When bulls get liquidated, bears get excited. When bears get liquidated, bulls get excited. 😁

I have no idea what happens when everyone gets liquidated. From Glassnode’s Liquidation Heatmap, here’s this insane look.

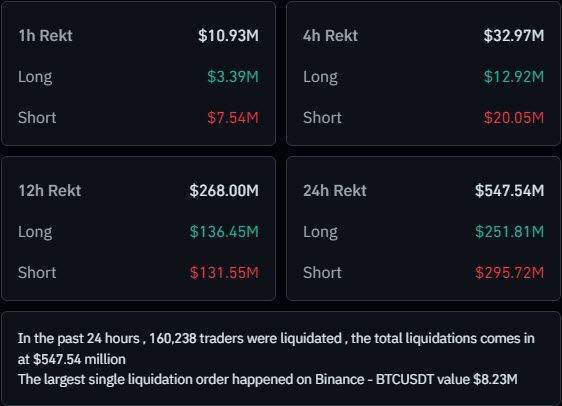

$251.81 million in longs liquidated, $295.7 million in shorts liquidated.

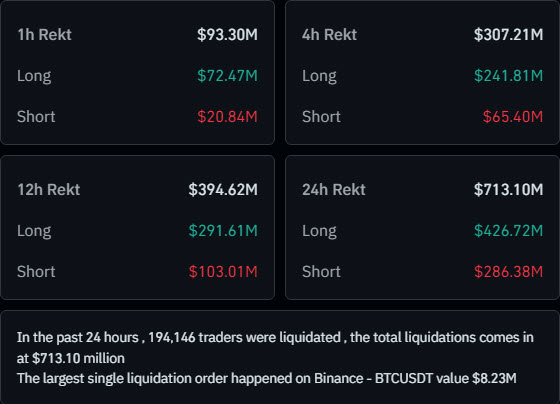

So as I was writing the text above, I thought I better check to see how much worse things are. The image above is from around 0900 EST. Sweet-Mrs.-Butterworth-on-my-waffles things got worse:

Almost 200,000 traders flushed. $476.7 million longs and $286.4 million shorts liquidated. $713 Million Total. 😵