It’s 13F season, and market participants are rushing to see what the most prominent investors are buying and selling. 🐋

Today we’ll look at Berkshire Hathaway’s 13F to see what Buffett was up to in the second quarter.

As a quick reminder, a 13F is a required quarterly report for institutional investment managers with at least $100 million in assets under management. These firms must file 13Fs with the Securities & Exchange Commission within 45 days of the end of each calendar quarter, which is why most firms file it on day 45.

The overall purpose of this rule is to increase transparency in the financial markets by making the public aware of what the nation’s largest institutions are investing in, at least in the public markets.

Given that this information is so easily accessible today, many use what the world’s ‘smartest’ investors are doing in the markets as another data point in their investment process.

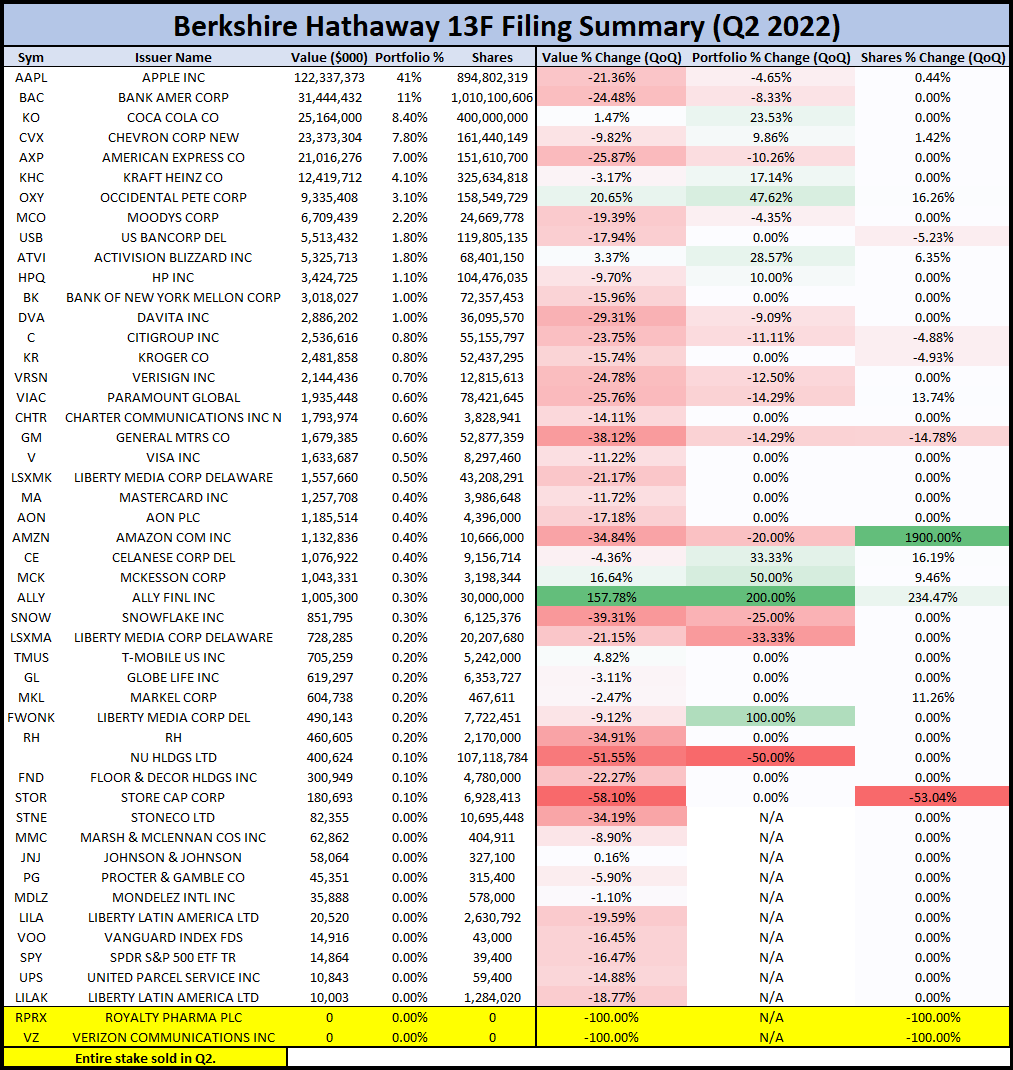

Below is a snapshot of Berkshire’s holdings as of June 30th, 2022. We’ve omitted some info that’s not as pertinent and added the final three columns where we calculated the percentage change in three key data points from Q1 to Q2. Also, please note that the “Portfolio % Change Column” represents a percentage of a percentage, not the absolute percentage change. 📝

Now that we’ve given the background let’s get into some key takeaways from this data. 🔑

First, let’s start with some facts about the overall portfolio.

The company’s roughly $300 billion public market portfolio has 47 total positions. Apple remains the portfolio’s largest position at 41%, followed by Bank of America, Coke, Chevron, and American Express. Together, those five stocks make up 75% of its portfolio, and its largest ten holdings comprise 88% of its portfolio.

Given Warren Buffett’s advice for individual investors to diversify, this seems like a very highly concentrated portfolio. But, an important point to remember is that these are only the company’s public equity holdings, and Berkshire is a massive conglomerate with stakes in a wide variety of businesses. Moreover, even in the company’s 10-k, he says he is not a stock-picker; he’s a business picker. So the surface-level hypocrisy on diversification is more or less a moot point.

Now, getting into the actual holdings. The first thing to note is that most of its portfolio holdings lost value with the overall market. So, not surprisingly, those who have held up best over the last quarter are more defensive names like Coca-Cola, Kraft Heinz, and McKesson Corp. 🛡️

The other outlier is Occidental Petroleum, which was the portfolio’s second-largest gainer and a name that Berkshire continues to buy more of. It increased the number of shares it held in the company by 16.26% in the quarter. 🛢️

Other major increases in share count included Amazon (+1,900%), Ally Financial (+234.47%), Celanese Corp. (+16.19%), Paramount Global (+13.74%), Markel Corp. (+11.26%), Mckesson Corp. (+9.46%). 👍

Meanwhile, Berkshire reduced positions in Store Cap Corp. (-53.04%), General Motors (-14.78%), US Bancorp (-5.23%), Kroger Co. (-.93%), and Citigroup (-4.88%). The firm also completely sold off its positions in Verizon and Royalty Pharma, which were tiny positions (essentially 0%) anyway. 👎

Overall, the data shows there were not a ton of significant changes by Berkshire this quarter. Many of the changes in its portfolio were driven by changes in the market value of its holdings rather than significant buys or sells by the company. 🤷♂️

For now, all we can do is watch and see how Buffett’s bets fare in the current quarter. 👀

***Quick update on 08/19/22 that Berkshire has won approval from the Federal Energy Regulatory Commission to buy up to 50% of $OXY’s shares in the secondary market.***