Sad. 😢

That’s the way I would describe $DOGE‘s weekly chart. Sad.

As sad as a penguin with a sunburn. 🐧

While there’s clear buying below the $0.07 value area, follow-through doesn’t appear to be that strong.

Bulls have had an equally hard time getting and staying above $0.09, as the bears have had to try to stay below $0.07. 🤿

And this misery has gone on since December 2022. Is there anything coming up that might make things better? Almost nothing, except for one teeny tiny thing on the monthly chart.

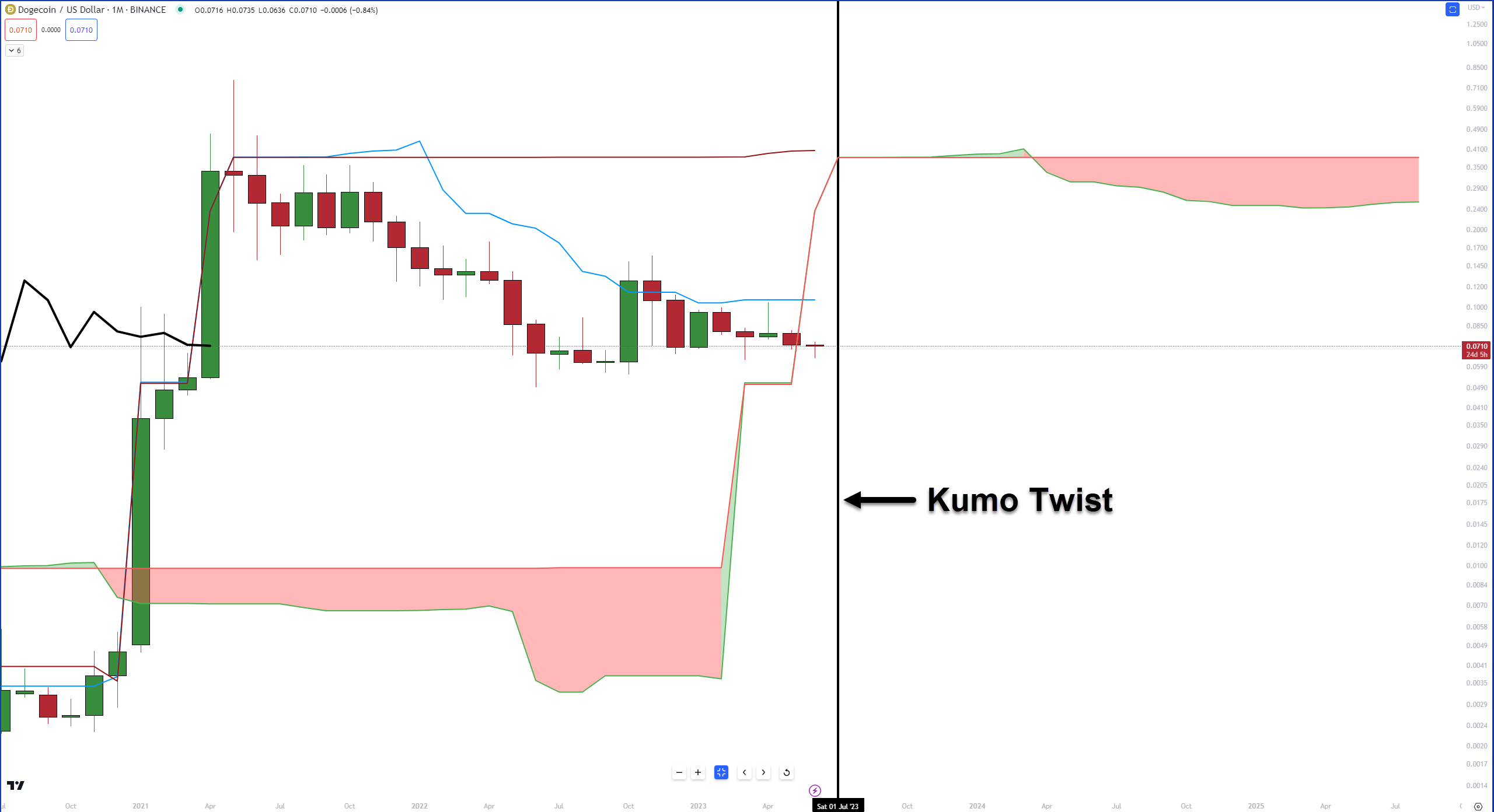

It’s barely noticeable, but there is a Kumo Twist that appears in July. Kumo Twists occur when Senkou Span A crosses above or below Senkou Span B. Kumo Twists can often be a ‘heads up’ for the market that a change in direction may occur.

This is especially true if the instrument has been trending in a single direction over a long period of time. Does that mean Dogecoin is set to rally? Nothing is certain, but it’s definitely something to watch out for. 👀