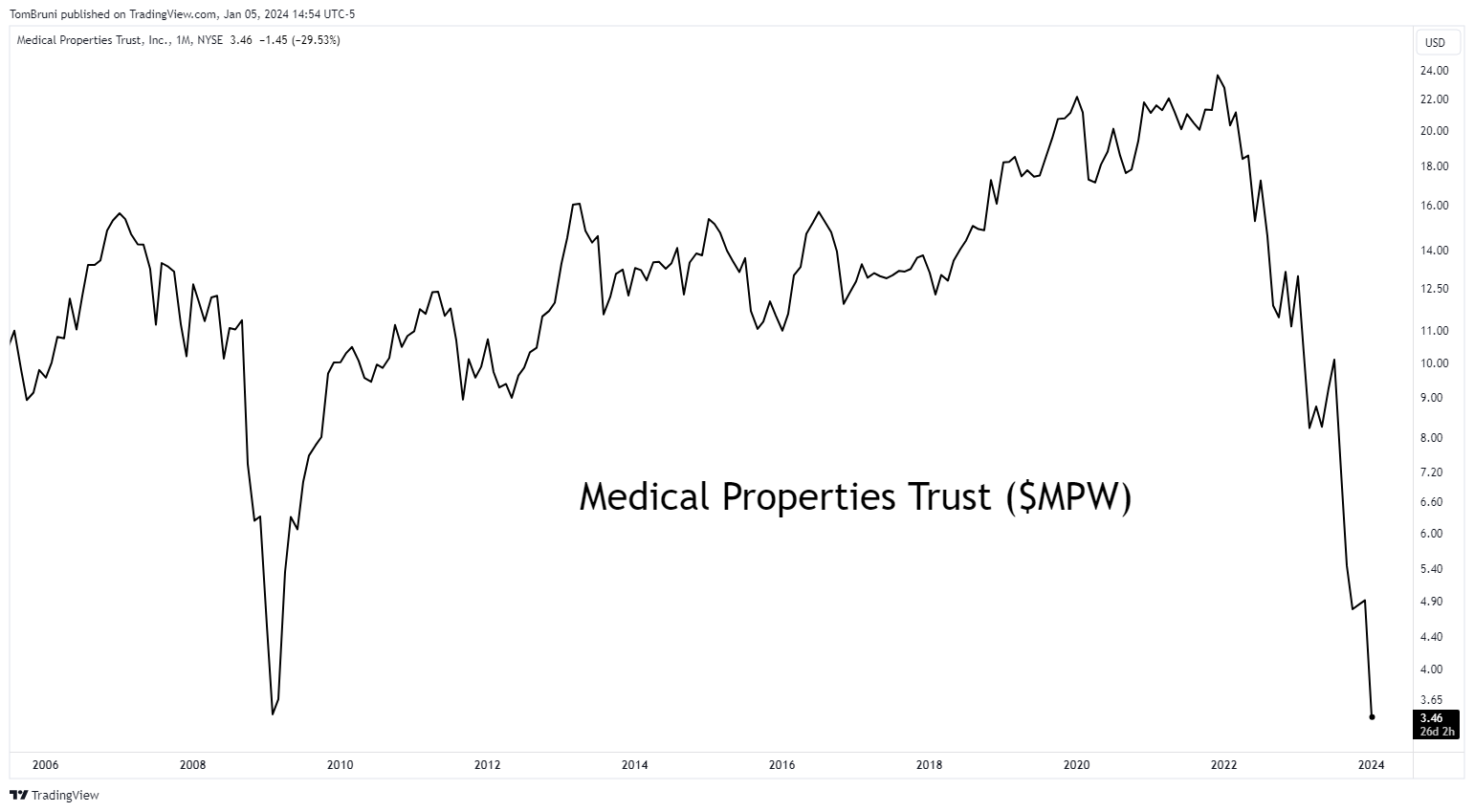

It’s been a rough eighteen months or so for real estate investment trusts (REITs), with higher interest rates giving investors alternative sources of yield and pressuring commercial real estate’s asset values. Unfortunately for Medical Properties Trust (MPT), that pain continues today, with its shares falling back to their Great-Financial-Crisis lows. 😬

The medical-related real estate property operator revealed to investors that one of its tenants, Steward Health Care System, is roughly $50 million behind in rent payments. As a result, MPT will take a $225 million noncash charge to write off rent receivables and other items.

While one-time writedowns are common, investors prefer when companies cut once and get back on solid footing. However, it doesn’t look like the company could provide sufficient clarity about the future, saying, “No assurances can be provided that further impairment of real estate and non-real-estate assets will not be taken with MPT’s fourth-quarter 2023 reporting.” 🔮

While the company is warning investors early of these tenant-specific issues, it’s also saying that it may have more problems to report with its quarterly results on February 1st. ⚠️

MPT is looking to recover uncollected rents and outstanding loan obligations, though analysts are unsure how much they’ll be able to recover. Steward recently informed the company that significant changes in vendor payment terms have negatively impacted its liquidity. In other words, they likely don’t have the funds to pay even if Medical Properties Trust takes legal action to recover them. 🪹

For now, MPT said it agreed to a new $60 million bridge loan secured by Steward’s existing collateral and second liens on its managed-care business. It’s also hired advisors to help explore its options to recover the late rent payments.

The stock caught several downgrades related to the news, with analysts citing uncertainty about tenant health, among other ongoing risks. $MPW shares neared all-time closing lows, falling 30% on the news as investors ditch the high dividend yield in favor of a rising (or stable) stock price. 😱