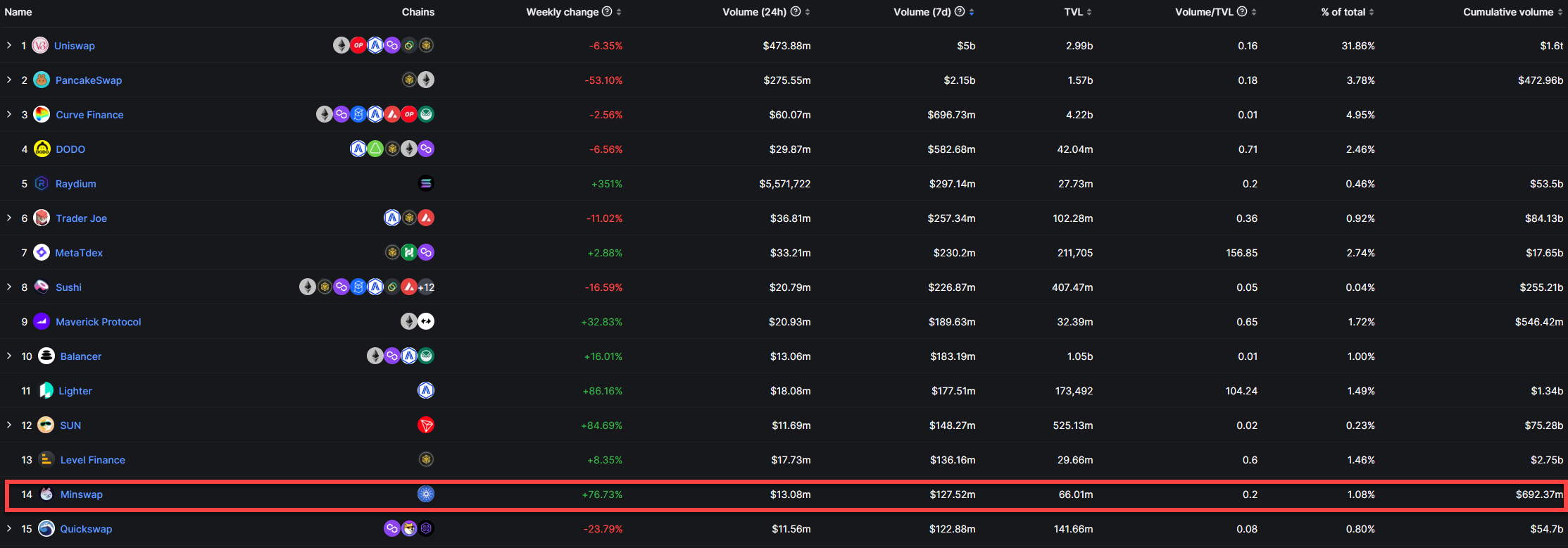

Minswap’s ($MIN) weekly volume pushed it above Quickswaps ($QUICK) for the past seven days, putting Minswap in 14th place. 🤯

Recently, Cardano’s native token, $ADA, saw a notable upswing in large transactions amounting to an impressive $2.5 billion within a single day.

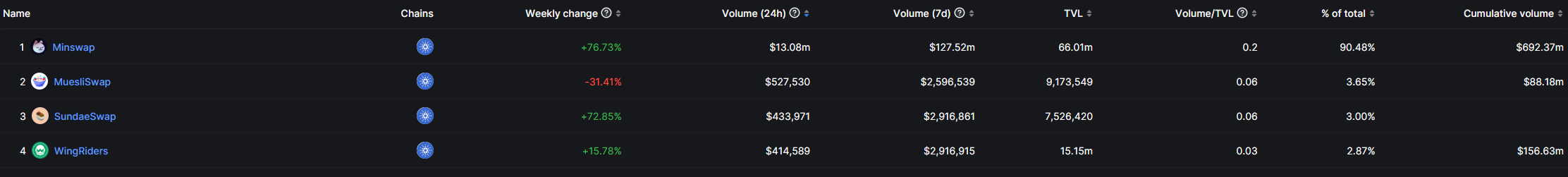

Almost all of the activity has been due to Minswap – look at the 24h volume and the 7d volume. 👀

Alongside, the total value locked (TVL) in the blockchain’s decentralized finance (DeFi) segment displayed significant growth, catapulting to more than $180 million.

There’s also a noticeable uptick in the trading volume on Cardano’s decentralized exchanges (DEXs), which suggests a growing interest in decentralized trading and the increased liquidity of ADA tokens.

The DeFi ecosystem on Cardano also set new records with an all-time high of 463 million ADA tokens, symbolizing consistent DeFi expansion on the network. In addition, the TVL in Cardano’s DeFi sector has seen a steep rise from around $50 million at the year’s start.

Even as ADA’s short-term price movement displays some volatility, the consistent inflow of large transactions underlines sustained confidence in the long-term potential of Cardano and its associated assets.👌