It was a mixed day for several of retail investors’ favorite stocks. Let’s see what’s moving. 👀

First up is Canadian Solar, which reported mixed second-quarter results and reaffirmed its full-year 2023 outlook. However, its third-quarter revenue forecast of $1.9 to $2.1 billion lagged the $2.5 billion consensus estimate. $CSIQ shares fell 13% as the solar industry remains under pressure. 🌩️

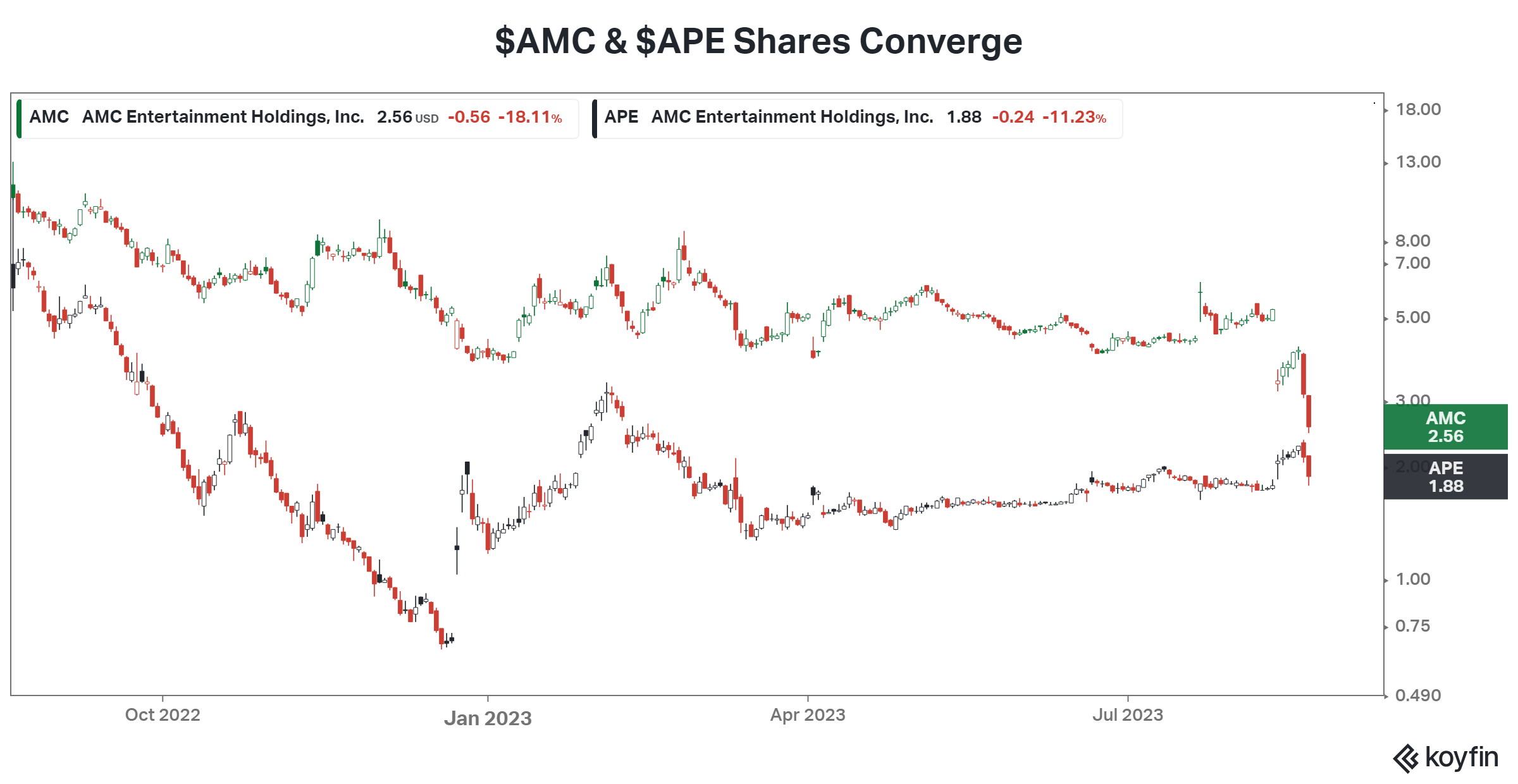

$AMC and $APE shares continued to fall ahead of this week’s corporate events.

On Thursday, AMC common shares will undergo a 10-for-1 reverse stock split, and on Friday, the company’s APE units will be converted to common shares. Many investors had anticipated the gap in share price would’ve closed by APE units rising, but instead, AMC shares are falling to reflect the impact of their coming dilution. 📊

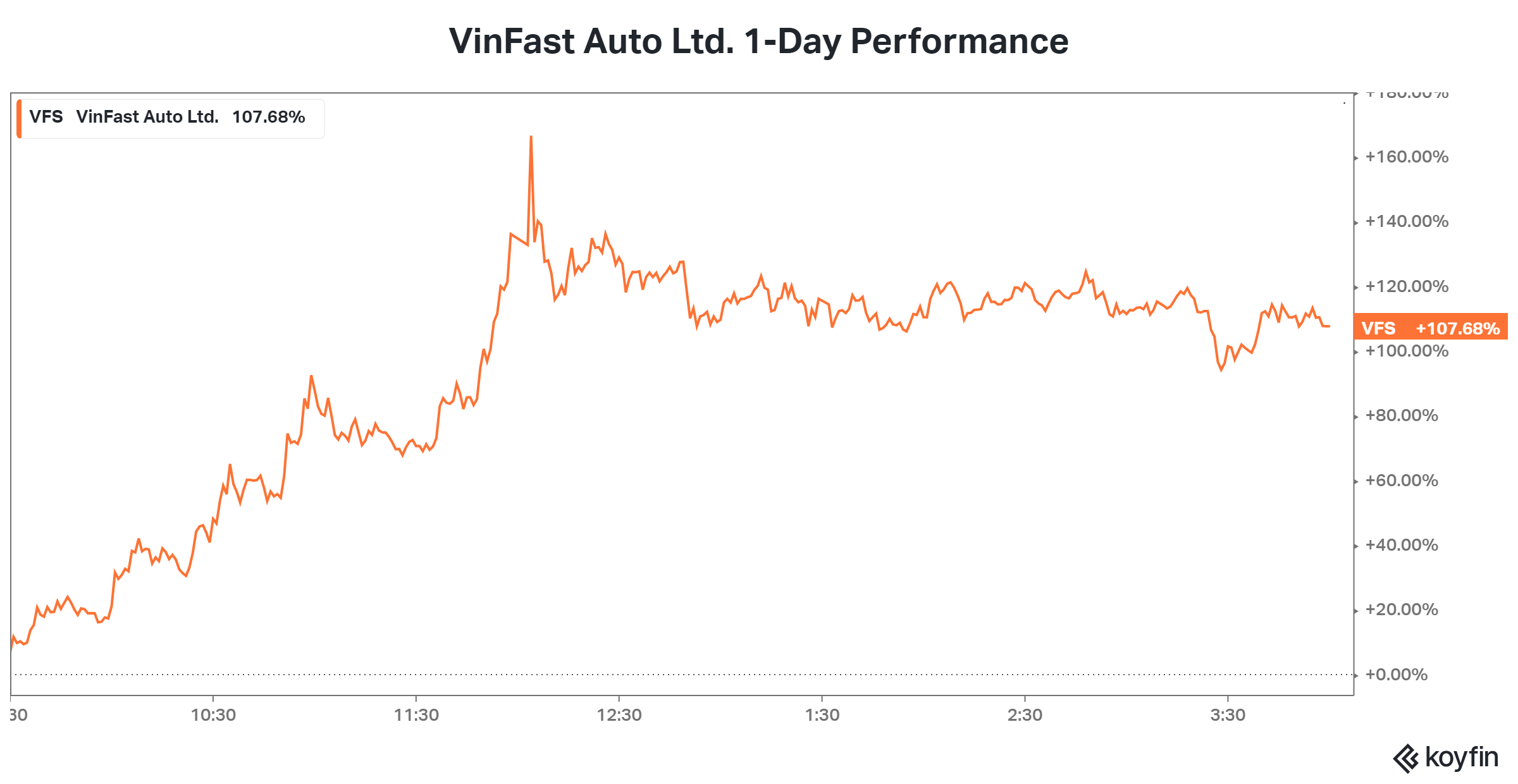

And lastly, Vietnamese electric vehicle maker VinFast’s wild ride continues, with the stock rising more than 100% today. The surge in price brings its market cap back above $84 billion, making it larger than General Motors, Ford, and China’s BYD.

Time will tell if the company’s underlying fundamentals can grow into that valuation, but for now, the stock remains volatile as the “price discovery” process continues. 🤷