Peloton investors are nervous but excited about the potential business impact of its new five-year strategic partnership with Lululemon. 🤝

The deal will bring Peloton’s content to Lululemon’s exercise app. In exchange, Lululemon will become Peloton’s primary athletic apparel partner, with a select number of its instructors becoming ambassadors for the apparel brand.

Neither company shared the financial terms or whether the two will share revenue, but the synergies are clear. 🤫

By the end of the year, Lululemon will officially discontinue its Mirror product, which allows users to stream workout classes. It acquired the company for $500 million during the pandemic but quickly wrote down most of it after failing to gain customer traction. Instead, it created a new fitness app focused on digital content as it pivoted away from the hardware-based fitness business.

Lululemon’s app has about 13 million members, nearly doubling Peloton’s 7 million global membership count. This is its first significant content partnership, with executives saying they’re not looking to do other content-sharing deals until they see how this develops. However, Peloton will not have access to the members consuming its content.

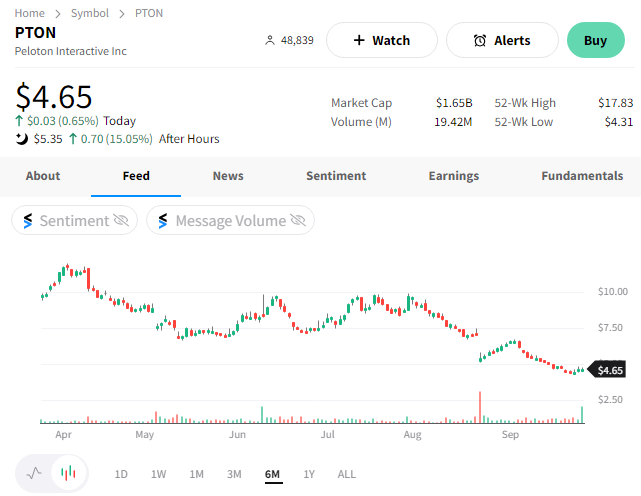

$PTON shares popped 15% after the bell, continuing their recent rebound from all-time lows. Whether or not this will be enough to help turn its business around remains to be seen. But for now, it’s doing the stock price some good. On the other hand, $LULU shares barely budged. 🤷