It’s been a good stretch of time since politics were at the center of market-related debates and analysis. Sure, the occasional debt ceiling scare and funding for specific industries were on the table, but since the pandemic, there’s not been much impacting the broader market.

However, that ended today with a flurry of news reminding investors that 2024 is an election year and will likely get complicated. 😬

First, a federal judge blocked JetBlue’s purchase of budget rival Spirit Airlines. In its lawsuit, the Department of Justice (DOJ) argued that the deal was anti-competitive and would ultimately hurt consumers. The judge ultimately agreed, ending the $3.8 billion merger that would’ve created the U.S.’s fifth-largest airline. 🚫

In his decision, U.S. District Court Judge William Young wrote, “JetBlue plans to convert Spirit’s planes to the JetBlue layout and charge JetBlue’s higher average fares to its customers. The elimination of Spirit would harm cost-conscious travelers who rely on Spirit’s low fares.”

Although JetBlue and Spirit Airlines disagree with the ruling and are exploring their next steps, the news immediately sent $SAVE shares plummeting. Ultimately, this marks a significant win for the Biden Administration, which said it would step up antitrust enforcement to promote fair competition.

Meanwhile, shares of Albertsons fell while Kroger’s rose after Washington state sued to block their proposed merger on antitrust grounds. Attorney General Bob Ferguson argued that the $25 billion deal would harm consumers and raise prices given that the two chains have more than 300 locations in Washington and account for over half its grocery sales. 🛒

Ultimately, this news shows there will be continued scrutiny of any major mergers, especially those that could directly or indirectly inhibit “fair competition.” 🕵️♂️

As for the upcoming election, former president Donald Trump secured a commanding win in the Iowa caucuses yesterday, likely setting us up for another Biden vs. Trump ticket in November. If that’s the case, there will be significant implications for investors.

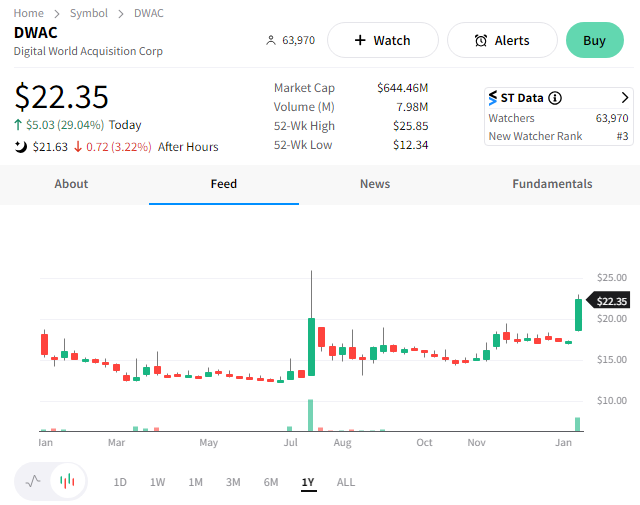

In the short term, we saw Trump-linked stocks like Digital World Acquisition Corp. ($DWAC), Phunware ($PHUN), and Rumble ($RUM) all rally sharply today. Some investors use these types of stocks to express their political views in the market, which is certainly the case today. 🗳️

How the upcoming election pans out will impact the stock market’s performance in many ways.

At surface level, the stocks mentioned above will undoubtedly be impacted. However, the underlying businesses are not sizeable and unlikely to impact the stock market’s overall performance. 🤷

Instead, investors will be most focused on the broader policies that impact specific sectors/industries that are heavily regulated. Also, economically sensitive decisions like who is leading the Federal Reserve or how the federal debt/deficit is addressed will impact the business environment and markets. ⚖️

Given Biden and Trump have run before, we pretty much know their platforms and potential implications. Since they have opposing policy views in many areas, the anticipated election outcome will likely drive investor allocation decisions as we near the year’s second half.

We’ll have to see how things develop in the coming months. But for now, we’ll leave you with some more worthwhile news that didn’t fit in the above paragraphs. 📰

- Rivals accuse mega-cap tech of not following new EU competition rules

- Allianz CEO warns of growing divide between political elites & working class

- Fed’s Christopher Waller advocates moving ‘carefully’ with rate cuts

- Northvolt secures largest-ever green loan from the EU ($5 billion)

- Banking group IIF sounds the alarm on record global debt

- IMF warns AI to hit almost 40% of jobs worldwide, worsen inequality