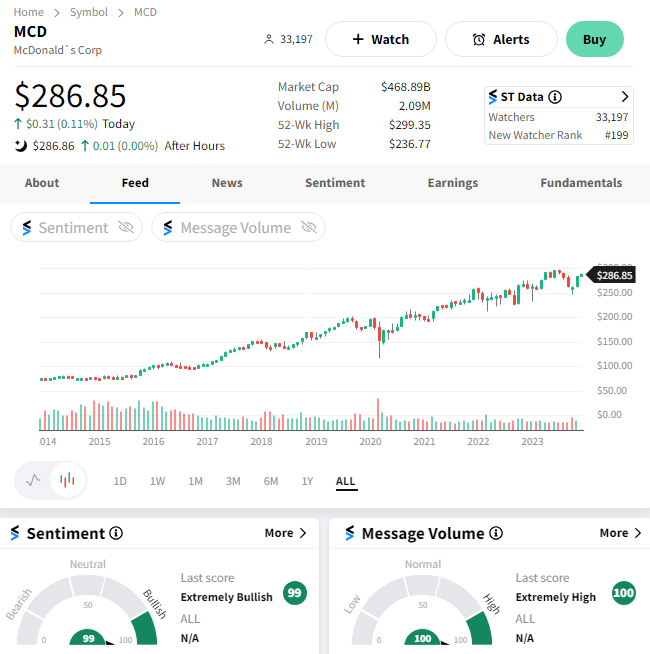

McDonald’s has been meandering near all-time highs for most of the last year, bucking the trend of other restaurant chains pinched by inflation. Despite its strong performance, some investors are concerned about how the company plans to continue its run into the future. 🤔

Today, the company revealed its big plans at its investor day.

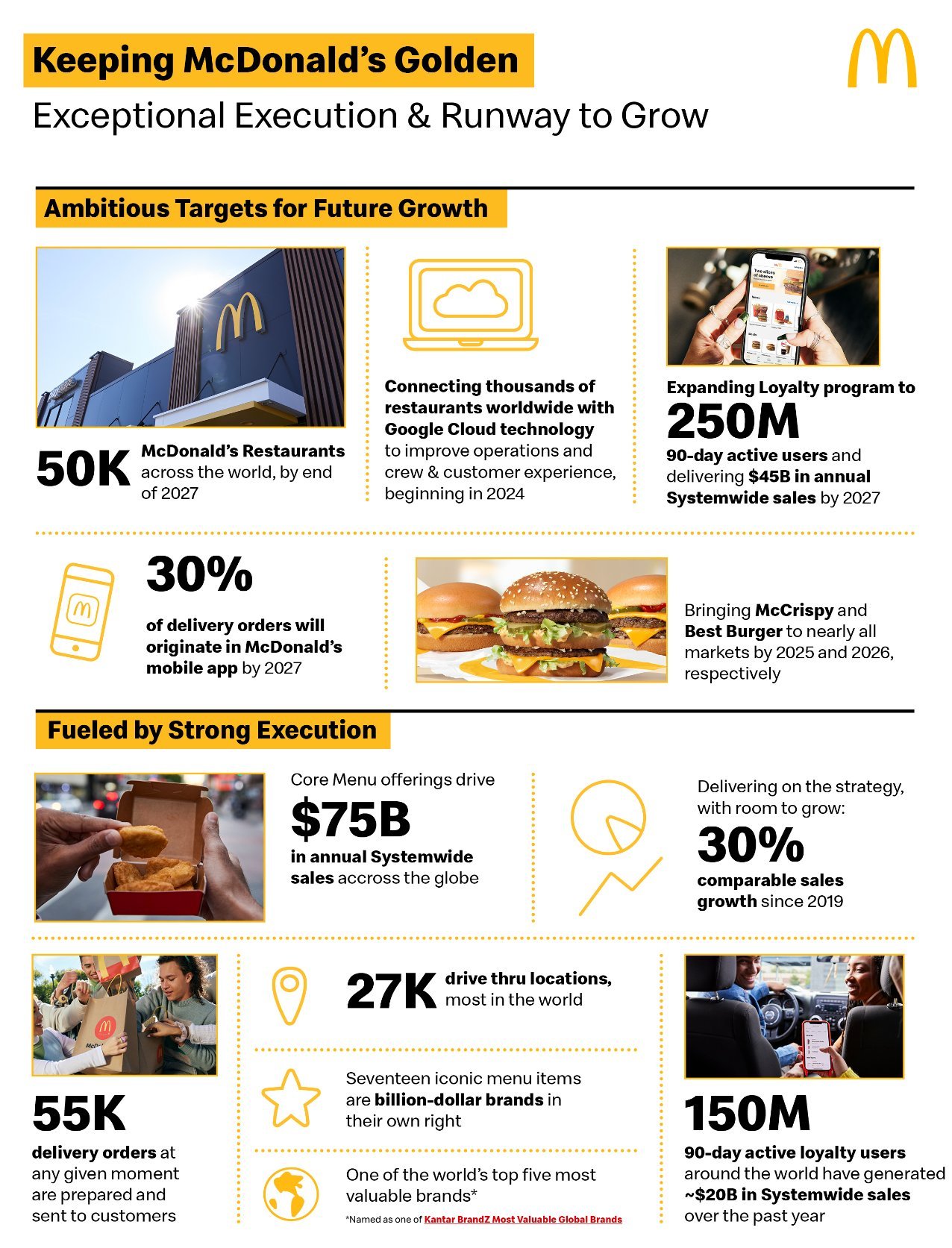

Let’s start with the company’s restaurant count, which currently sits at just over 40,000 worldwide. While that may seem like a large footprint already, McDonald’s is looking to enter its fastest period of growth in company history. It’s targeting an expansion to 50,000 restaurants by the end of 2027, ramping up to 1,000 gross openings across the U.S. and International Operated Markets in 2027. 🍟

In addition to expanding its footprint, it’s also looking to use Google Cloud technology to improve its operations beginning next year. Its strategic partnership with Google Cloud will connect the latest cloud technology and apply generative AI solutions across its global restaurants. Not only is this expected to improve wait times and the overall customer experience, but it should also drive further satisfaction among its crew members. 🤖

In business terms, a bigger footprint means more potential sales. And more efficiency in its operations means higher margins. Combine the two, and you’ve got very happy shareholders.

Additionally, it’s looking to squeeze more gains out of its loyalty program. Although it currently has one of the world’s most extensive customer loyalty programs at 150 million users, it’s looking to expand that to 250 million 90-day active users by 2027. 📱

Overall, the company is simply expanding on its 2019 “Accelerating the Arches” strategy, which aims to maximize marketing, commit to the core of the business, and double down on the three Ds (delivery, digital, and drive-thru).

This graphic we shared on social earlier in the day sums up the plan well. 👇

One takeaway from this graphic is that many investors thought McDonald’s had far more locations than it currently does. However, as long as the company can continue to deliver slow and steady growth, along with a healthy dividend and share buyback, investors are likely to remain happy.

$MCD shares were up marginally on the day but remain just below all-time highs. 🤏