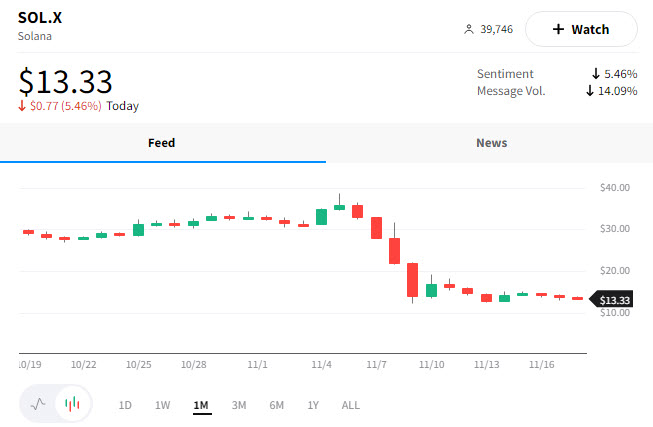

If there’s one major market cap cryptocurrency that’s suffered the most after FTX’s collapse, it’s Solana ($SOL.X).

So why is Solana getting hit more than its peers? Because of this guy:

It’s no secret that Sam Bankman-Fried (SBF) and FTX had a close relationship with Solana – heck, FTX held nearly $1 billion in SOL before declaring bankruptcy. The largest single asset owned by FTX ((according to the Solana Foundation’s blog post) is/was $2.2 billion of the Solana-based liquidity hub Serum ($SRM.X).

Serum, according to TheStreet, “… is one of the foundations of the Solana DeFi infrastructure, as it is the protocol and ecosystem that brings high speed and low transaction cost to Solana DeFi. It implements an on-chain central limit order book and matching engine, allowing to share liquidity and to offer powerful trading features to institutional and retail investors.”

What are SBF’s ties to Solana and Serum? SBF created Serum.

Anything that guy touched, people want to get rid of. The resulting FUD from FTX and SBF’s fall saw Solana fall -60% last week with little to no recovery this week.

The unfortunate collateral damage is the other projects in Solana’s ecosystem: almost none had/have any exposure to FTX. 😵