It’s not been “party time” for the alcohol industry recently, but Constellation Brands offered investors something to celebrate to start the year. 🙁

The wine and spirits distributor posted adjusted earnings per share of $3.19, topping the consensus view of $3.01. However, a roughly 2% YoY growth in sales to $2.471 billion fell short of analyst estimates of $2.538 billion.

CEO Bill Newlands highlighted the strength of Modelo Especial, which delivered double-digit volume growth and retained its position as the number one beer brand in the U.S. by dollar sales. Corona Extra and Pacifico were also “top 10” share gainers in the U.S. beer category. 🤩

Strength in the beer market partially offsets near-term headwinds in the wine and spirits market that Constellation and its competitors have pointed to in recent quarters. That said, it will not fully make up the difference, with the company now expecting fiscal 2024 earnings per share of $9.15 to $9.35, down from original estimates of $9.60. 🔻

Regarding hard numbers, beer sales rose 4% YoY, driven by a 3.4% increase in shipments and depletion volumes of 8.2%. Meanwhile, wine and spirits sales fell 8%, with shipments and depletions down 11.6% and 10%, respectively. Wine and spirits organic net sales are anticipated to fall 7% to 9% YoY due to broader marketplace deceleration and U.S. wholesale underperformance. 📊

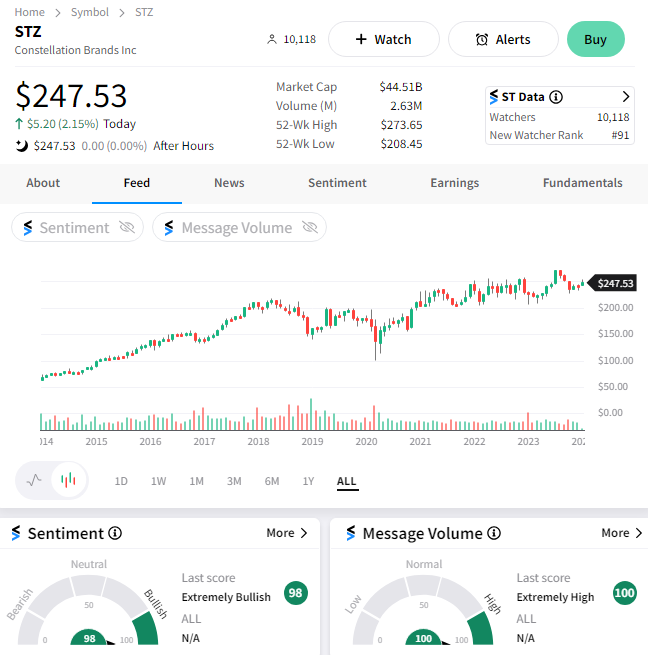

$STZ rose as much as 5% on the day but pared gains late in the day to close up 2%. Investors and traders will be watching to see if this positive momentum can continue through the first quarter as the stock looks to challenge its all-time highs again. 🍻