Have you ever heard the phrase ‘volume precedes price’? It’s an old-school technical analysis 101 maxim. For example, if an instrument is in a downtrend but then you start to see volume tick up, the theory is that price will follow the volume. 🧑🎓

It’s what technical analysts call a leading indicator—a heads-up or a warning that the probability of change is high and that it might happen soon. Analysts and traders might apply that principle (volume precedes price) to the Stocktwits Social Data.

Here’s one way an analyst might use the Stocktwits Social Data:

- Identify things that are overbought or oversold – at extremes.

- Ensure it’s active and liquid, meaning people trade it.

- Look at the Stocktwits Social Data to spot divergences – for example, price action is bearish, but volume and sentiment are ticking higher.

- Work it into their regular analysis.

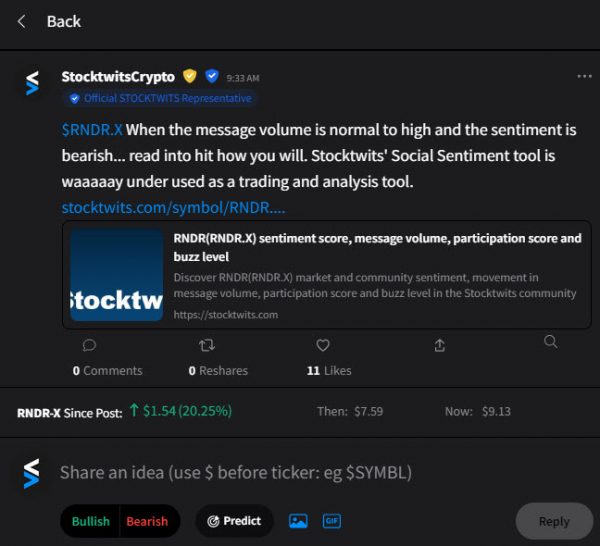

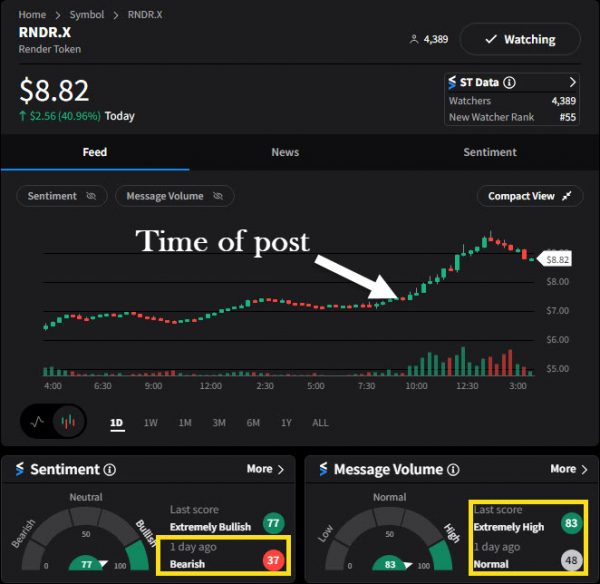

$RNDR is a good example from today, posted this morning:

Like everything else in crypto, RNDR collapsed yesterday. But price action started to pop up a bit and recover. The message volume shifted to normal, and the sentiment over the past 24 hours was bearish.

Using these tools, the StockTwits Social Data can be leading indicators, more so than the old-school volume-precedes-price approach—again, that’s just one way.

It’s like the Stocktwits Social Data leads the actual traded volume or supersedes it somehow—but it’s up to interpretation.

And please, for the love of Oreo cookies and milk, don’t take our word for it just because you read it in possibly the finest and best cryptocurrency newsletter in existence.

So do your due diligence before you nose dive into using a new tool or approach. 🧠