Plug Power hasn’t given investors much to be excited about over the last few years, but today’s news has people (and its stock price) charged up again. So let’s see what happened. 👇

The alternative-energy company, which provides hydrogen fuel cell technology, finalized a deal with the Department of Energy (DOE) for a $1.6 billion loan facility. This critical funding comes at a time when the company has faced immense liquidity issues, issuing a going-corn warning last quarter and disclosing a secondary share offering of up to $1 billion. 💸

Management says its initial priority with these funds is to address its liquidity and resolve its “going concern.” In other words, they need to walk the company back from the edge of insolvency so that they can focus on sustainable growth going forward.

However, once that is resolved, there is reason for investors to be hopeful. The company says its Georgia plant is now operational despite construction taking longer than anticipated. And once its short-term needs are taken care of, this loan facility will support the development, construction, and ownership of up to six more hydrogen-production facilities. 🔋

As for costs, the company’s hiring freeze is in place, and it believes attrition will lower payroll costs over time. It’s also looking to “significantly raise” prices across all of its offerings, something it’s not done despite the last few years of inflationary pressure. 📊

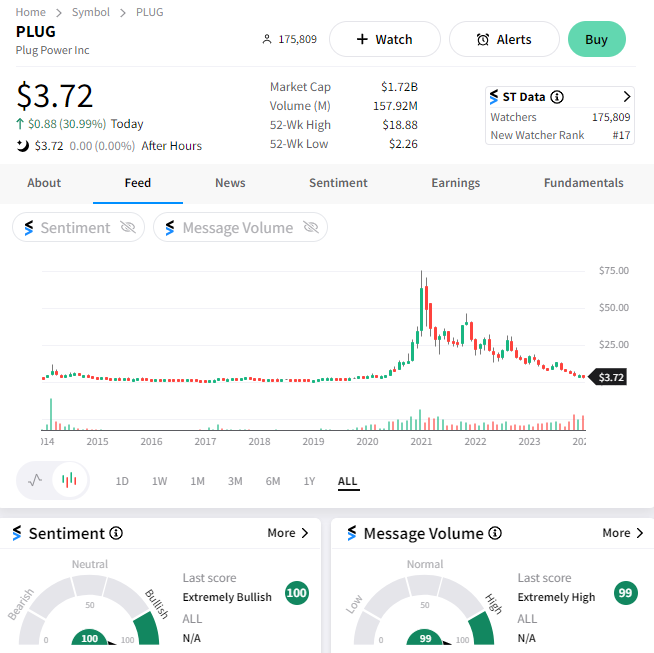

$PLUG shares rallied another 31% on the news, with prices up nearly 70% over the last four trading days. The Stocktwits community is “extremely bullish,” with message volume exploding and pushing the stock into the top 20 most newly-watched stocks on the site today. 👀