Spend any time on the Stocktwits Bitcoin stream; you’ll see many people screaming bull and others screaming bear. 🐻

There are strong cases for both, and I want to go over them, starting with the bearish case because it requires a ton more explanation than the bullish case.

A Damp Before The Pamp – The Bearish Case

This is where your tinfoil hat should be applied because this shit gets weird. I’m talking about time cycles.

W.D. Gann’s methods are some of the most crazy things you’ll ever learn. If you ever delve into Gann’s style of analysis, it will be the closest thing to being in an Indiana Jones story you’ll ever get. 🪖

Gann believed that the factor of time was why markets moved – not price, not the news, but time. He focused on price, too, but to him time was the most important. Gann focused on several time cycles, and when a good amount of those cycles ended in a cluster simultaneously, that was Gann’s way of saying pay the F attention to what happens around that period.

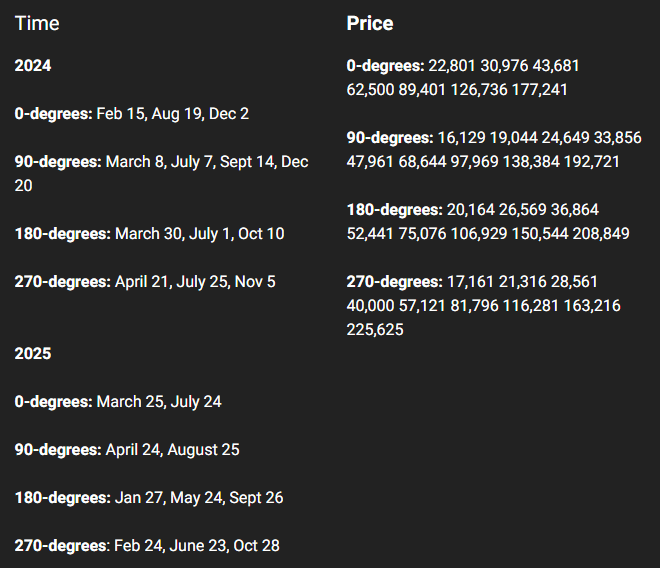

Here are some time cycle reasons for the bearish case and the respective numbers for the chart above:

- 180-day cycle: This is Gann’s second most important cycle, he consistently warned (and showed) that if an instrument is trending strongly in one direction over a 180-day (180 to 192 days to be specific) period, to be on alert for a violent pull back of broader trend change.

- 49-day Death Zone: Gann said that an instrument has a very high probability of retracing (pullback/throwback) if its been trending strongly over seven weeks (49 – 52 days to be specific).

- Six consecutive months higher is the longest Bitcoin has ever moved.

- As we read at the beginning of today’s Litepaper, March has a high probability of being a down month.

- 26 is an important number in Japanese Ichimoku Kinko Hyo analysis.

And as long as we’re talking about Gann, the following dates and price levels are from his Square of 9, which was one of Gann’s forecasting tools to identify important dates and price ranges in the future. 🔮

You’ll notice one of those dates is coming up soon and is inside the time cycles we just looked at:

That sums up the bearish case, now let’s look at the bullish case – which is much easier.

Continuation – The Bullish Case

This is crypto. Sometimes it seems like fundamentals and technicals don’t matter. It’s like Warren Buffet once said, “The market can remain irrational longer than you can remain solvent.”

And depending on how long you’ve been involved with crypto, you’ve probably seen or at least heard of some crazy ass parabolic moves that this market has.

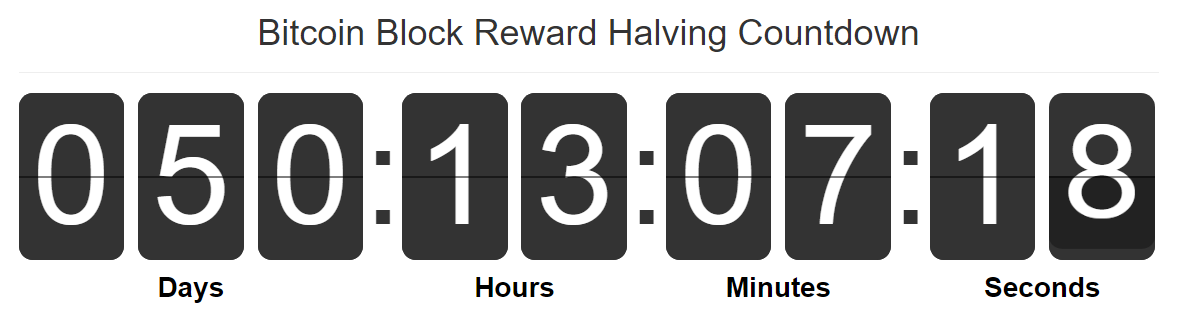

Bitcoin’s halving is right around the corner. Februaries close nearly pulled off the highest monthly close ever, BlackRock has $10 billion in BTC and keeps buying, Wells Fargo and Bank of America are entering, Vanguard fired their big boss probs because he said no to BTC… you could go on and on about the fundamental strength behind Bitcoin and why it will only keep mooning.

In a nutshell – who the hell knows? Don’t risk money you can’t afford to lose; if you don’t know how much to risk, talk to one of those fancy schmancy financial advisors. And I mean a real one, not the 28-year-old with a mullet walking around his pond on TikTok. 🤑