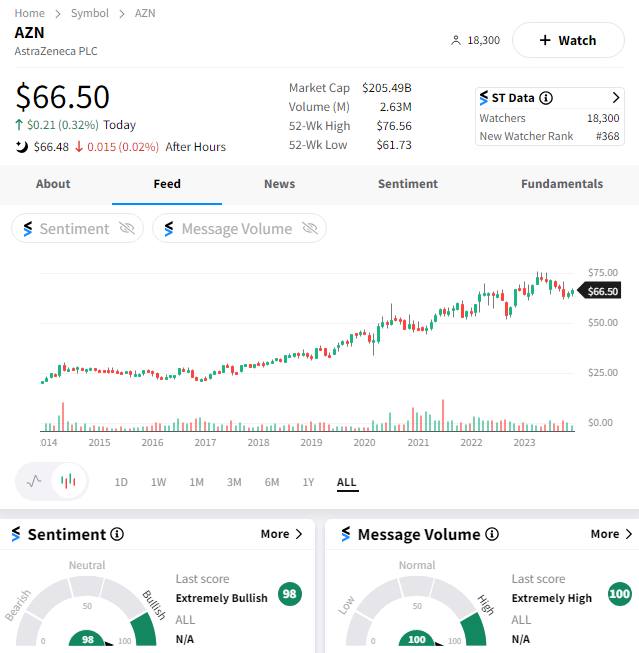

Next up, AstraZeneca is buying China-based cell therapy biotech Gracell for $1.2 billion. The Anglo-Swedish pharmaceuticals giant is one of the biggest drugmakers in China but is reportedly planning to spin off that part of its business to shield it from growing geopolitical tensions. 🧬

As for this acquisition, AstraZeneca looks to expand its cell therapies for cancer and autoimmune diseases. It’s hoping to challenge the likes of Gilead Sciences, Novartis, and Bristol Myers, which currently dominate the cell therapy space.

$AZN shares were up marginally on the news. 🔺