Alright, now we know this is primarily an equity-focused newsletter. But speculation in the market has been building extensively through the last few months, and there’s no better vehicle to visualize that than one with no intrinsic value. 😆

Ok, you had to let us get one joke in there. After all, we just said what we were all thinking but wouldn’t say out loud. Let’s dive into some wild stats. 👇

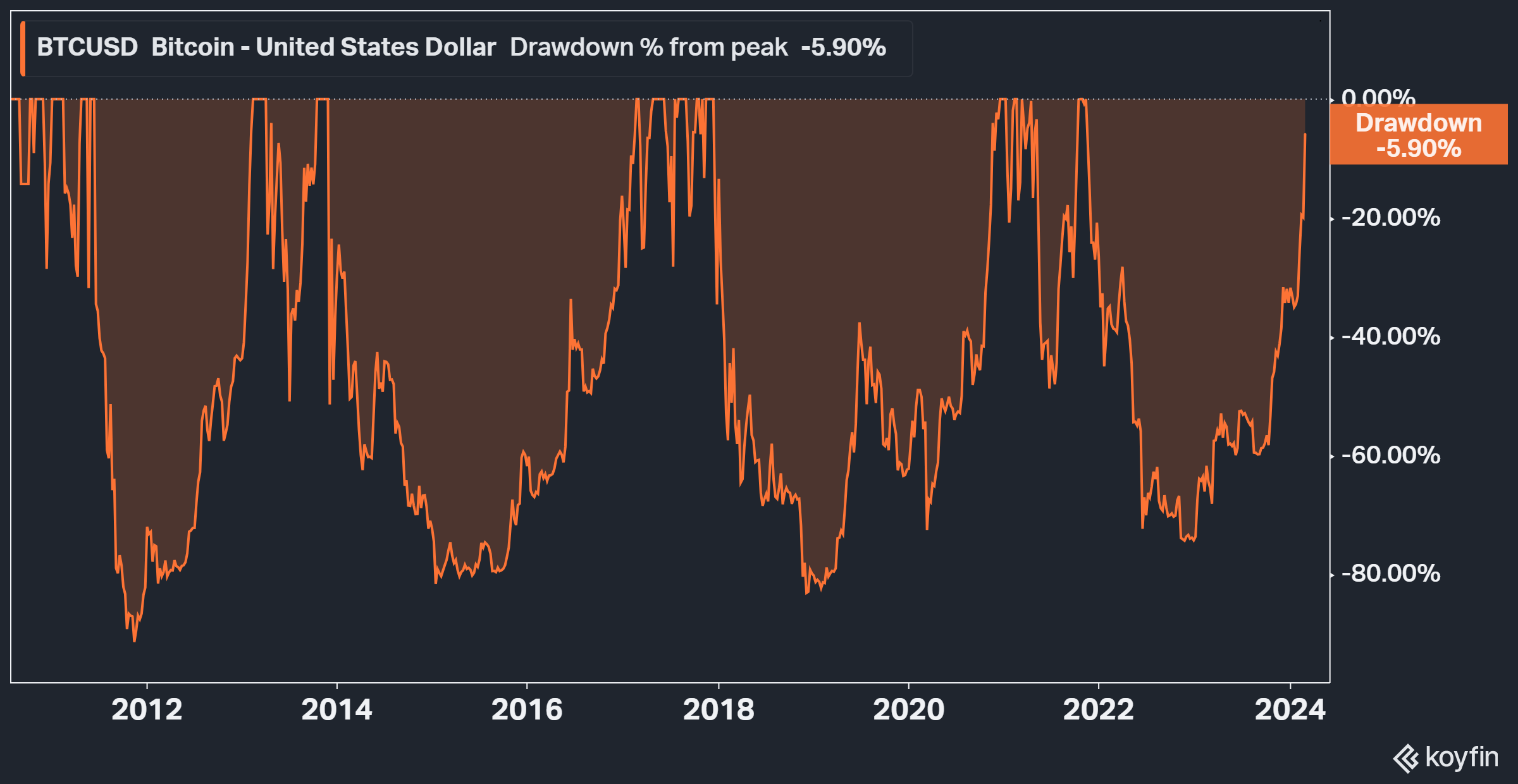

Regardless of what you think about Bitcoin and cryptocurrency in general, the market is speaking. The historical drawdown chart below shows that prices are now just a stone’s throw away from all-time highs less than 15 months after a 75% decline. And nothing gets bulls more excited than all-time highs. 🤩

I like to joke that when we’re in a crypto bear market, everyone in the space is “building.” And when we’re in a bull market, everyone in the space is tweeting every uptick in Bitcoin’s prices in real time. That’s essentially what we’ve gotten back to over the last few months, with it all coming to a head this week.

The FOMO that’s building is palpable; you can feel it online, and especially in the price action. Below is a 1-minute Bitcoin chart showing prices soaring past $60,000 this morning before quickly reversing and wiping out $95 billion of value in 30 minutes. While the market has recovered most of that decline since, the point is trading activity in crypto is back in a big way. 📈

In fact, activity got so crazy today that crypto exchange Coinbase effectively broke, showing users a “glitch” that indicated they had a zero balance in their account and prevented them from trading. Last time we checked, exchanges didn’t experience significant interruptions unless there was massive activity all at once. 🫨

Bloomberg also reported that Bitcoin ETF trading volumes hit a new record at $7.69 billion just today. Equity market crypto-proxies like Microstrategy also set new trading volume records, and exchanges like Robinhood continuing to rise alongside crypto prices. 📊

And speaking of retail brokerages, U.S. investing platform Webull announced it is going public through a SPAC Deal while the market is still hot. It’s hoping the recent resurgence in animal spirits can help it enter public markets since it missed the boat back in 2021/2022. 💸

Whether this is a symptom of a healthy bull market or a sign of significant froth remains to be seen. But what’s clear is that everyone wants their piece of the pie and is saying, “count me in” by grabbing exposure as quickly as possible. 🪙

P.S. If you want extensive coverage of the crypto market, make sure you’re subscribed to our crypto-focused newsletter, The Litepaper. ₿